Silvergate has fallen

Silvergate had to face the inevitable.

Silvergate Capital, the biggest cryptocurrency bank in the United States has decided to stop its operations and start liquidating its assets on March 9th due to significant effects caused by the collapse of FTX.

BREAKING: Silvergate Capital plans to wind down operations and liquidate its bank after the crypto industry’s meltdown sapped the company’s financial strength https://t.co/y0EOOdVWaM pic.twitter.com/oCBXG79xaZ

— Bloomberg (@business) March 8, 2023

Silvergate Bank's shares have experienced a drastic decrease of nearly 98% from their all-time high, and have fallen by approximately 60% since the company announced a potential operational review on March 2nd.

According to a tweet by unusual_whales, only 10% of traders are using call options when trading Silvergate Capital's stock, the majority of them are instead shorting the stock.

Silvergate Capital, $SI, is liquidating its bank.

— unusual_whales (@unusual_whales) March 9, 2023

Many shorted $SI nonstop, with only 10% calls.

Yet two traders opened up NEW heavy put positions today + yesterday in $SI $2 strike and $SI $4 strike expiring in 9 days.

They likely will have made 500% tomorrow.

Unusual. pic.twitter.com/sRz4uLfFhs

Silvergate is the largest bank in the US providing crucial services to many big companies in the cryptocurrency market, including FTX, which is one of its biggest customers. As a result, investors in the cryptocurrency market have become suspicious about Silvergate's health since the unexpected collapse of the FTX exchange in November 2022.

Can Signature Bank fill Silvergate's void?

