What is Clover Finance (CLV)? All about CLV Token

What is Clover Finance?

Clover is a parachain on Polkadot. It provides easy-to-use blockchain infrastructure and creates a one-stop comprehensive infrastructure platform. Clover has built an EVM compatible infrastructure to easily migrate existing dApps.

Clover Products:

- Multi-chain Wallet: Mobile, web & extension.

- Cross-chain infrastructure.

- Cross-chain bridge.

How does Clover work?

Clover is a Blockchain Operating System, which contains storage layer, smart contract layer, DeFi protocol layer and eApp layer.

Clover also supports the evolution from dApp to eApp (External App). Developers can build and deploy their eApps easily on Clover, without the need for machines, domain names, or network bandwidth.

Clover’s Main Features

- EVM Compatibility: It offers seamless multi-chain indexing across Bitcoin, Ethereum, Binance Smart Chain and Polkadot.

- Gas-fee Redistribution: Clover will automatically share a percentage of the fees to dApp builders in order to incentivize them. By this way, developers can earn passive income in a sustainable manner.

- Gasless: users of Clover-based dApps can pay for gas with the asset they transact with (no need to keep a base currency like ETH for gas), while frequent users will benefit from lower gas fees

- Identity-based Fee schedule: Clover has a unique gas calculation method which allows users to get gas discounts proportionally to the frequency of their network activity. Less interaction -> pay more gas and vice versa.

This network allows its upper-layer application projects to focus on improving user experiences and accelerate innovations of diversified financial applications through its composability.

Clover can potentially convert a large number of DeFi users into users of its upper-layer applications. This way, upper-layer applications will be able to bootstrap their communities and inject more market values.

Clover will also establish a developer-centric community through giving rewards to those who provide constructive contributions.

Clover Incentive Program: To bootstrap the ecosystem, Clover released two incentive programs including DIP and UIP:

- The Developer Incentive Program (DIP) is a feature that aims to direct a percentage of transaction fees to registered smart contracts to incentivize in Clover third party contract developers and commons, mainly to boost external dApp development

- The User Incentive Program(UIP) is another feature that aims to lower the barrier for users to use the Clover network for transactions. Since Clover enables the dapp functions of Ethereum chain, there is a fundamental setup to bind Clover address and virtual Ethereum Address. Then the incentive program will work consistently on both networks.

Detailed information about CLV Token

CLV token metrics

- Ticker: CLV.

- Deployment Network: Clover.

- Relay Chain: Polkadot.

- Token Standard: Updating…

- Contract: 5CyngUVPJD2MnAbrYR9F72CA5YX1VekR6ip9n2QuuBWcKXKB

- Token Type: Utility and Governance.

- Total Supply: 1,000,000,000 CLV.

