What is Terra (Terra Classic)? Everything you need to know about LUNA token

What is Terra?

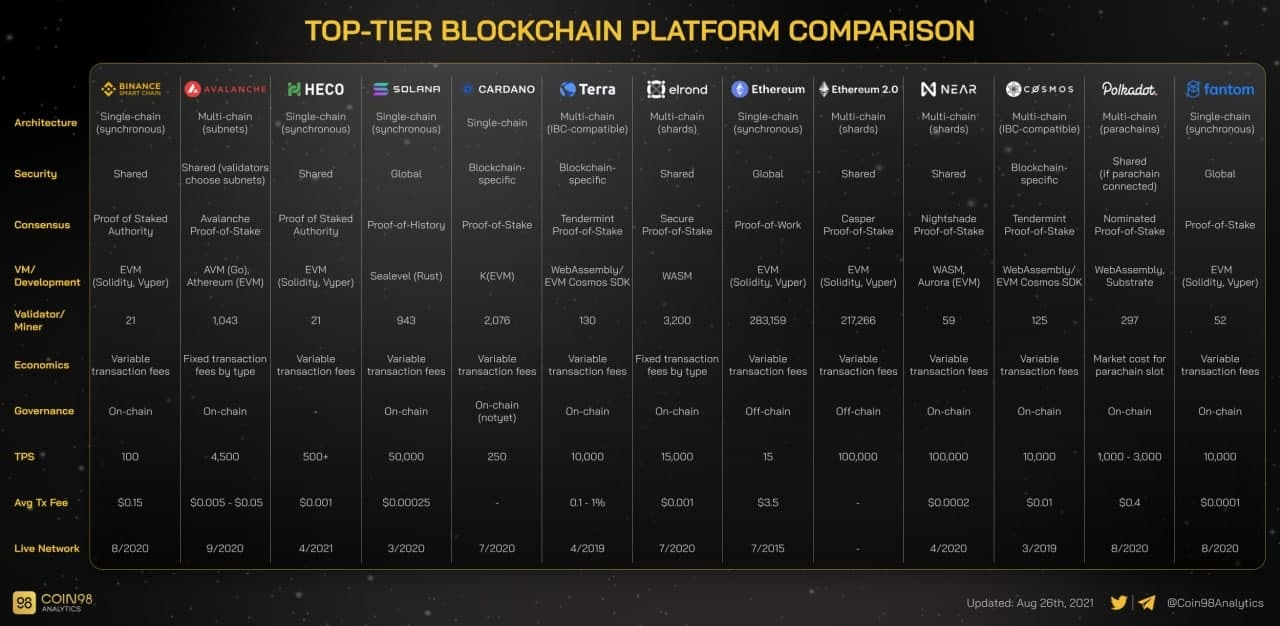

Terra is one of the most active blockchains inside the Cosmos universe, using the CosmWasm technology. It was founded by Terraform Labs, a Korean company led by Daniel Shin and Do Kwon - one of the most influential figures in crypto as stated by CoinDesk.

Terra was initially known as the blockchain with notable payment apps such as CHAI, MemePay. However, after having its smart contract in November 2020, Terra started to develop its own DeFi ecosystem. And now, Terra has thousands of projects and has been growing at a fascinating pace.

What is LUNA Token?

LUNA is the native token of Terra that captures value effectively from the growth of the Terra ecosystem as a whole.

Terra knows how to increase the value for their native tokens by creating many privileges for LUNA holders. Besides earning fees and taking part in the governance, LUNA stakers also have a chance to receive airdrops from various protocols on Terra.

Moreover, the price of LUNA benefits directly from the expansion of Terra stablecoins, which will be explained in the next part.

How does Terra work?

This part will explain in detail how LUNA can effectively capture value from the growth of the Terra ecosystem through the pegging mechanism with the Terra stablecoin - UST.

