Terra Ecosystem: A Mega Expansion Beyond A DeFi Ecosystem

Terra Overview

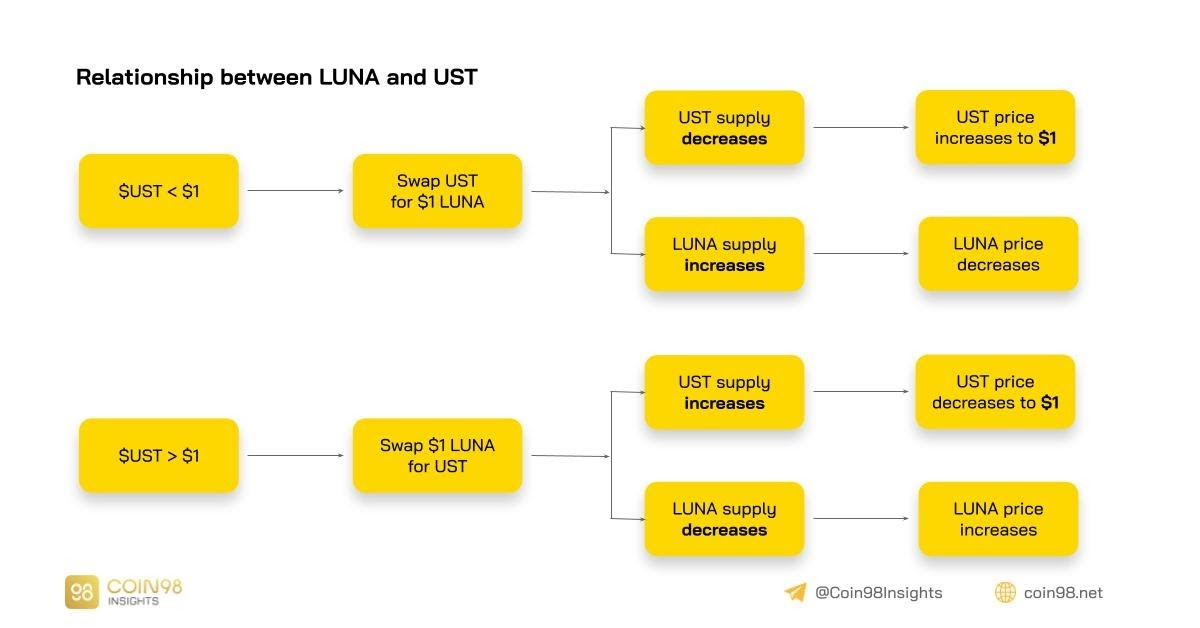

Terra (LUNA) is the most successful smart contract blockchain platform on top of Cosmos that has its own USD-pegged algorithmic stablecoin UST. The native token of Terra is LUNA receiving lots of benefits from the growth of this stablecoin UST and the DeFi ecosystem on top of that.

Leveraged by its in-ecosystem stablecoin, DeFi applications on top of Terra blockchain are thriving fast as the total TVL firmly ranks second in crypto, only behind Ethereum ecosystem’s TVL. The TVL performance proved the stablecoin strategy of Terra viable.

Terra Highlights

- Algorithmic stablecoin UST: LUNA has a knot-knit relationship with UST since the rebalance mechanism of the stablecoin relies on LUNA. In short, UST > $1, then $1 worth of LUNA is swapped to UST to increase the supply of UST to get the stablecoin back to $1 and vice versa. It’s for the first time when the future of a DeFi ecosystem is pegged to the UST stablecoin implemented at a large scale.

- DeFi Strategy: Terra is building moats surrounding DeFi applications which can ultimately be cross-chain Dapps. Unlike other smart contract platforms, Terra built a leading stablecoin UST with incentives to support the growth of Dapps.

- Interoperability of Cosmos: As mentioned, Terra is built on top of Cosmos, and many crypto degens believe in the future of the internet of blockchain. Cosmos is welcoming many blockchains as time goes on. Terra will connect to the father blockchain Cosmos to inherit the advantages of others.

- Value Capturing: Cosmos (ATOM) only captured a little value as the Terra ecosystem and the LUNA price has been rising recently. Therefore, LUNA only shares a little with ATOM.

- A payment alternative: Terra is envisioned to be the decentralized payment system dethroning traditional payment methods like Paypal.

- Do Kwon and SEC: Do Kwon - founder of Terra responded to the SEC’s case against him and Terraform Labs, which created a surge among the community. The final result has not been made yet, but the event showed the responsibility of the team to protect the Terra community.

Terra Highlight Numbers

Updated: Feb 8th, 2022

- Main Currency: LUNA;

- LUNA Supply: 818M;

- Native Stablecoin: UST;

- Stablecoin UST Supply: 11.25B;

- Terra Unique Addresses: 120,769;

- Total LUNA delegated/Total LUNA supply: 306,164,879/818,527,236 (37%);

- LUNA Staking APR: 9.66%

- Nakamoto Coefficient: 20;

- Gini Coefficient: 0.5135;

Roadmap and Development Progress

- 2018: The Terra idea came up.

- 2019: Columbus-1 mainnet, Columbus-2 upgrade accelerating DeFi infrastructure, Columbus-4 focusing on leveraging the utility of LUNA and improving security.

- 2020: CHAI Card to reach further the user frontier. Columbus-4 allows developers to deploy smart contracts on Terra blockchain.

- 2021: Columbus-5 with economic changes, community pool, Ozone, IBC, and Stargate.

At the moment, IBC is the key driver that allows Terra to communicate with other Cosmos-based blockchains. Crypto assets and liquidity are interconnected to a joint force followed by the notion of Cosmos.