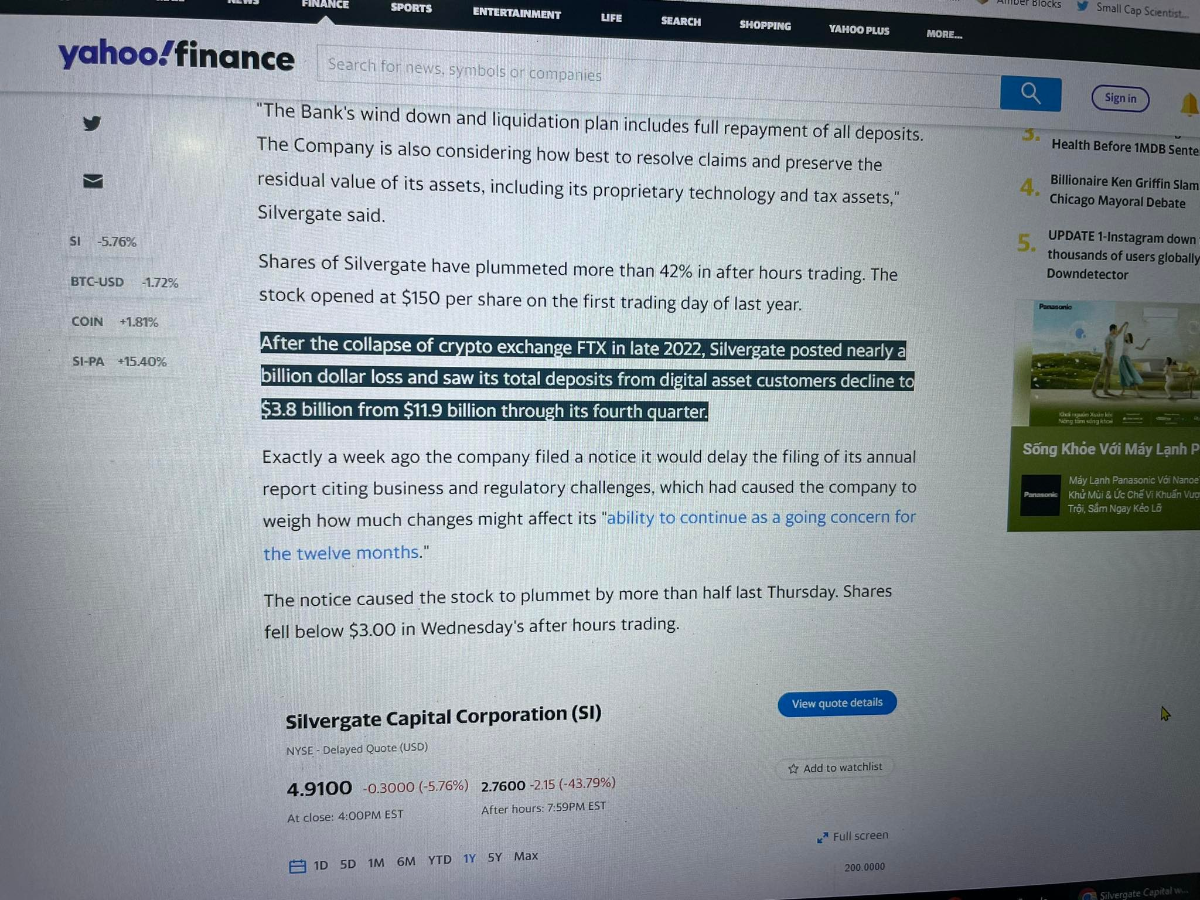

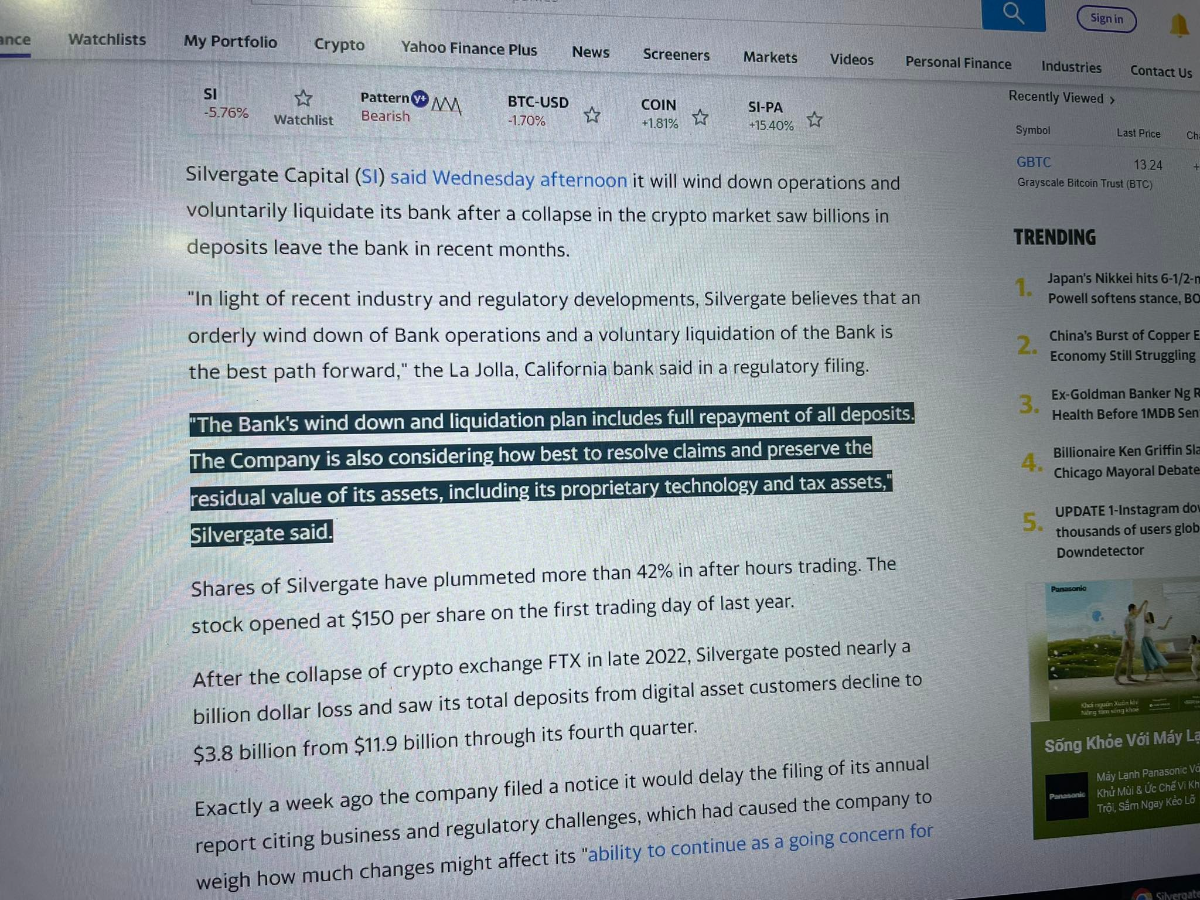

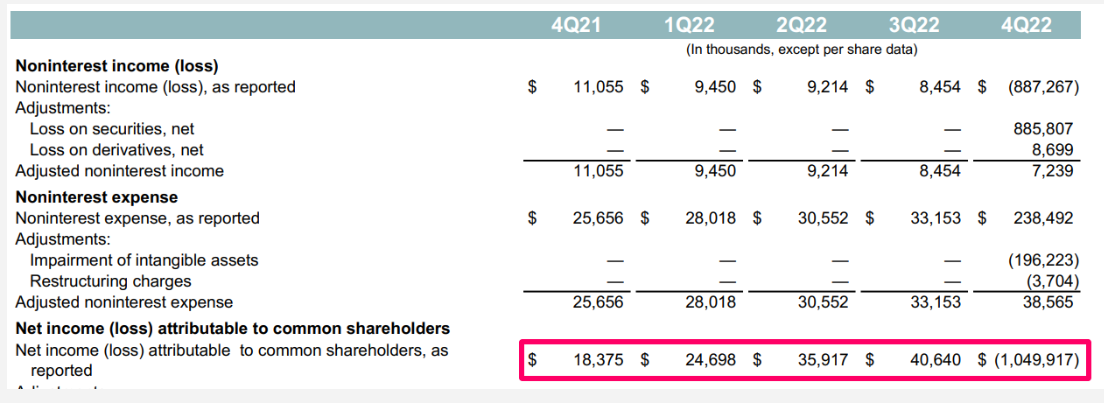

Yahoo Finance reported that Silvergate incurred losses of nearly $1 billion due to the collapse of the FTX exchange. In addition, deposits from customers in the cryptocurrency market significantly dropped from $11.9 billion to $3.8 billion in the fourth quarter of 2022.

“The Bank's wind down and liquidation plan includes full repayment of all deposits. The Company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets,” Silvergate, as reported by Yahoo Finance, stated in a released statement.