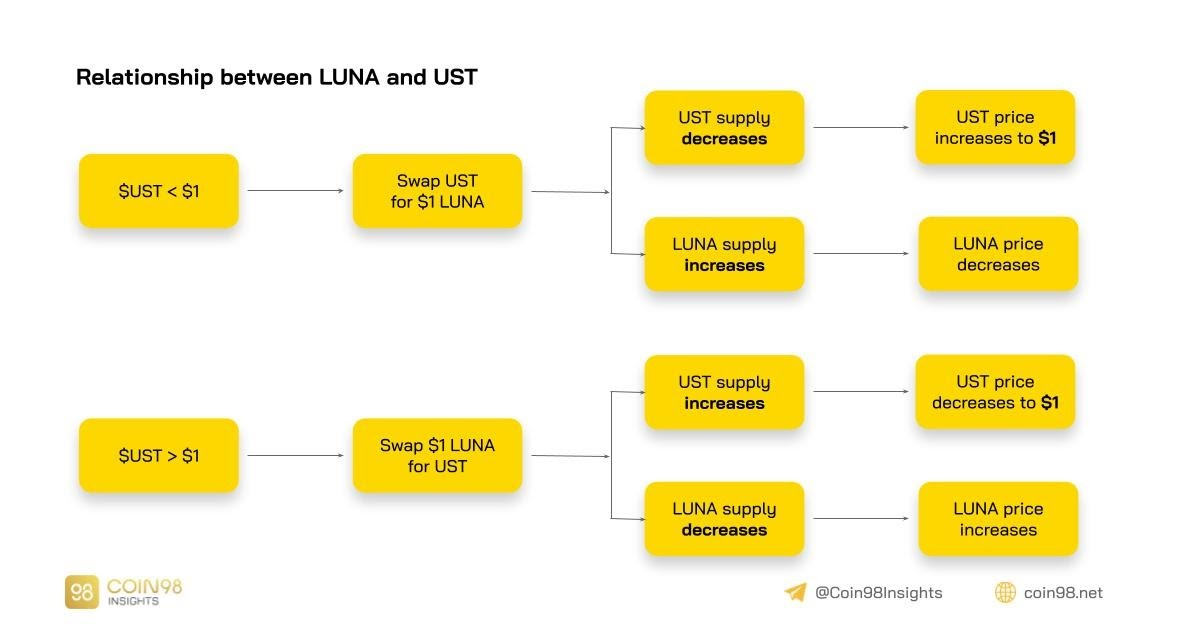

Firstly, we must understand how UST can remain its peg through LUNA.

The price of UST is determined by 2 factors: users’ demand and the supply of UST. While users’ demand is hard to control, Terra can control the supply of UST. And it achieves this by a mechanism for people to swap between 1 UST for $1 worth of LUNA.

- When the price of 1 UST is below $1 ⇒ Users swap 1 UST (<$1) for $1 in LUNA to earn profits ⇒ UST supply decreases ⇒ Price of UST increases to $1.

- When the price of 1 UST is over $1 ⇒ Users swap $1 LUNA for 1 UST (>$1) to earn profits ⇒ UST supply increases ⇒ Price of UST decreases to $1.

This is how UST can remain at $1. So what does this mechanism mean for the value of LUNA?

You can see from the mechanism above that the price of LUNA will increase when the demand for UST increases ($UST > $1). This will create a flywheel for LUNA and the Terra ecosystem as a whole.

When the Terra ecosystem grows with an improvement in the quantity and quality of projects on Terra, offering users more opportunities to earn profits, the demand for UST as the means to take part in the economic activities on Terra will increase. This leads to UST’s price increasing and the LUNA supply decreasing accordingly to remain the peg of UST.

As a result, the price of LUNA will increase. Part of the decreased amount of LUNA supply will go to the community funds to be invested in building and growing the Terra ecosystem. And the loop begins.

And that is how LUNA can effectively benefit from the growth of the Terra ecosystem.