Ecosystem development

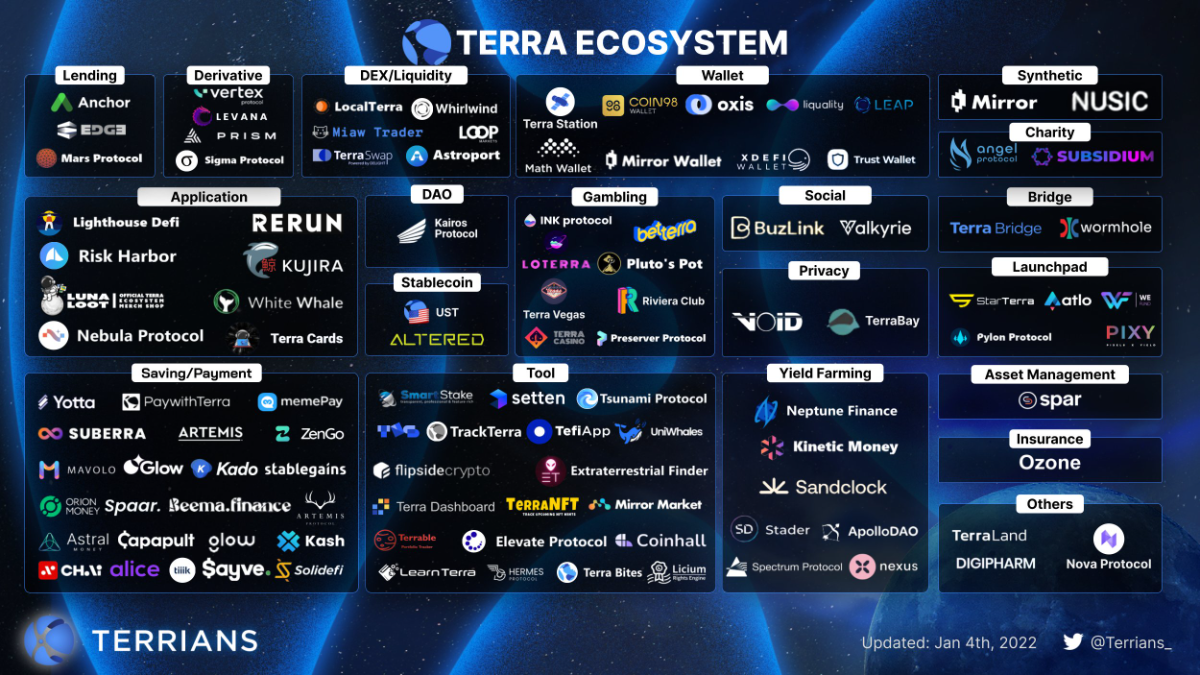

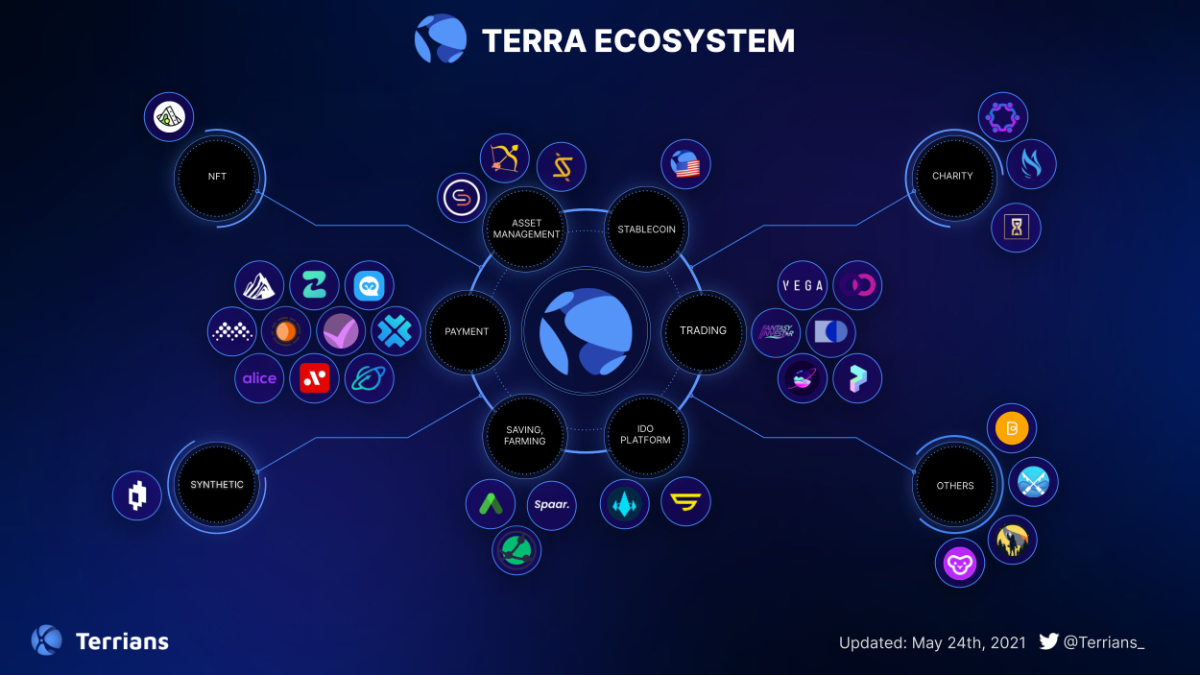

Starting from a few projects to a DeFi industry (100+ projects) on top of the Terra blockchain, it showed the huge number of crypto builders who are contributing to the ecosystem. This growth is a remarkable milestone for Terra as it created a complete DeFi ecosystem surrounding the Cosmos-based blockchain.

Beyond an ecosystem

Terra will aim at the global payment market with the stablecoin UST, an ultimate goal of the team. To reach this milestone, Terra supports building UST applications on various platforms (mobile, web, and hardware) to hit the user frontier all over the world.

Investors and Partners

In 2019, HASHED invested in Terra. The investment is the biggest success of the venture capital HASHED. As an early investor, it set an ambitious vision for Terra to take over the money market with blockchain technology. The outcome is massive for HASHED.

Terra and HASHED share a common thing in Korean. Both sides have built a knot-knit relationship since the beginning. In late 2021, HASHED raised $200M to fuel the development of Web 3, the previous fund was $120M raised in 2020. Although HASHED has not released the detailed plan for the fund, we can expect the money will come to the Terra ecosystem.

Algorithmic Stablecoin UST

Terra has an ultimate mission to bring its algorithmic stablecoin UST to mass adoption worldwide. UST's over 11B market cap has revealed its acceptance since it outperformed the biggest decentralized stablecoin of MakerDAO, DAI, with a 10B market cap. As a result, LUNA captures lots of value as the total supply of UST is growing.

The UST stablecoin circulating in the ecosystem is like blood in a body, diagnosing the health and estimating the size of the ecosystem. The strategy of Terra is to concentrate support to accelerate DeFi applications. Since the Terra team envisions conquering the real-world market with the stablecoin, DeFi will be an indisputably important driver.

