Kyber Network - Everything you need to know about KNC Token

What is Kyber Network?

Kyber Network is a multi-chain crypto trading (DEX) and liquidity hub that connects liquidity from different sources to enable trades at optimized rates. Kyber Network is a hybrid of KyberSwap and KyberDAO.

- KyberSwap is a protocol that connects liquidity from diverse sources to provide the best rates.

- KyberDAO is a community platform that allows KNC holders to participate in the governance process.

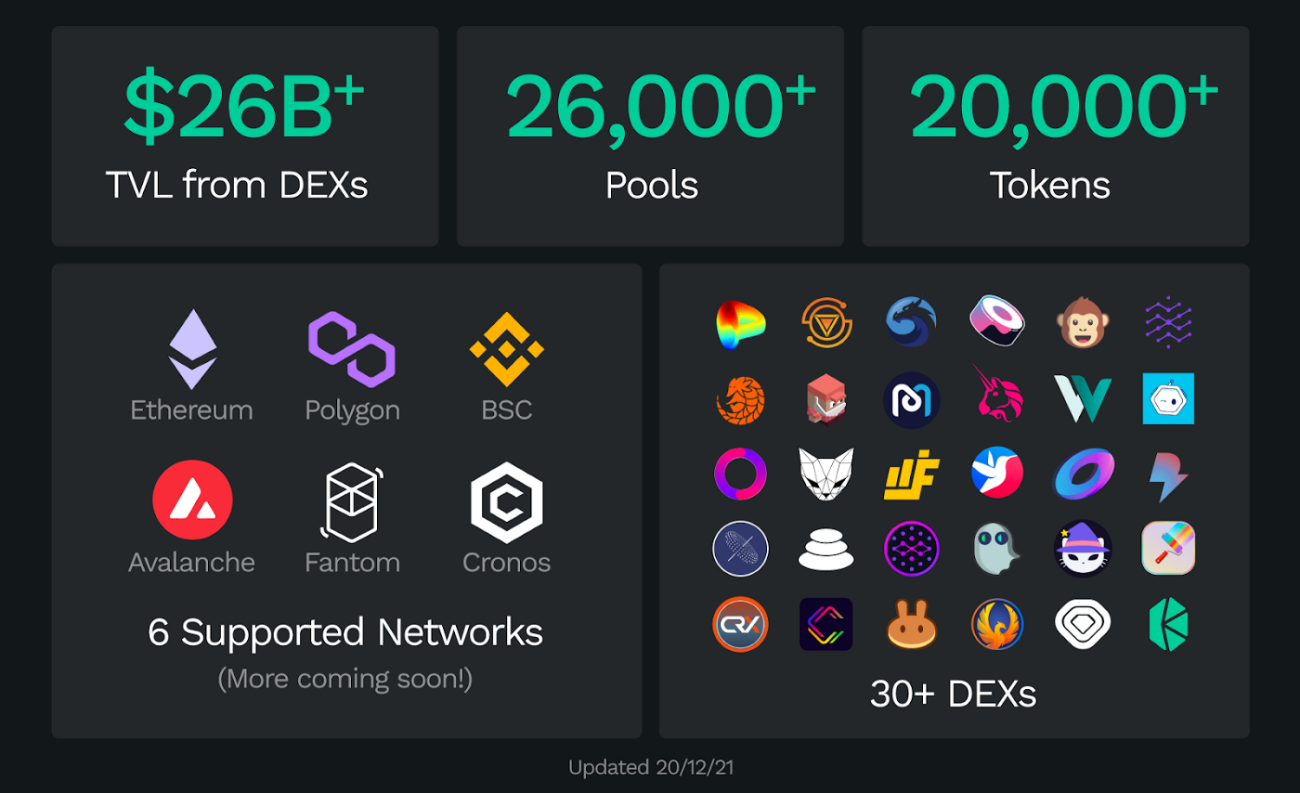

Kyber Network currently supports five ecosystems, including Ethereum, Polygon, Binance Smart Chain, Avalanche, Fantom, and Cronos.

How does Kyber Network work?