- Circulating Supply: 211.071.790 CLV

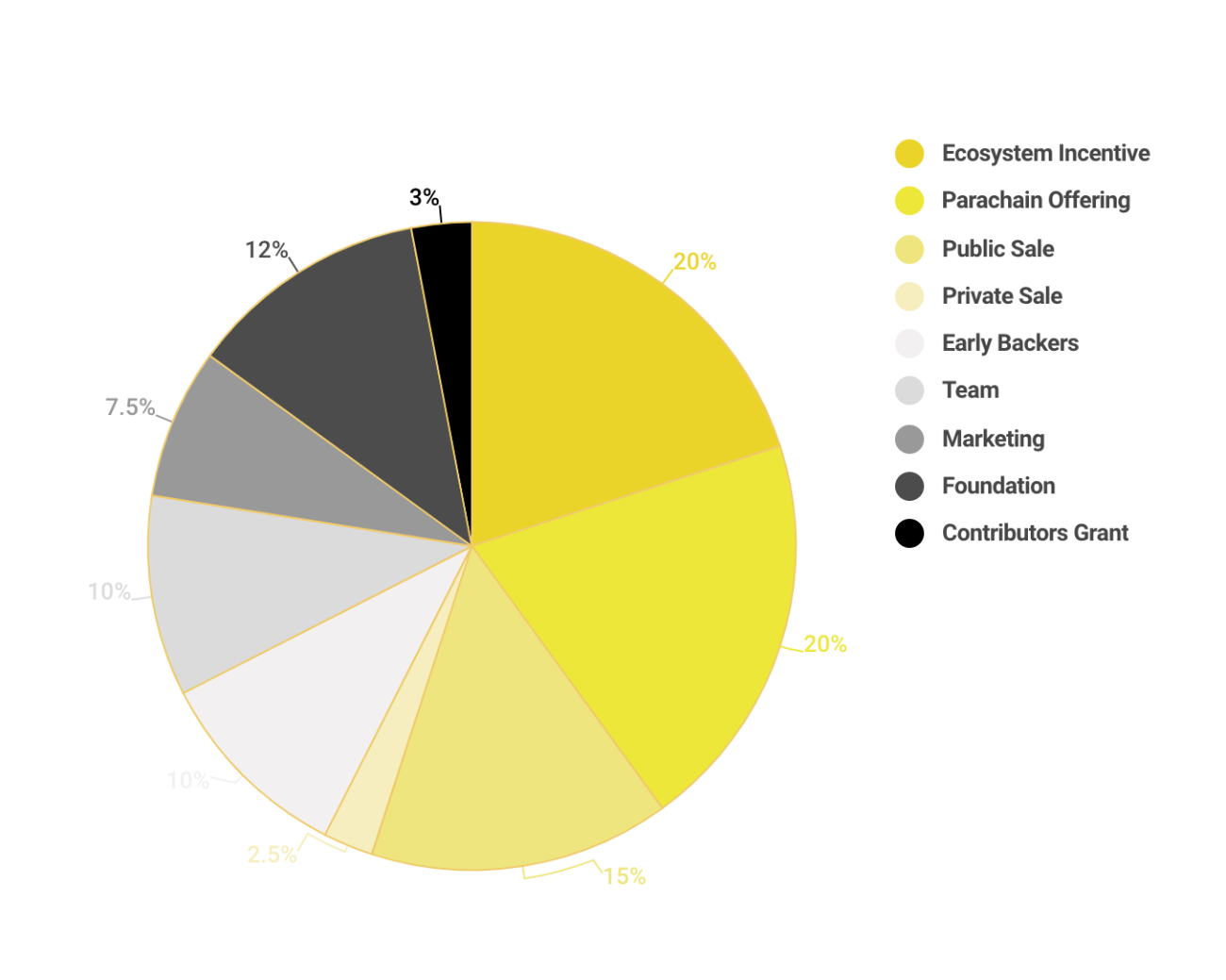

CLV Token Allocation

- Ecosystem Incentive: 20%

- Parachain offering: 20%

- Public Sale: 15%

- Private Sale: 2.5%

- Early Backers: 10%

- Team: 10%

- Marketing: 7.5%

- Foundation: 12%

- Contributors Grant: 3%

CLV Token Sale

- Early Backers (May 2020 - March 2021): 0.06$ per token.

- Private Sale (April 2021): 0.2$ per token.

- Coinlist Sale: Three rounds, 0.2$ - 0.35$ per token (ended).

CLV Release Schedule

- Ecosystem Incentive: 36-month vesting.

- Parachain offering: 24-month vesting.

- Public Sale: 3 options including 12 months lock up, 6 months lock up & 40 days lock up.

- Private Sale: 18-month vesting.

- Early Backers: 36-month vesting.

- Team: 36-month vesting.

- Marketing: 36-month vesting.

- Foundation: 36-month vesting.

- Contributors Grant: 36-month vesting.

CLV Token Use Case

The CLV token has these use cases:

- Transaction Fees: Pay gas fee in CLV, or have the option to pay with any network token.

- Governance: Lock CLV to elect council members and guide the development through on-chain governance.

- Validation: Stake to validate the network.

- Treasury: Support early projects on Clover.

- Nomination: Stake to nominate node validators using a single-click deployment.

- Deployment: Use to deploy smart contracts and dApps on Clover.

You can buy CLV Token through these exchanges: Binance, MEXC Global, AEX, Coinbase Exchange,...