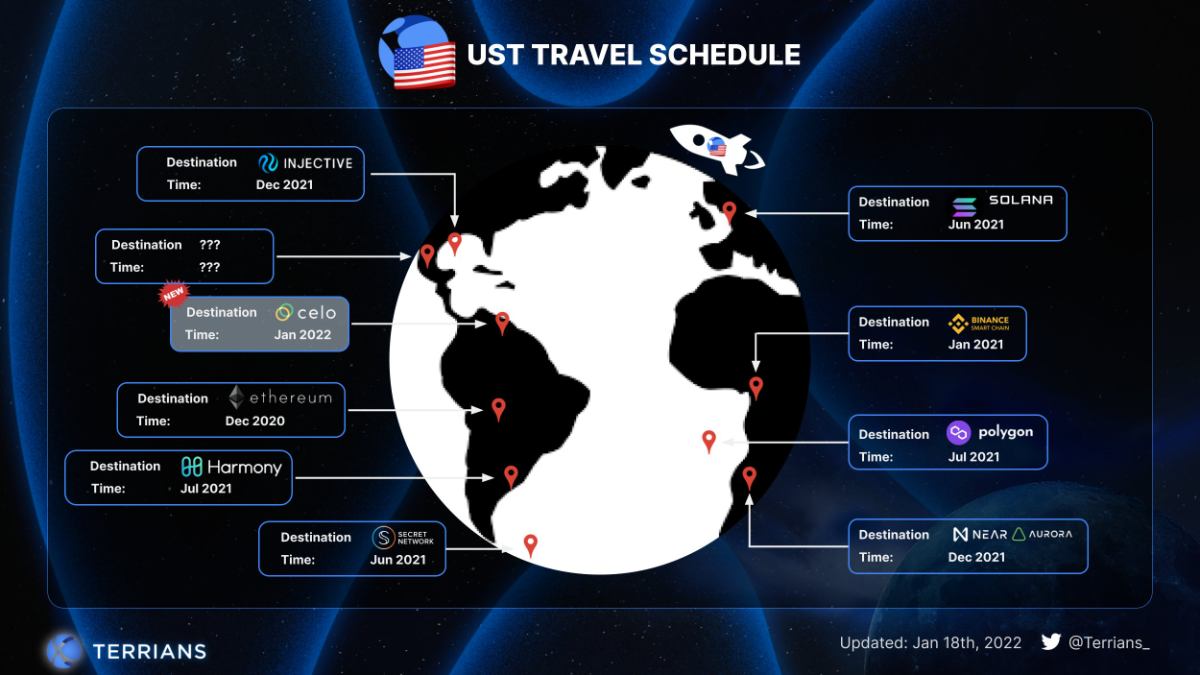

It will be such a waste not to leverage the biggest decentralized algorithmic stablecoin UST among blockchains. UST is now supported on most top blockchain platforms, delivering a huge impact when boarding the ecosystems.

In December 2021, NEAR jumped over 20% when the UST integration was released, showing the influence of the UST stablecoin with a growing user base. The expansion of UST is undoubtedly, and we can look forward to the stronger adoption of it in the future.

Terra Ecosystem Overview

2021 was an epic year for every blockchain ecosystem, including Terra. The total TVL of the Terra ecosystem is continuously growing at a fast pace (almost 400x in 2021), making Terra’s TVL ranking only behind the smart contract giant Ethereum. Notably, Anchor is a leading project with over 50% dominance in the ecosystem.

DEX/Trading platforms

- Terraswap and Astroport are standard-like DEXs on Terra that is one of the first Dapps onboarding the ecosystem. As in its project name containing “Terra” and the pioneers, which is one of the factors helping Terraswap and Astroport be the DEXs with the highest number of TVL on Terra, $700M and $800M respectively.