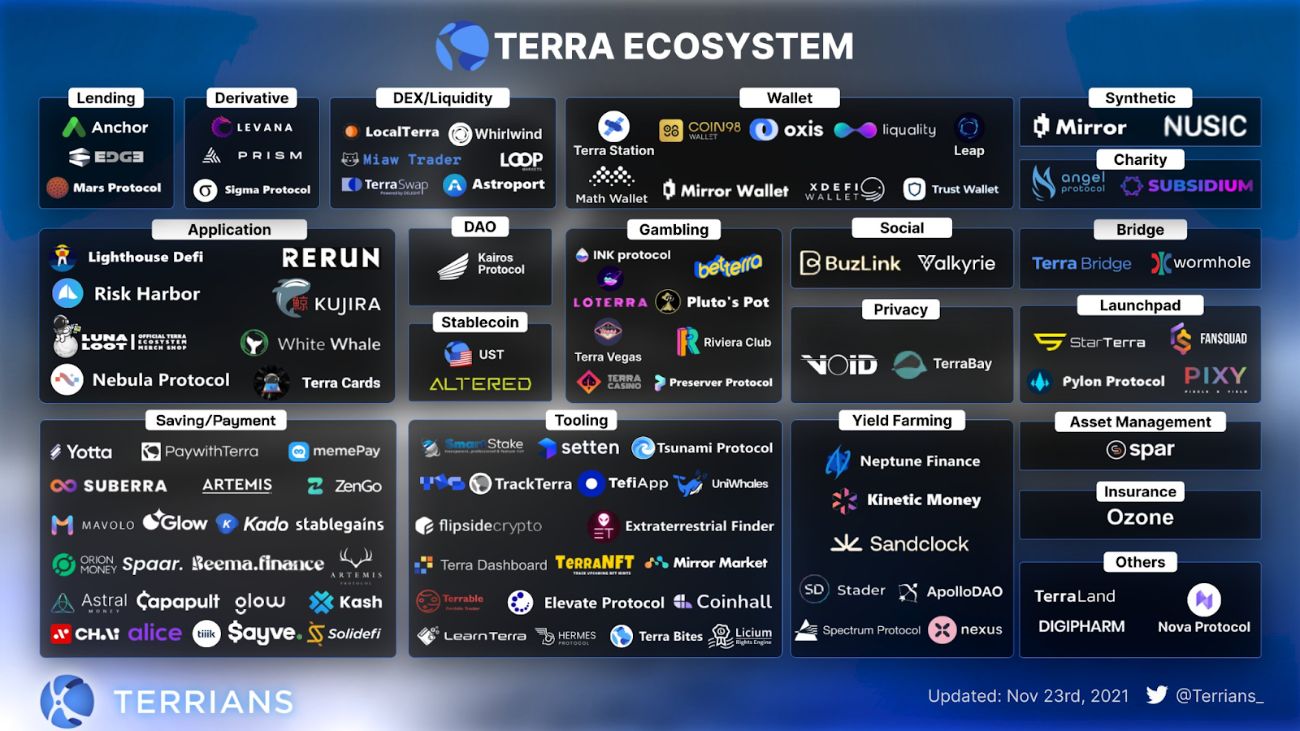

The Terra Ecosystem

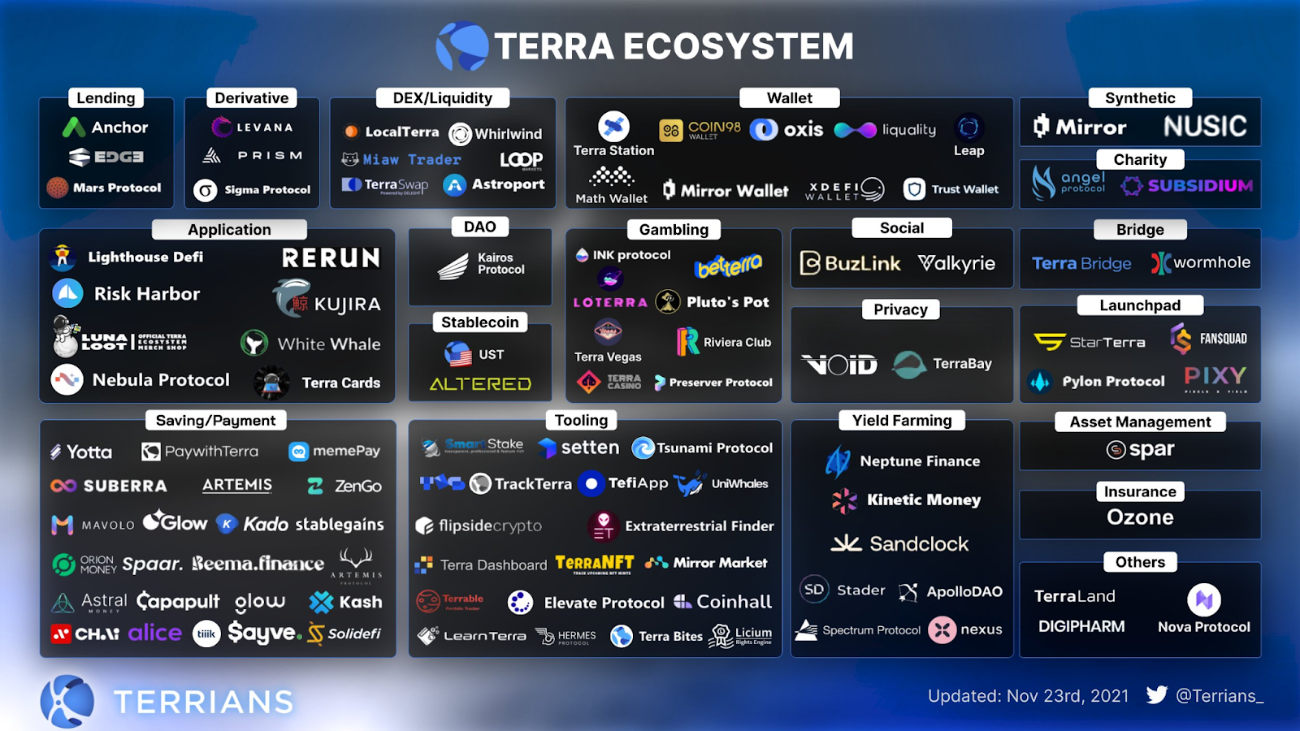

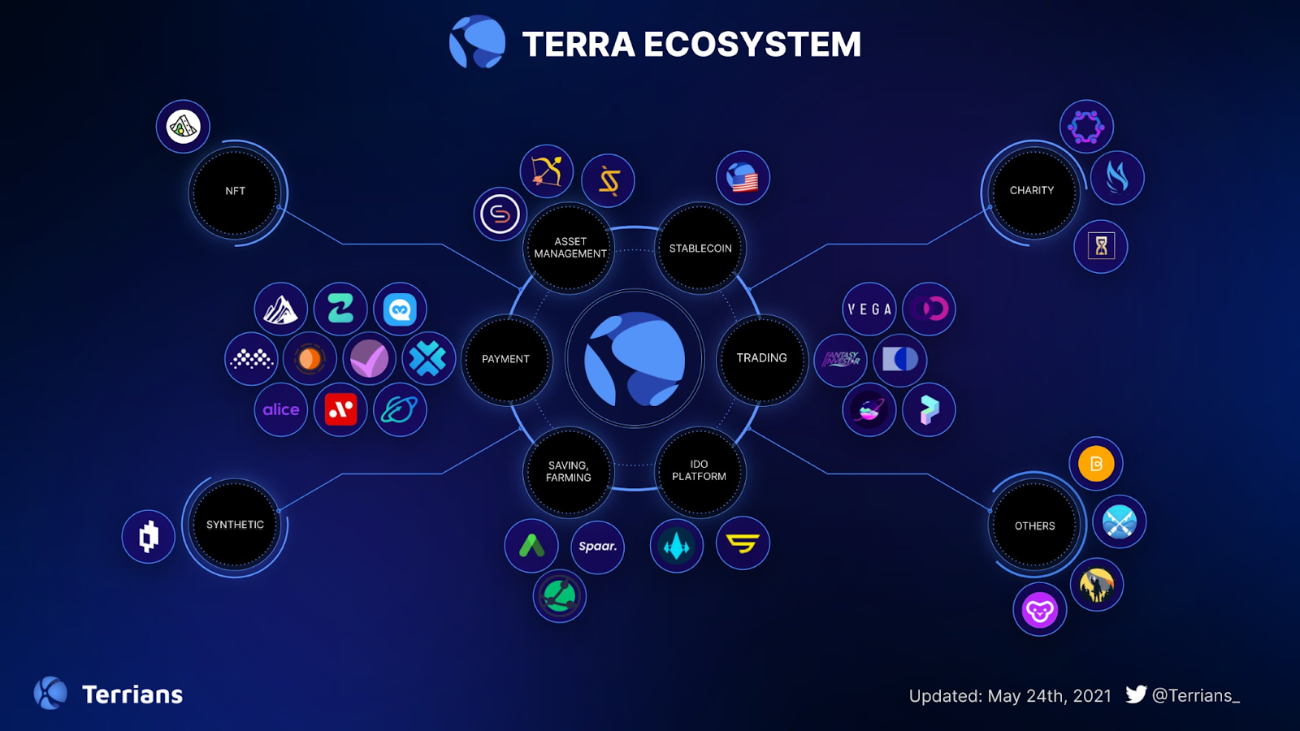

Since building its own DeFi ecosystem, Terra has invented many outstanding protocols such as Anchor (which allows users to have a stable saving rate at a volatile market like crypto) or Mirror (which provides users access to real-world assets like US stocks).

However, at that time, the ecosystem on Terra was quite centralized as the number of projects was still small, and most of them were built by Terraform Labs.