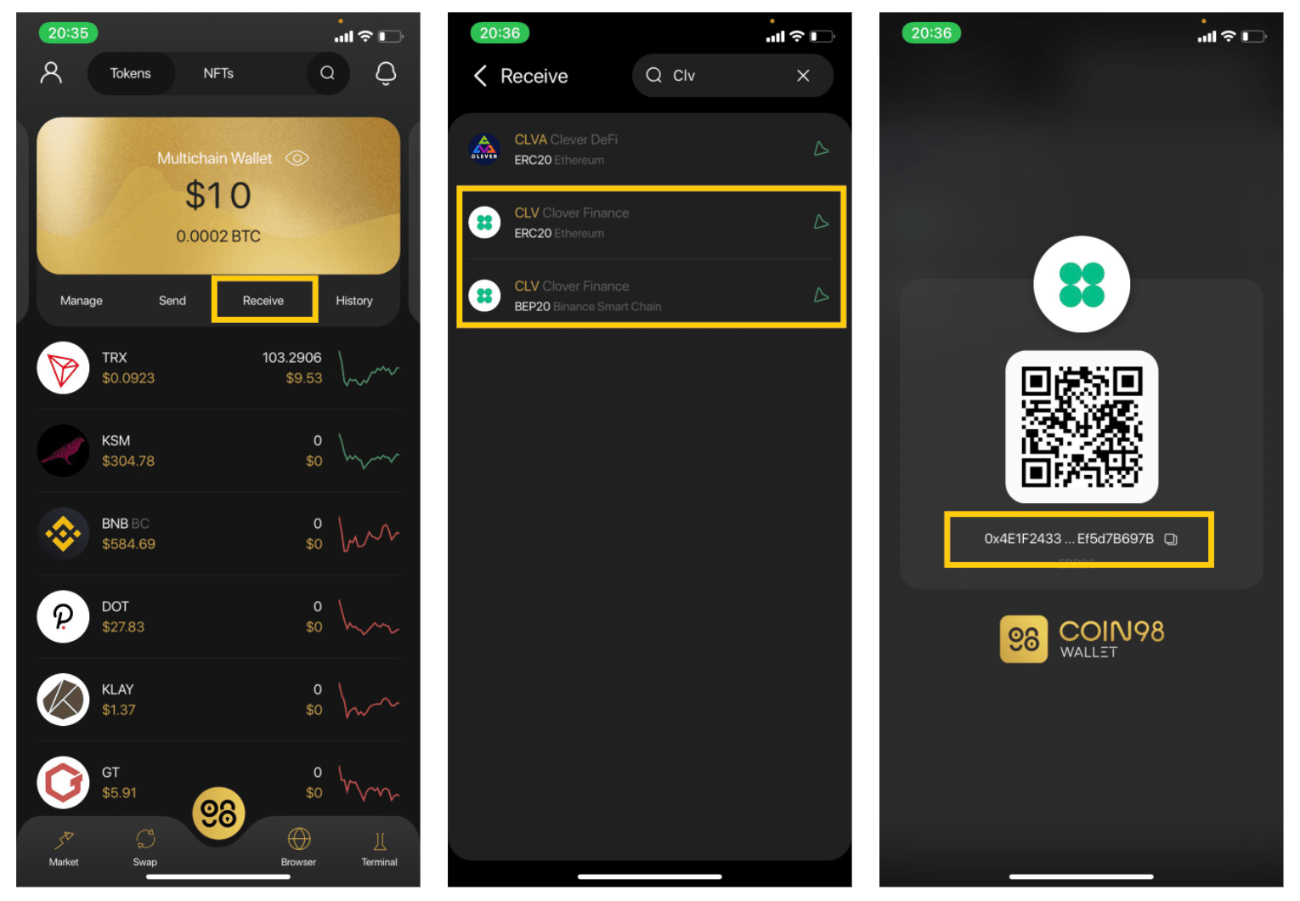

How to store CLV Token

You can store CLV tokens on Coin98 Wallet with these simple steps:

Step 1: Open Coin98 Wallet & click Receive on the home screen.

Step 2: Search CLV Token.

Step 3: Click on the correct result, copy the wallet address and send CLV to this address.