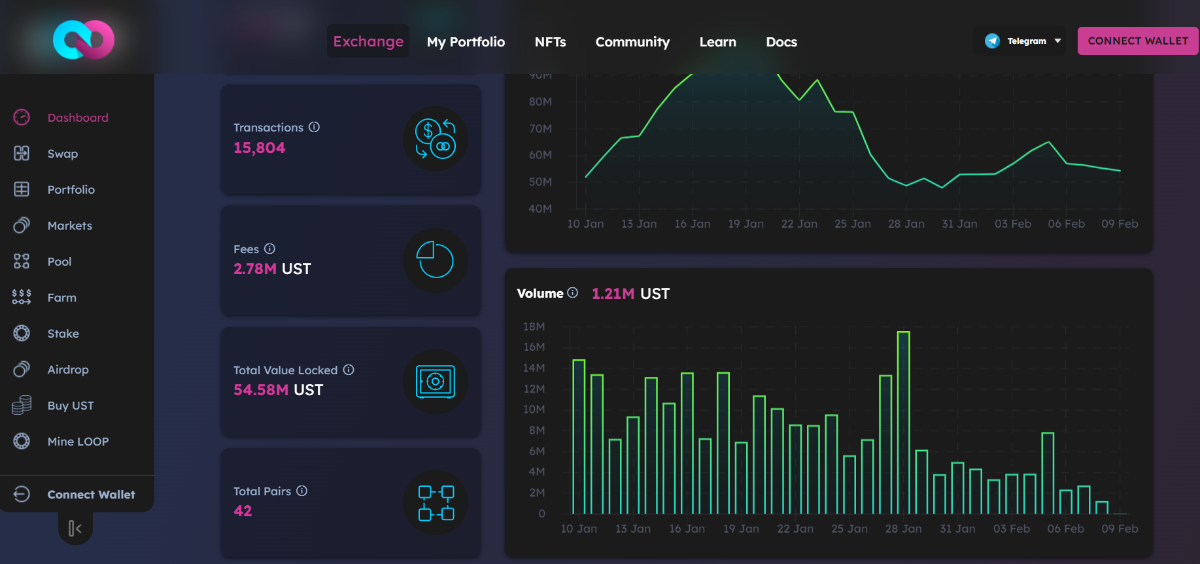

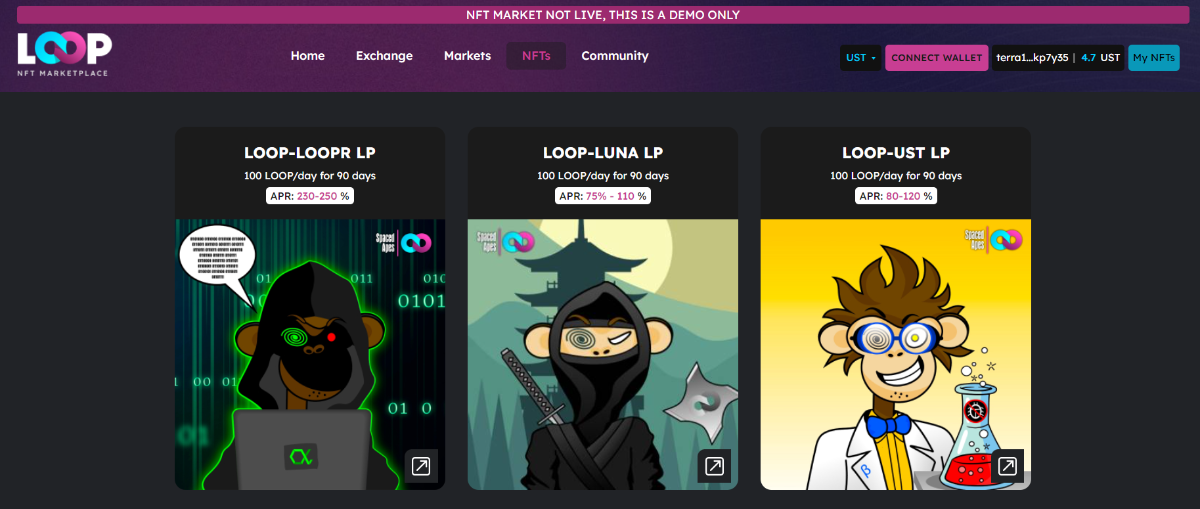

- Loop Markets is an exchange hub on top of Terra blockchain, containing many utilities for users to experience. The total TVL of Loop Markets is about $50M, a humble number in comparison to other DEXs. However, the platform has built a DeFi suite on Terra to facilitate users with crypto trading.

- OpenOcean is expected to be 1Inch of Terra that has impressive performance numbers. The platform integrated with DeFi and CeFi to facilitate the user experience with the best rates across the crypto market.

⇒ DEX and trading platforms always generate the most trading volume and concentrate liquidity for every blockchain ecosystem. In general, DEX and trading platforms on Terra are seamlessly operating for the time being. Some DEXs generate millions of dollars in revenue from trading fees.

However, despite the high revenue and the large user base, TerraSwap, Astroport, and OpenOcean have not released their tokens plans. This might be an opportunity for crypto degens to look for token retroactive airdrops from meaningful contributions. In addition, we should follow more for further announcements and consider carefully before making any investment decision.

Derivatives/Synthetics

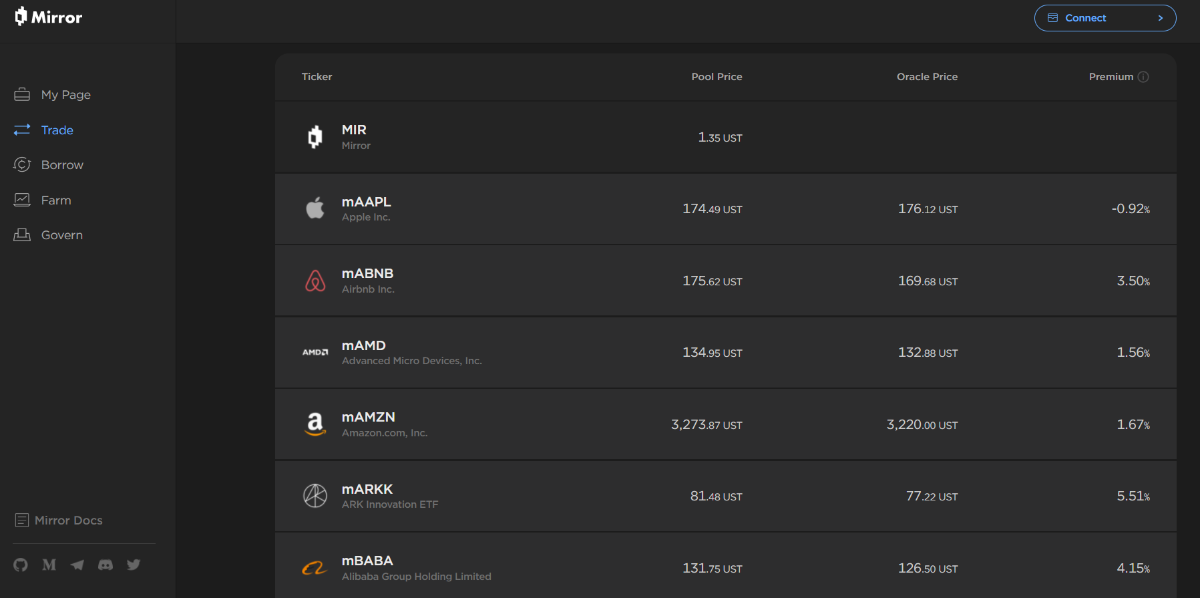

- Mirror Protocol, a synthetic asset protocol incubated by Terraform Labs, provides not only synthetic assets but also borrowing and farming on the platform. With over $600M in TVL, it has a solid position in the top protocols which have the largest TVL on Terra. Since it gets support from the Terraform Labs, it’s undoubted to get traction from the community.

The total TVL of Mirror Protocol has been going down since launch and there is no sign of additional money inflow.

- Altered Protocol, an elastic token project, released its platform for users to swap UST to ALTE. Furthermore, the platform can create synthetic assets in the form of the CW-20 token but this feature has not been released yet.

- Nebula, an ETF platform, integrated with Astroport for liquidity enhancement. However, the team has not launched Nebula yet despite the November 2021 and January 2022 announcements.

⇒ The synthetic asset category is developing at a fast pace since it gets bootstrapped by the venture arm of Terra Money, Terraform Labs. Mirror Protocol is the most active player in the field while others are imminent to launch their platforms.

We can notice that Terraform Labs with their granted projects are dominating the Terra ecosystem with money flood ($150M DeFi ecosystem fund in July 2021). Whether there is any room for other Terra-based crypto projects to grow?

Money Market / Lending & Borrowing Protocol

- Anchor Protocol, a decentralized money market incubated by Terraform Labs, with a TVL of $7.9B is dominating the Terra ecosystem. The graph shows the stable growth of the TVL on Anchor, meaning the money flow is pouring in the protocol. On the flip side, the ANC token market cap seems to go the other way at the beginning of 2022.

The market cap/TVL ratio of Anchor Protocol is about 0.046, making the ANC price undervalued since the protocol holds billions of dollars in TVL. This number on other protocols is bigger than Anchor; so we should evaluate the tokenomics as well as the value captured to the token to estimate the viable price.

- Orion Money, a cross-chain stablecoin yield generating platform, connects with Anchor Protocol on Terra to leverage the use of stablecoin among blockchains.