Now, the Terra ecosystem is becoming more decentralized with the increasing number of projects in different DeFi stacks. By that, the Terra ecosystem is expanding relentlessly with many innovations inside the ecosystem.

Detailed information about LUNA token

LUNA Key Metrics

- Token Name: LUNA

- Ticker: LUNA

- Blockchain: Terra

- Token Standard: CW-20

- Contract: Updating…

- Token type: Utility, Governance

- Total Supply: 850,655,883 LUNA

- Circulating Supply: 377,701,697 LUNA

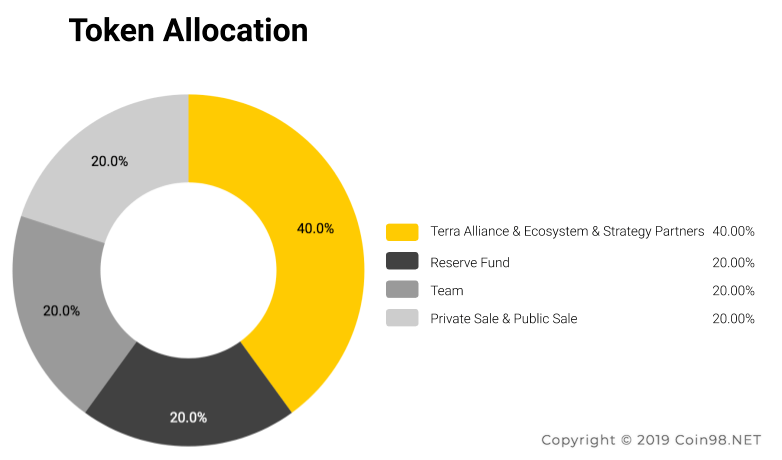

LUNA Token Allocation

LUNA Token Sales

Updating...

LUNA Release Schedule

Updating...

LUNA Token Use Cases

LUNA can be used for various purposes in the Terra ecosystem:

- Governance.

- Airdrops.

- “Skin in the game” on Terra: saving, farming, lending, joining IDO,...

How to get LUNA token

You can earn more LUNA by staking LUNA in the Terra ecosystem.

How to buy LUNA token

You can buy LUNA from the following exchanges: Binance, Gate.io, Bitfinex,...