Team, Investors, and Partners

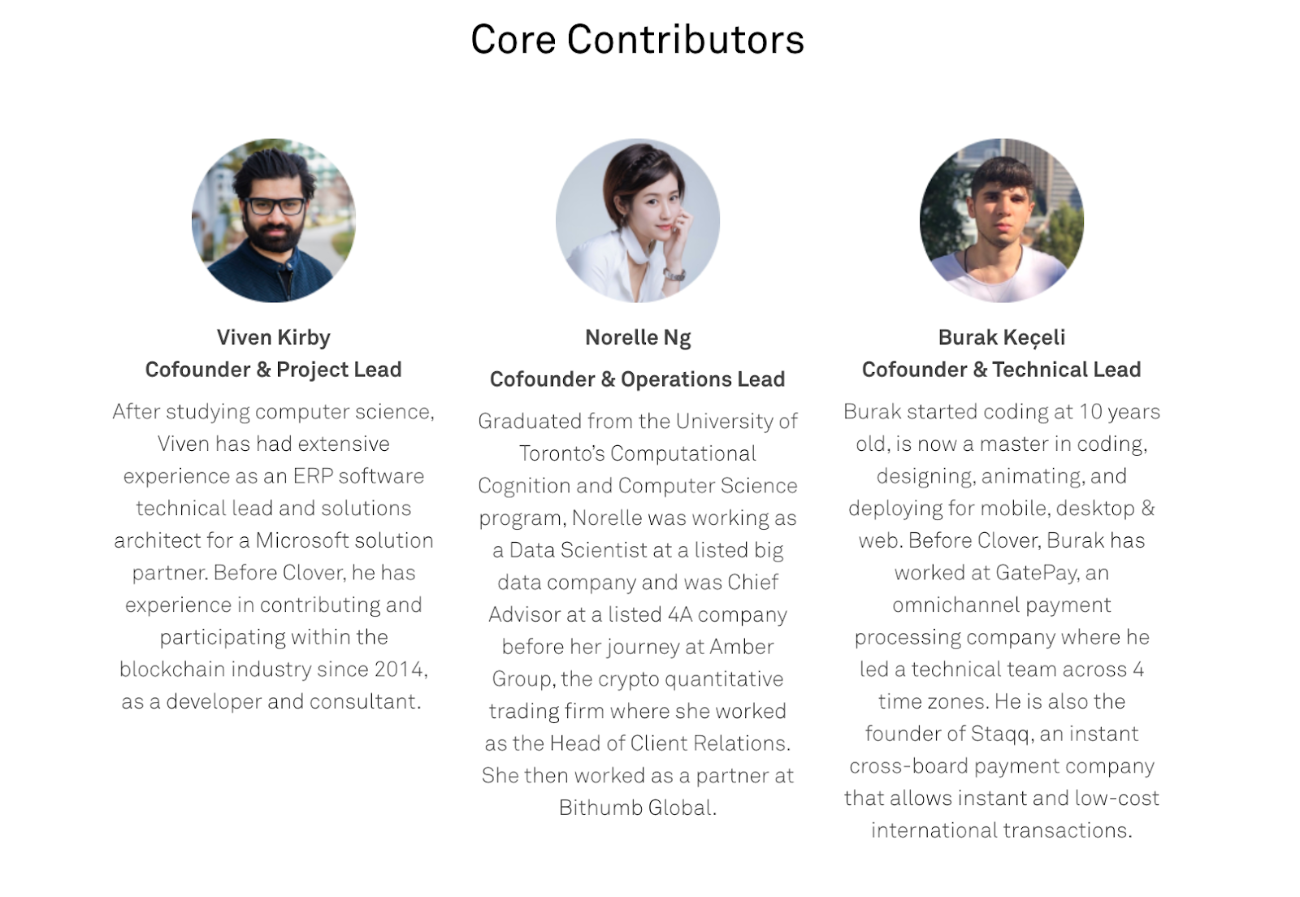

Team

Investors

Some of their investors from seed round including Polychain Capital, Hypersphere, Divergence Ventures, Bithumb Global.

Partners

Clover Finance has numerous partners in various fields. They’re continuous expanding the ecosystem to provide the most optimized platform to both developers and users.

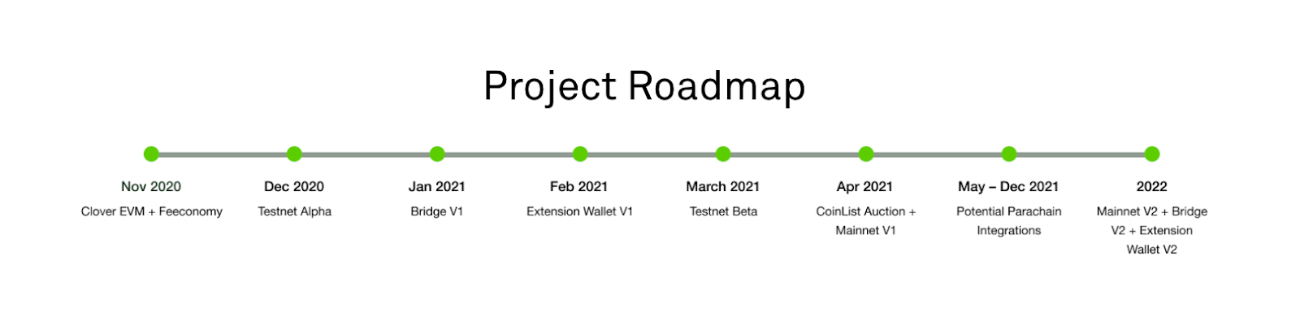

Roadmap and Updates

Currently, Clover is preparing for the crowdloan on Polkadot. Once it becomes an official parachain, this event will open a new era for Clover.

Is CLV a good investment?