- Levana Protocol integrated with a Terra-based lending protocol, Mars Protocol, to leverage deposited assets for better utilization. However, Mars Protocol has not announced the mainnet yet. As a result, both projects are expected to release soon, delivering the ecosystem more quality players.

⇒ The money market is the strategic arm of Terra since it can maximize the potential of the stablecoin UST. Terra has Anchor Protocol as a leading DeFi player supported by Terraform Labs, which is good for the health of the ecosystem. In the blooming phase, Terra picked out a strategy to concentrate the liquidity in the money market protocol for stable growth.

Currently, all the DeFi components of Terra are actively operating and we have some interconnected liquidity among crypto platforms. Retail investors can participate in asset staking or lending activities to earn stable returns.

Staking Yield

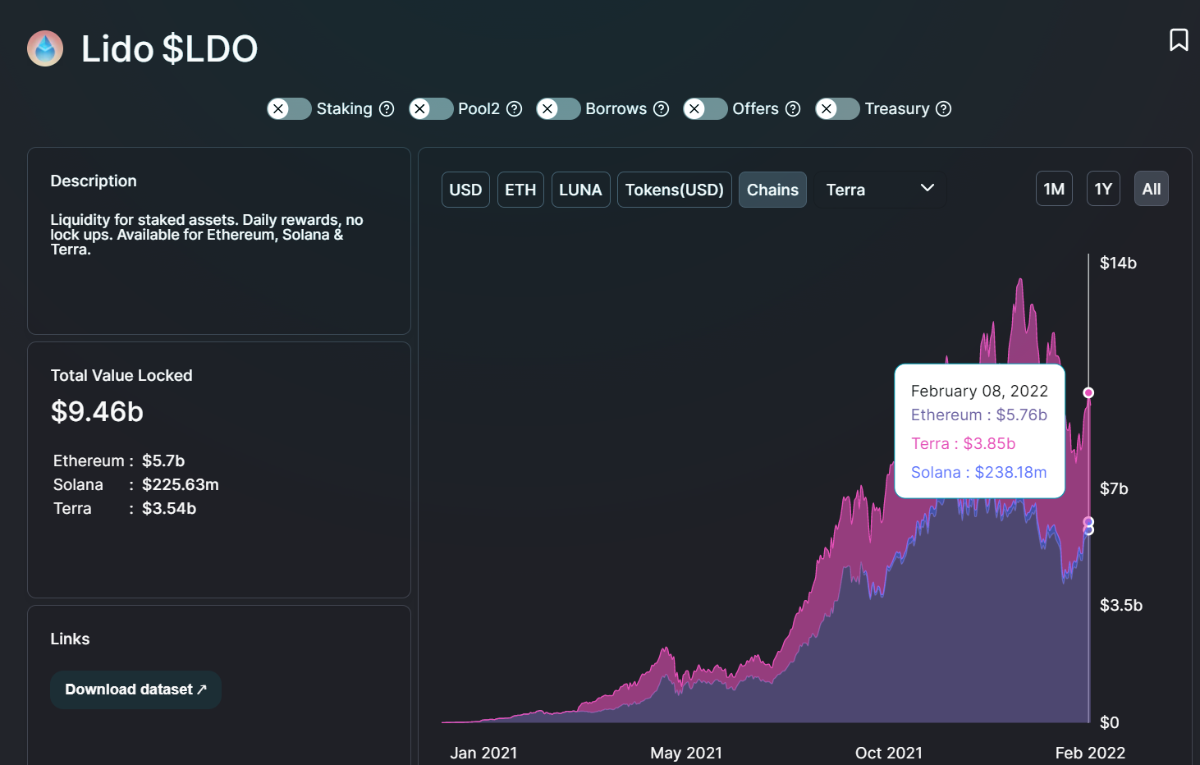

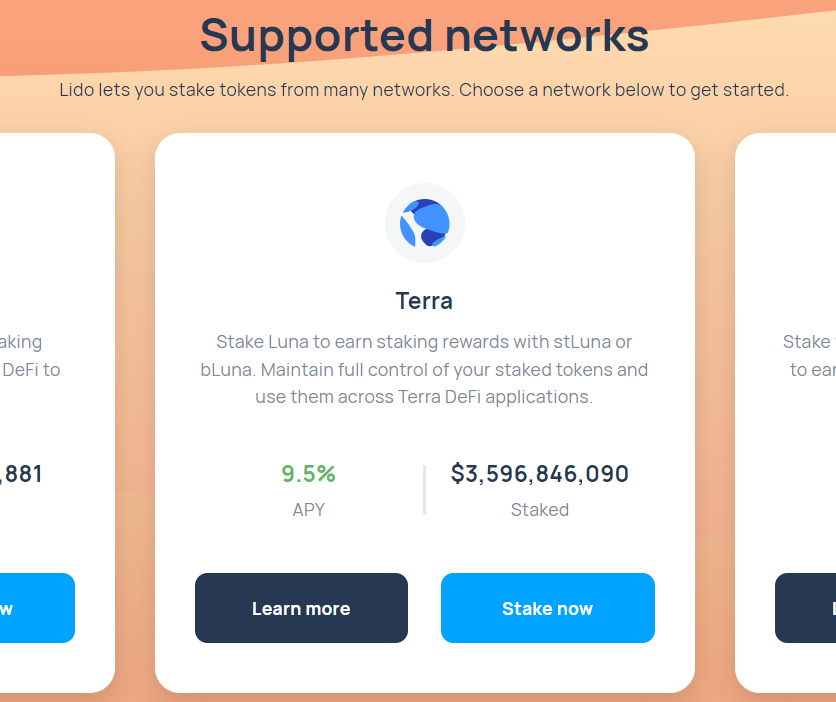

- LIDO, a liquidity staking platform, is the second biggest name on Terra with over $3.5B in TVL. The platform is also available on Ethereum and Solana with $5.7B and $200M in TVL, respectively.

Pylon Protocol, a yield investment protocol, is another strong DeFi application on Terra. This project proves the competitive ability of the Terra blockchain with UST. As users are looking for a lossless investment platform in this high volatility market, Pylon is a go-to place.

⇒ With the two protocols in this category, Terra users can utilize capital more efficiently as generating yield and passive income out of their crypto assets. LIDO and Pylon offer about 9% and 20% APY respectively, which is above the average number of 5% APY staking on most protocols/blockchains.

Terraform Labs

In this section, we will dive into the venture arm of Terra, Terraform Labs, and why it plays a leading role in the development of the ecosystem. Let’s explore the Terraform Labs portfolio:

- Mirror Protocol - synthetic asset protocol.