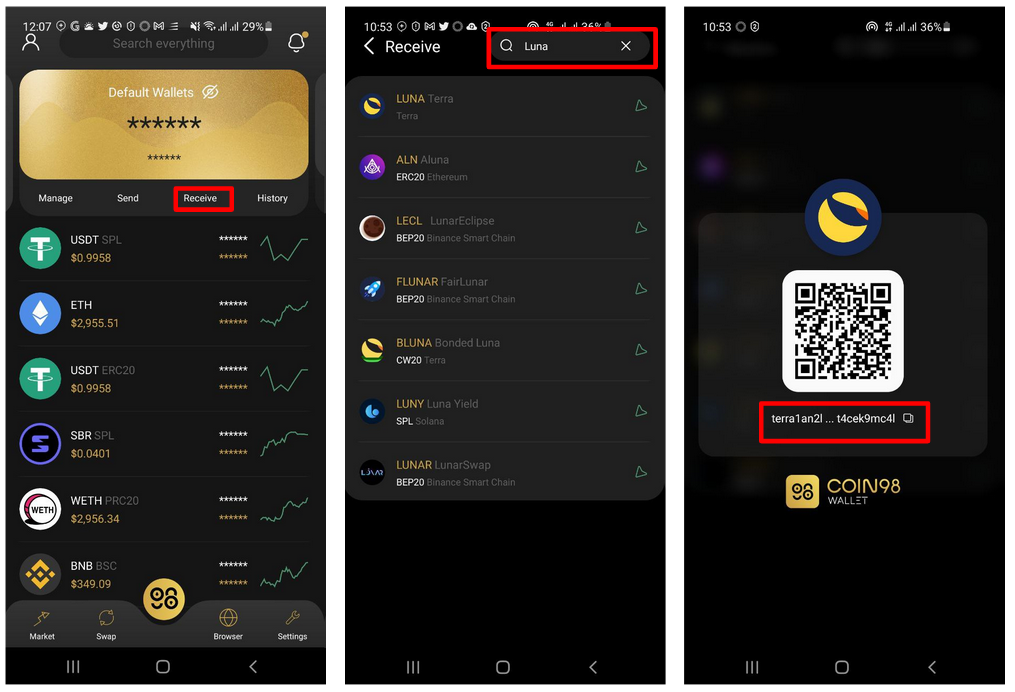

How to store LUNA token

You can store ETH tokens on Coin98 Wallet with these steps:

Step 1: At the main screen of Coin98 Wallet, click Receive

Step 2: Search for LUNA token.

Step 3: Copy your LUNA wallet address and send LUNA tokens to this address.

Terra Roadmap

The ultimate goal of Terra is always for the “mass adoption” of its stablecoins, in other words increasing demand for its stablecoins. And this, as I explained before, creates a strong flywheel for the whole Terra ecosystem.

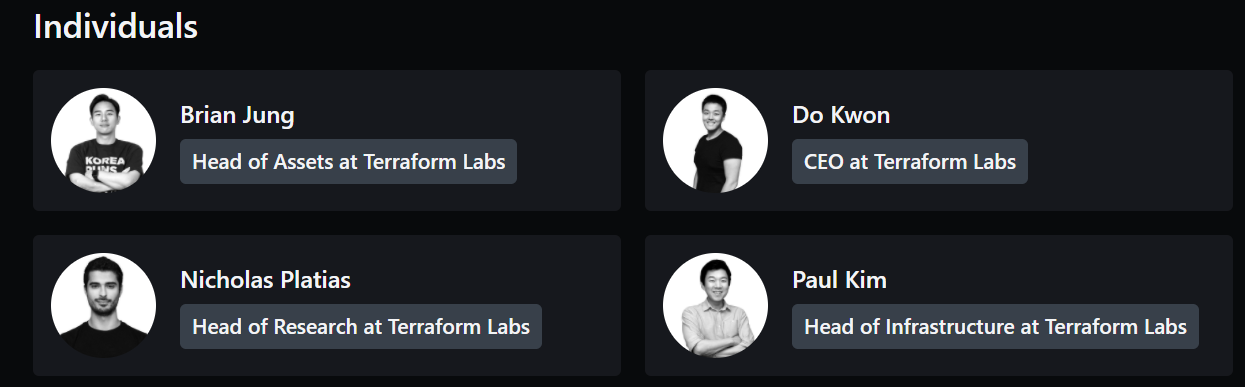

Team, Investors, and Partners

Team

The team behind many core projects on Terra is Terraform Labs, a team led by the CEO Do Kwon, who has been listed in the Top 10 most influential figures in crypto by CoinDesk for his contribution to Cosmos and the multi-chain future.