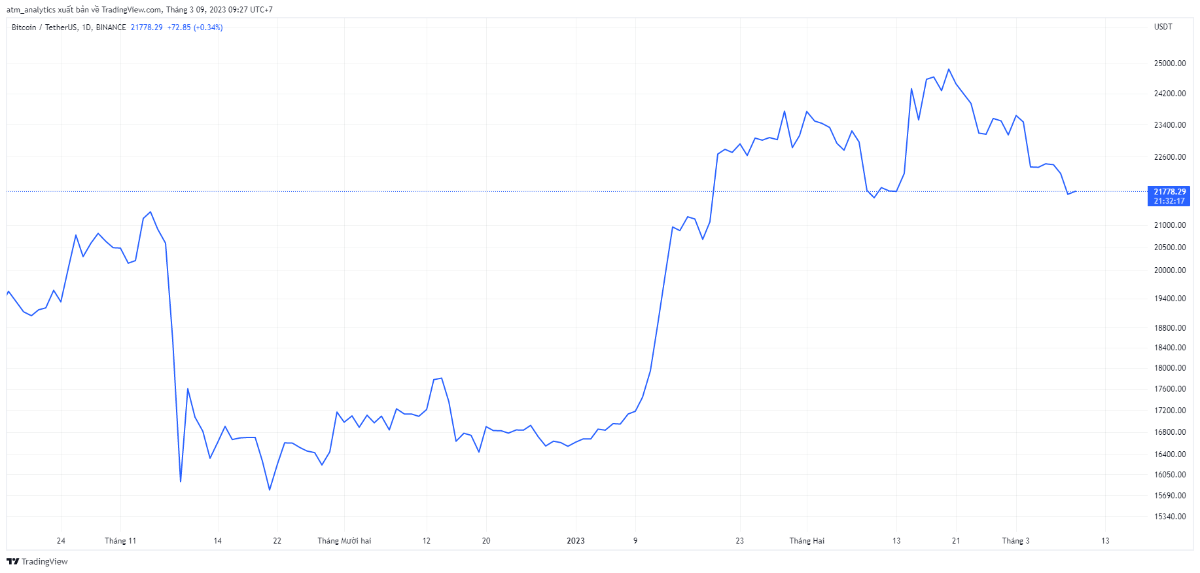

Currently, the cryptocurrency market is exhibiting a rather subdued reaction to the announcement made by Silvergate. Even though the price of Bitcoin briefly decreased due to FED’s Chairman Jerome Powell's strict position during the March 7 hearing, it has even shown a slight recovery following news of Silvergate's asset liquidation.

The announcement of Silvergate's closure has not caused much panic among investors in the cryptocurrency market. This could be because they believe that the amount of assets held by Silvergate is relatively small compared to other industry collapses in the past, such as Terra, Three Arrows Capital, FTX, or MTGox. Additionally, the fact that all customer deposits will be refunded as part of the asset liquidation process may have temporarily calmed investors.

Coinbase, a former customer of Silvergate that has since stopped using their services, offered condolences and also emphasized that they have “no client or corporate cash at Silvergate” and that “client funds continue to be safe, accessible & available.”

Update: We’re sorry to see Silvergate make the tough decision to wind down their operations. They were a partner & contributors to the growth of the cryptoeconomy. Coinbase has no client or corporate cash at Silvergate. Client funds continue to be safe, accessible & available. https://t.co/78oMrLQ6VH

— Coinbase (@coinbase) March 9, 2023

Silvergate, as previously discussed in the article "Could the Silvergate Bomb Cause Difficulty for the Cryptocurrency Market?" (only in Vietnamese), is the largest cryptocurrency bank in the United States and plays a significant role in providing services to companies in the industry.

If Silvergate falls, companies will need to find another replacement link. A potential name that has been mentioned is Signature Bank.

However, Signature Bank's services have announced a 50% reduction in customer deposits on December 7 and plans to separate from Stablecoin business operations.

Moreover, due to certain policy regulations, Signature Bank has caused Binance to announce that it will only settle fiat transactions of users over $100,000 on January 21.

Many cryptocurrency investors, such as Nic Carter, see these as indications that the US government is enacting Choke Point 2.0, the updated version of the 2013 Choke Point campaign under the Obama administration. The goal of the latter was to eliminate specific lawful industries by putting indirect pressure on them via banks.

“Crypto Bank Silvergate goes under. Don't worry everyone, Crypto Bank Signature is up next,” expressed the investor Bitfinex'ed, who has more than 106,000 followers, following the Silvergate collapse.

Crypto Bank Silvergate goes under.

— Bitfinex’ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) March 8, 2023

Don't worry everyone, Crypto Bank Signature is up next.

Who knew that providing banking services to Ponzi schemes, frauds, companies trading tokens issued by companies laundering money for US designated terrorists, would be a bad idea? pic.twitter.com/FHfvvaWauN

Furthermore, the cryptocurrency market has been in a downtrend since 2021, and lenders in the industry have consistently suffered greatly from asset price fluctuations when an event occurs.

For example, the lending company Voyager declared bankruptcy as a result of the failure of the Three Arrows Capital Fund, or Genesis as a result of the Sam Bankman-Fried scandal,...

This could make banks that lend to cryptocurrency companies more cautious and increase collateral requirements. “In the aftermath of the Silvergate incident, many banks and funds that lend to cryptocurrency companies may require additional collateral or debt transfer,” said Dr. Ho Quoc Tuan, Senior Lecturer in Finance and Accounting at the University of Bristol.