- Anchor Protocol - money market.

- Pylon Protocol - lossless investment and payment.

We’ve looked into the three projects in the previous sections, and understand their solid positions inside the Terra ecosystem. At the moment, they are acting as the leading players in DeFi on Terra.

Terraform Labs is the most contributing builder of the Terra blockchain and stablecoin UST. Therefore, the team understands the vision behind the two ambitious ideas. To accelerate the development of Terra, they also lend a hand to build Dapps on top of the blockchain via incubations.

In July 2021, Terraforms Labs stood out to raise $150M from major venture capitals, including Arrington Capital, BlockTower Capital, Delphi Digital, Galaxy Digital, Hashed, Lightspeed Ventures, Pantera Capital, Parafi Capital, and SkyVison Capital, to bootstrap DeFi development on Terra. Three mentioned names were discussed.

Despite the clear outcome of the three incubations, other Terra-based projects are struggling to pave the way for spotlights on Terra. We might expect future incentive programs from others not to make Terra a “centralized” playground only for big players.

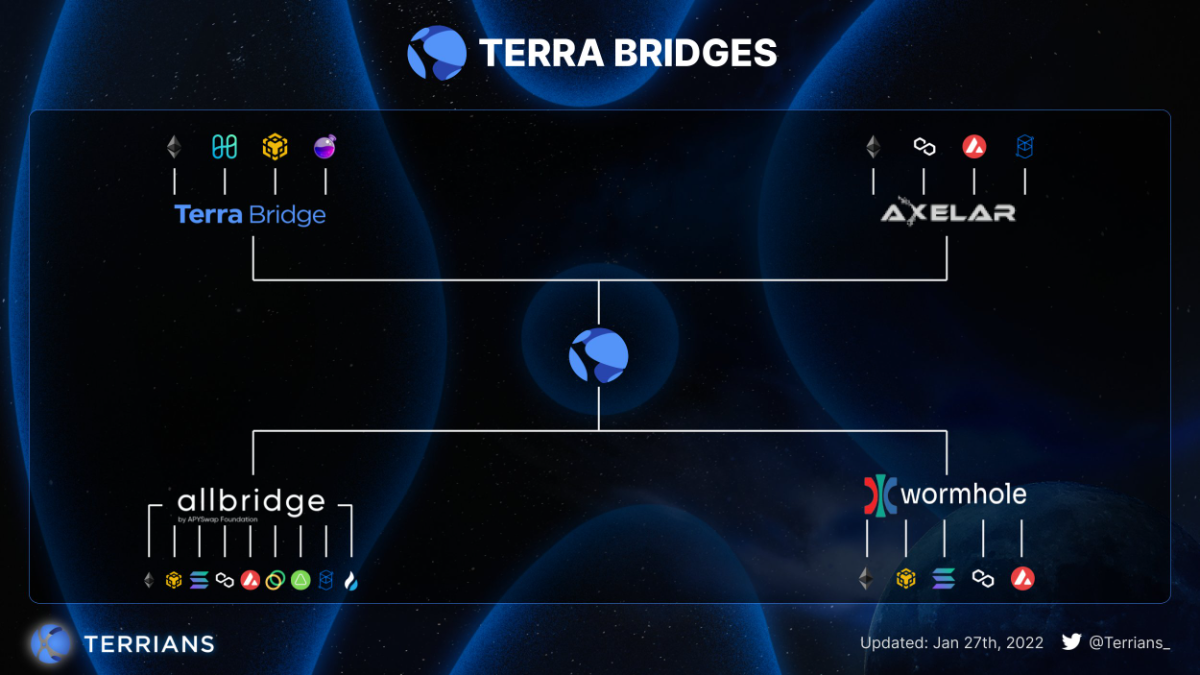

Bridge

Cross-chain bridges allow Terra to expand beyond its ecosystem, especially it’s built on top of the layer-0 blockchain platform, Cosmos. Allbridge, Wormhole, Axelar, and Terra Bridge help crypto assets interconnect among blockchains.

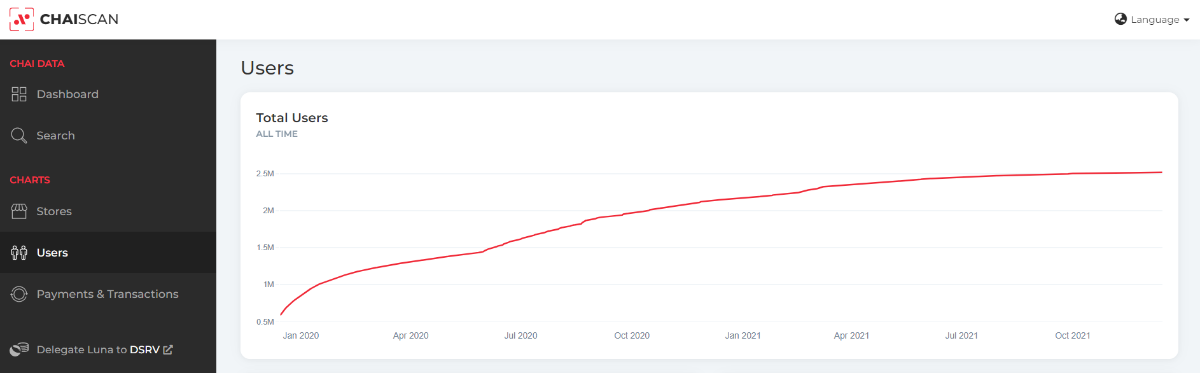

Payments

- Chai, a payment app, delivers UST applications to mass adoption in South Korea - the homeland of Terra and UST. It reached millions of users. As depicted in the graph, the number of new users is gradually increasing over time, which is about 2.5M users in South Korea. The Koreans are adopting the new blockchain-based stablecoin.

- Kado, giftcard gateway, allows users to spend UST on real-world purchases.

- Memepay, a payment gateway, focuses on the Mongolian market.

- Tiiik Money, a money-saving application, targets the Australian market.

⇒ Payment is the frontier for UST to go mass adoption. It will become useless for UST if it limits itself only to one DeFi ecosystem. As UST is available for payment in some countries, including Korea, Mongolia, and Australia, it follows a secure strategy when targeting countries with throughout crypto regulations.