KyberSwap

For Traders

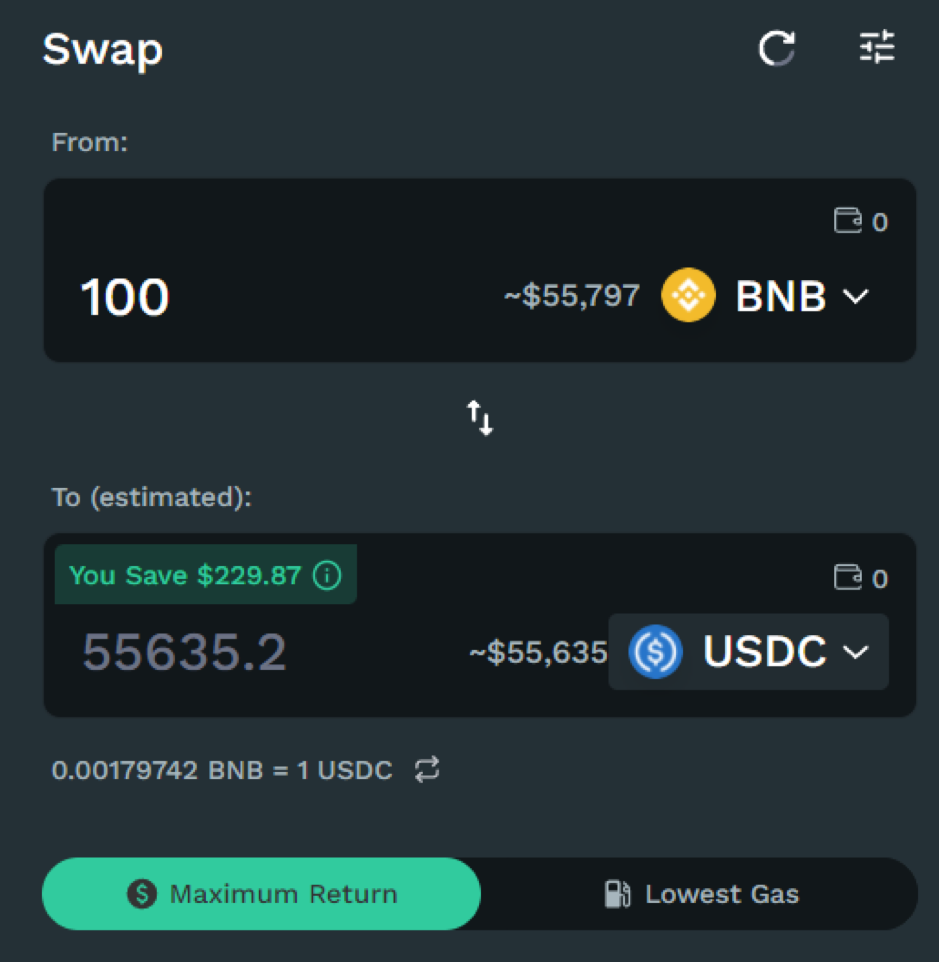

Kyber has Dynamic Trade Routing, which aggregates liquidity and enables users to source liquidity across different DEXs to achieve the best rate for any token swap, on any supported network. In this case, Kyber can be seen as a cross-chain yield aggregator (similar to Beefy Finance).

Traders can save a lot of money due to “aggregation” features that maximize returns to users.

Users can trade tokens that may not be in KyberSwap pools but are available on other DEXs.

For Liquidity Providers (LPs):

- Amplified Liquidity Pools: KyberSwap enables liquidity pool creators to create amplified pools in advance or add liquidity to existing pools to achieve higher capital efficiency for providers and better slippage for users compared to AMMs.

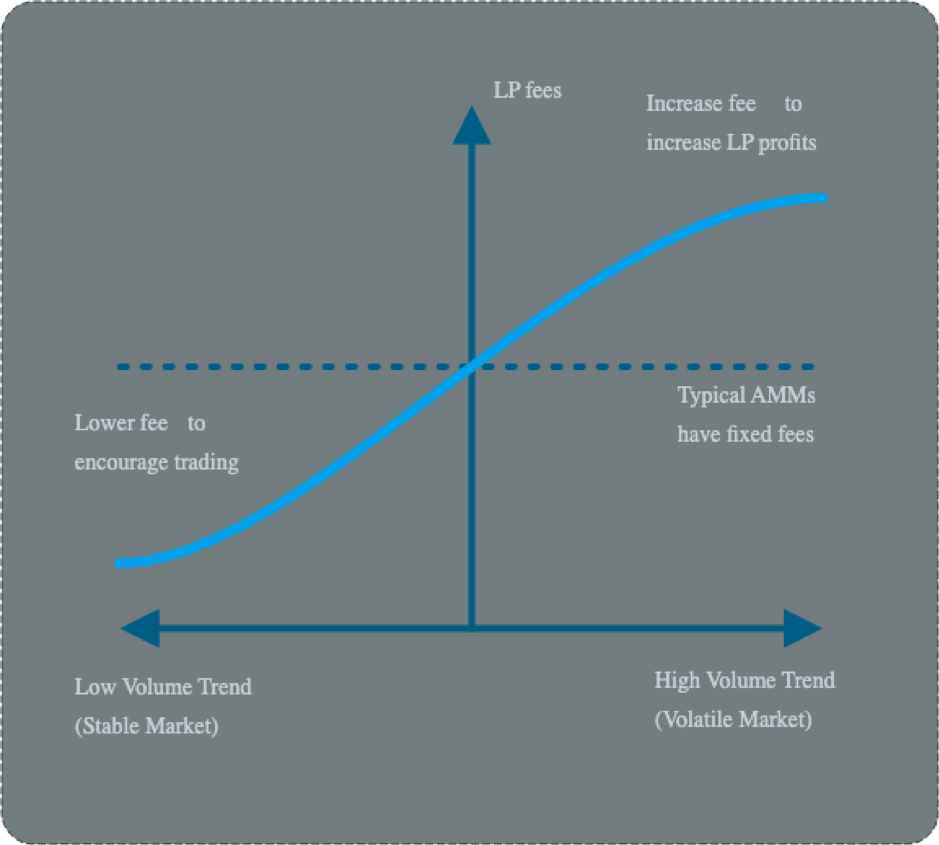

- Dynamic Fees: Trading fees are adjusted dynamically according to on-chain market conditions. In a volatile market (higher than usual volume), fees automatically increase to an optimal level for higher fees, which will go to liquidity providers. In periods of low volatility, fees decrease to encourage more trading and total fees collected.