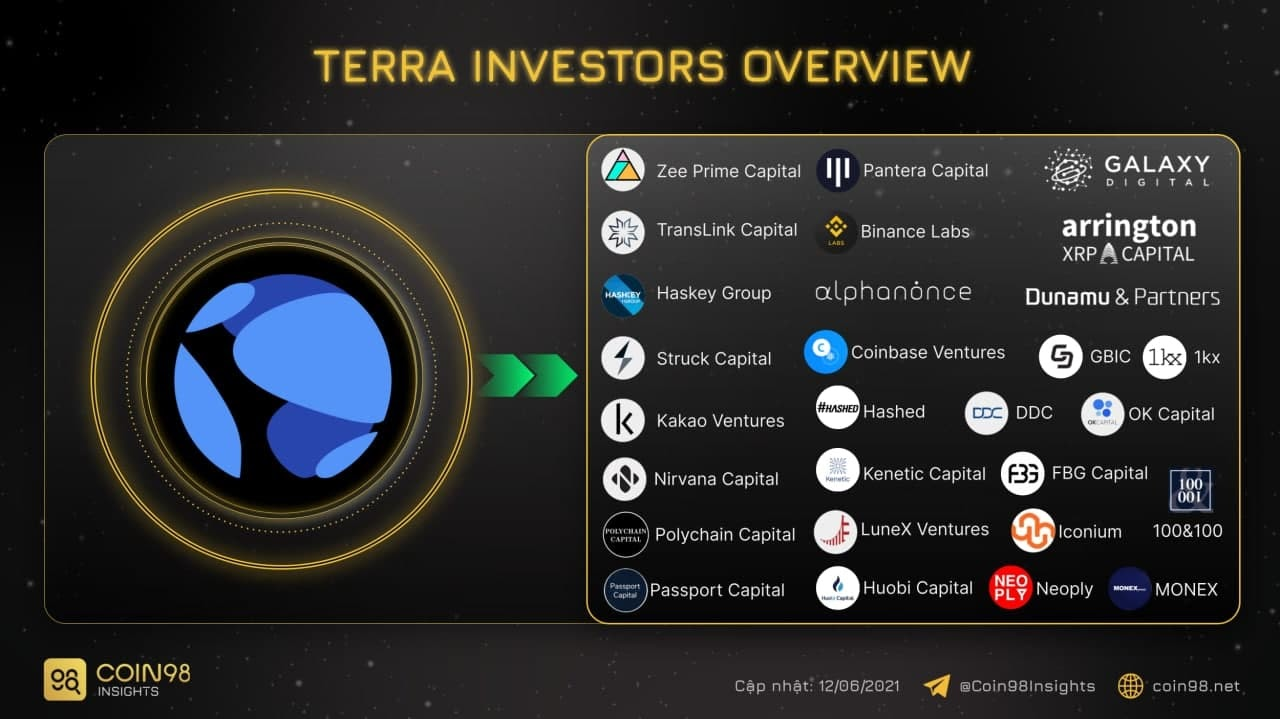

Investors

Terraforms Lab has successfully raised $150 million from top-tier investors: Hashed, Pantera Capital, Parafi Capital, Delphi Digital, etc.

Partners

Terra has established relationships with many other protocols on different blockchains to accelerate the expansion of its stablecoins as well as the whole Terra ecosystem.

Most recently, Terra even has a new direction in its development strategy: building a gaming ecosystem on Terra to accelerate the adoption rate of its stablecoins, which plays a critical role as the “money” in Terra games. Terra has started by establishing a partnership with a gaming company: COM2US.

Is Terra (LUNA) a good investment?

Below are some highlights about Terra (LUNA) for you to take as a reference. However, remember to do your own research and make your own investment decisions.

Terra is the blockchain with a unique approach compared to other blockchains. It did not only focus on the native crypto world, but the highest mission of Terra is that its stablecoins is mass adopted by both crypto and non-crypto users. Therefore Terra’s potential to grow is significant as the target market is enormous.

When focusing on stablecoins expansion as the core mission, Terra also, at the same time, creates a virtuous flywheel for the whole Terra ecosystem and LUNA in particular, as I explained above. Suppose there are more use cases for Terra stablecoins (both in the crypto and real-life world). In that case, the UST demand increases, resulting in a decrease in the LUNA supply, making LUNA increasingly more valuable.

Regarding the Terra DeFi ecosystem, in particular, it is growing at a fascinating pace. More Dapps are being built to create more use cases for UST, LUNA, and other Terra-based tokens. Terra has attracted many users by being an ideal destination for payment and saving services. Now Terra even offers a broader range of services and has started to enter into new sectors: NFT, Gaming, and Metaverse. This promises an explosion on Terra soon.

Similar projects

Some similar projects to Terra: Binance Smart Chain, Avalanche, Solana,...