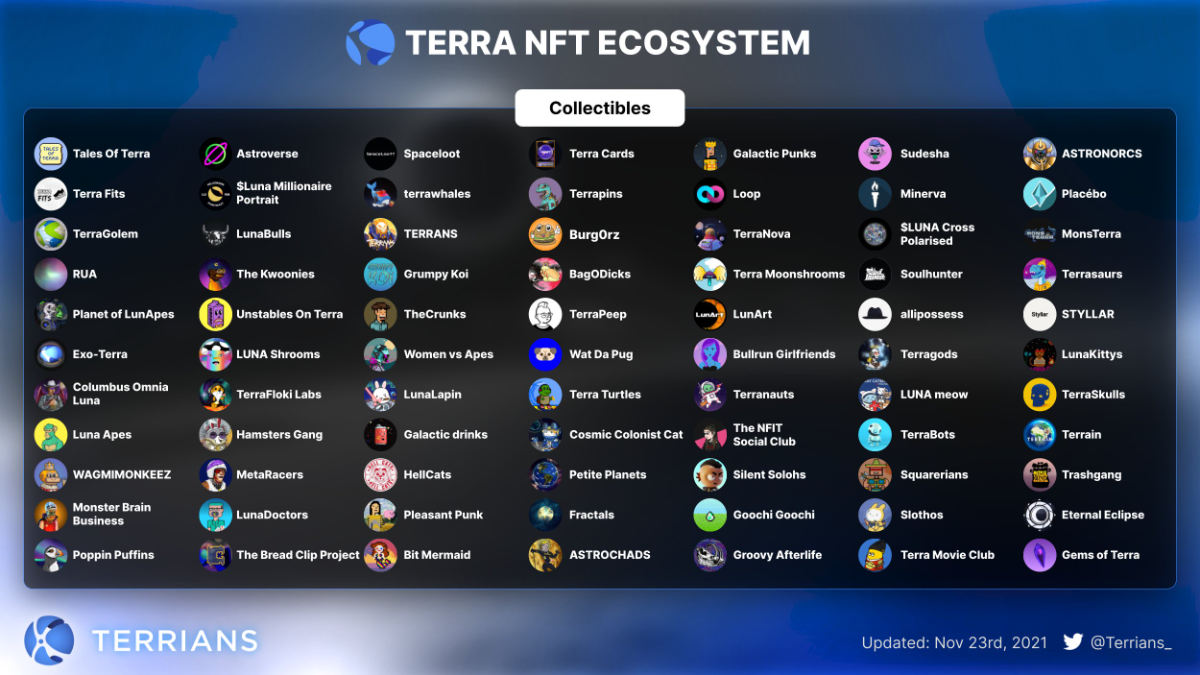

NFT

⇒ Despite the DeFi-focused strategy, NFTs on Terra also thrive. We can name some NFTs that are similar (somewhat forked) to NFTs on other emerging blockchain platforms, Galactic Punks, LunaKiittys, Luna Apes, Wat Da Pug, TerraFloki Labs, etc.

NFTs are illiquid and have almost no use case. Loop Markets stands out to be a pioneering player to integrate an on-platform NFT marketplace and create an NFT collectible. It will implement NFTs in a way that empowers NFTs with more utilities for collectors. However, at the moment, Loop NFT Marketplace is in the demo stage, not officially launched.

Investment Opportunities with Terra

Token investments

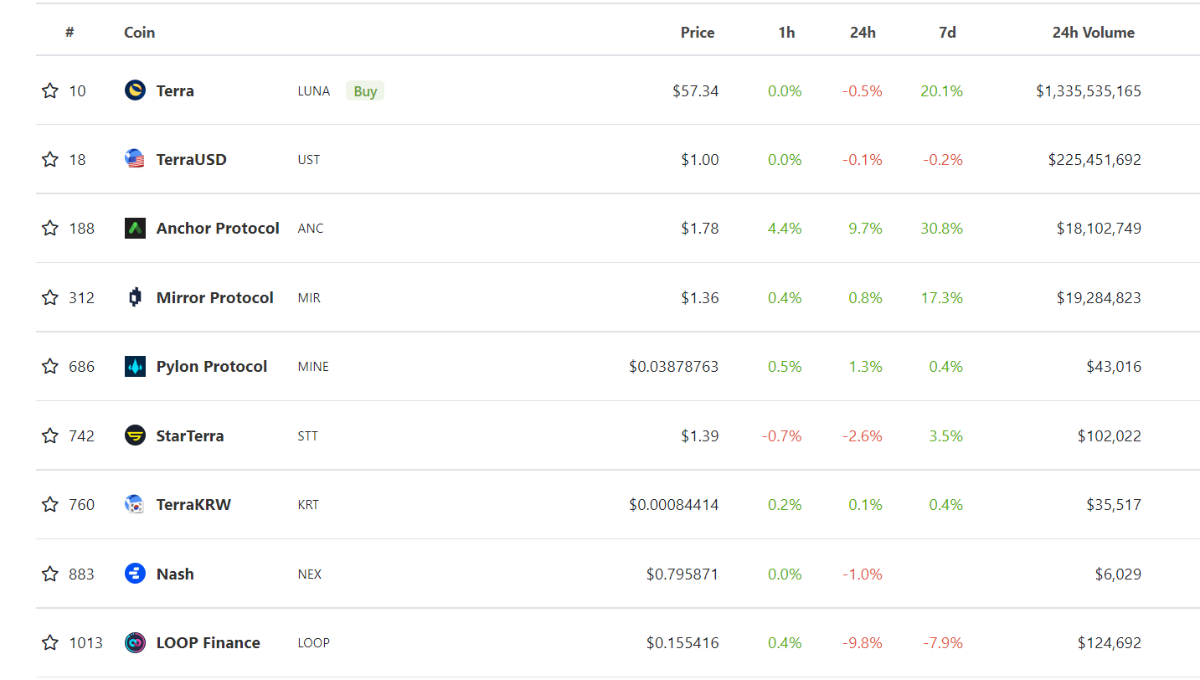

This is the easiest way to invest in the Terra ecosystem for retail investors. Many protocols on Terra have released their project tokens after launches. We can assess those to evaluate whether they are undervalued or overpriced to time our investments.

Staking/Yield Farm/Lending

With crypto assets on Terra, investors are able to deposit into some protocols to get considerable returns on their investments. However, investors should be aware of the risks, including rug-pull, Impermanent Loss, Liquidation, Token Locking,... while participating in those investment methods.

Let’s explore the average APY of those protocols:

- LIDO: 9% APY.

- Pylon Protocol: 20% APY.

- Anchor Protocol: close to 20% APY.

- StaderLabs: 10% APR.

- LUNA Staking: 9.66% APR.