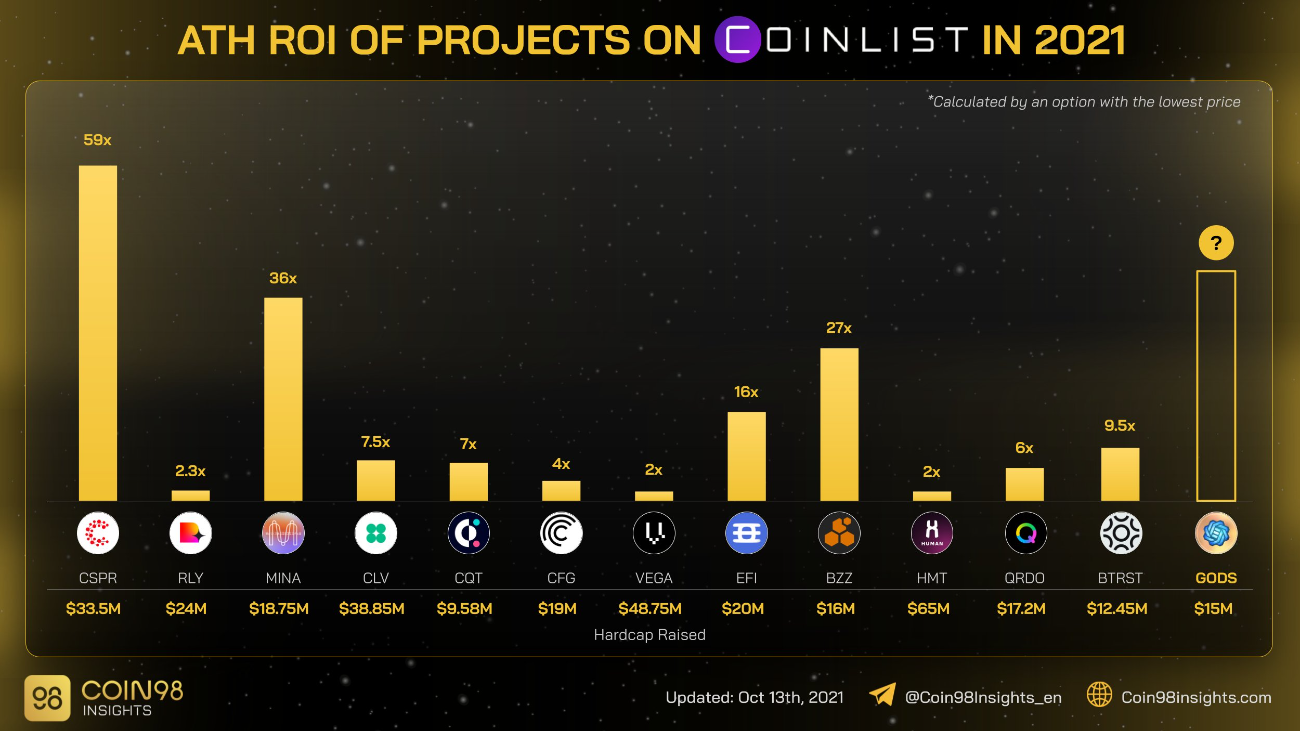

IDO on Coinlist

Featured as Coinlist’s most noteworthy projects in 2021, Clover’s functional products currently have more than 200,000+ users and is also the first Polkadot project parachain candidate token that went on Coinlist’s public sale.

As can be seen, that the CLV token price increaseds 7.5 times if anyone buys from the IDO.

Coinlist is a platform that helps blue-chip crypto projects connect with new token holders.

In my personal opinion, Coinlist’s team has a long-term vision. Therefore, almost all projects launched on Coinlist are usually outstanding with an impressive ROI to investors. That is the reason why every project launching on Coinlist usually entices a large number of people to take part in. Some of their prominent projects with very high ROI are Solana, Flow, Casper,...

The $30 milllion CLV Wallet Incentive Program

Clover Finance has announced the first leg of the Clover Ecosystem Incentive Program, a 30 million CLV user adoption initiative specifically designed to drive users to a multi-chain wallet experience. Clover Finance will be coordinating with projects on every chain to integrate the Clover extension and mobile wallets. All projects that integrate the Clover wallet will make their dApp users eligible for a share of the 30 million CLV, accounting for 3% of the total supply

This incentive program puts an effort to attract developers and builders coming to the network. By sharing and supporting projects which integrate Clover Wallet → Expanding the partners range and DeFi applications as well.

Similar Projects

Astar Network: Astar Network (formerly Plasm Network) is a Substrate blockchain that provides the methods for developing scalable Dapps and supporting cutting-edge layer 2 solutions.