- Loop Markets: 285.45% - 12 Month APR.

- Apollo DAO: 15%-70% APY, depending on token pairs.

Synthetic Assets Investment

If investors are looking for synthetic products, Mirror Protocol is a go-to synthetic asset platform. It also offers users a premium deriving from the difference between the pool and oracle price. The synthetic assets follow the volatility of the real-world prices and they can be hugely impacted when the pools have little liquidity. Investors should put this into accounts for synthetic asset investments.

Launchpad

StarTerra launchpad performance:

- Orion Money (ORION): 1,460%.

- Loop Markets (LOOP): 380%.

- Terra Land (TLAND): 770%.

For an IDO platform, the number of new launches is an important metric to measure sustainability in the long term. Without launches, the IDO platform will be useless. Speaking of StarTerra, we can see there are always imminent projects ready to be launched, building a moat for it.

In general, the IDO trend in crypto is getting exhausted as the market is shaking with high volatility at the moment. When it’s in the bullish phase, IDO launches often get lots of community traction, resulting in raising a huge amount of capital.

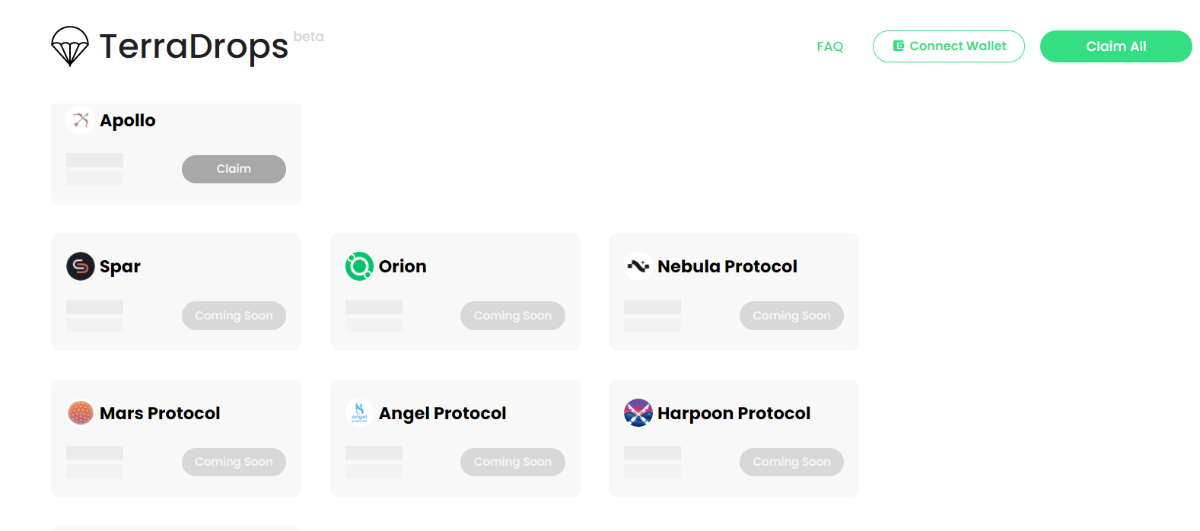

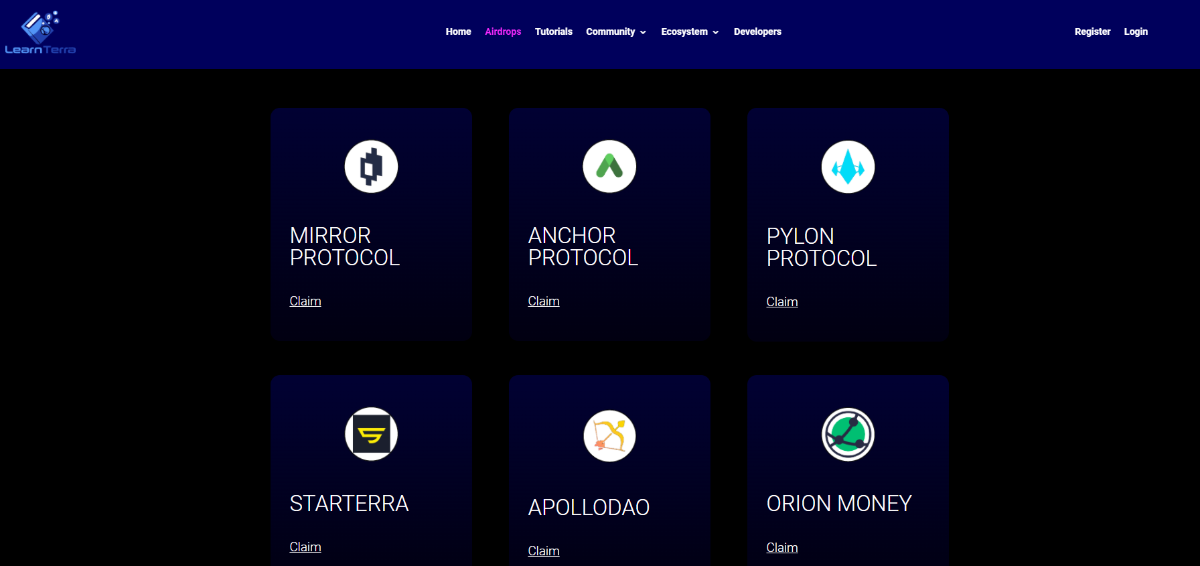

Airdrop

Terra Predictions

Terra with an adventurous stablecoin idea has spurred the market since it climbed from down the bottom to the top 10 crypto projects with the highest market cap. Coin98 Insights will put forward some predictions that Terra and its ecosystem might go ahead and let's explore what we can do in the next surge.

- Opportunities for other DeFi niches: DEXs and Money Markets are getting the most traction from the community. On the other hand, the derivatives and options niche is still in the developing process. The opportunities for investors are imminent but we should consider our investments carefully since the crypto market is extremely risky.

- NFT-based Games with DeFi model: In November 2021, Terra announced to roll in the gaming market in Korea, giving a good signal since Korea’s gaming industry was estimated to have a value of over $15B in 2020.

- Other than Terraform Labs? Terra is expected to attract more and more big players coming into the ecosystem to accelerate Dapps. There are still a few big venture capital names appearing and the IDO launchpads on Terra will be a key player to get traction from the community.

- Going mass adoption: This is the main goal of Terra with UST. The global payment system is now worth multi-trillion dollars, and UST is targeting to be a winner. If UST is able to realize the ambition, LUNA will surely capture tons of value.