- By using programmable pricing curves, which is similar to Uniswap, Kyberswap removes the need for intermediaries, therefore prioritizing decentralization and security.

- Rainmaker Yield Farming: Rainmaker is KyberSwap’s yield farming program, allowing users to earn bonus incentives by adding token liquidity and staking the corresponding liquidity provider tokens (LP tokens) into the eligible farms.

For Developers/Projects

KyberSwap protocol can be used and integrated into the new protocol. The use cases can include new UI, analytics tools, wallets, or many DeFi-related projects.

On November 11, 2021, KyberSwap introduced a Single Token Deposit feature that helps use either token in the pair to add liquidity and receive LP tokens in one seamless transaction. Therefore, users can now use just one token in the pair (e.g. only ETH) to deposit and add liquidity to the pool, and receive the corresponding liquidity provider (LP) tokens.

Learn more: How to use Kyber DMM.

KyberDAO

Besides Kyber DMM, KyberDAO also plays an important role. KyberDAO helps Kyber Network become community-driven, whereas stakeholders of the KNC token have their voice over the decisions and proposals that happen in the network. As a result, they participate in every change and growth along the development process.

What is KNC Token?

KNC is a utility and governance token of Kyber Network.

KNC token metrics

- Token Name: Kyber Network Crystal

- Ticker: KNC

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0xdd974d5c2e2928dea5f71b9825b8b646686bd200

- Token Type: Utility and Governance

- Total Supply: 179,000,000 KNC

- Circulating Supply: 102,500,000 KNC.

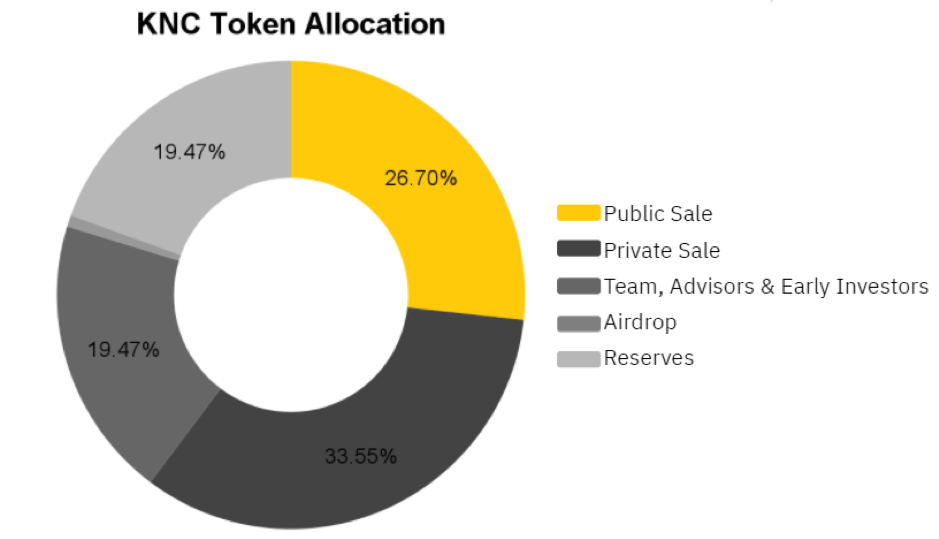

KNC Token Allocation

- Public Sale: 26.7%

- Private Sale: 33.5%

- Team, Advisors & Early Investors: 19.47%

- Reserves: 19.47%

- Airdrop: 0.86%

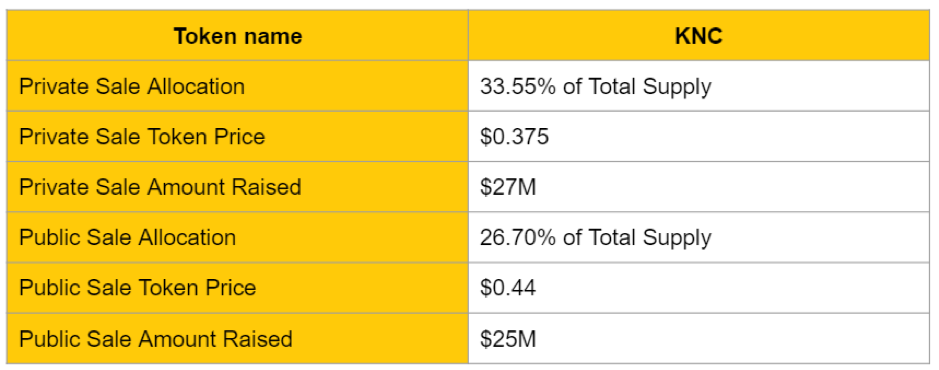

KNC Token Sale

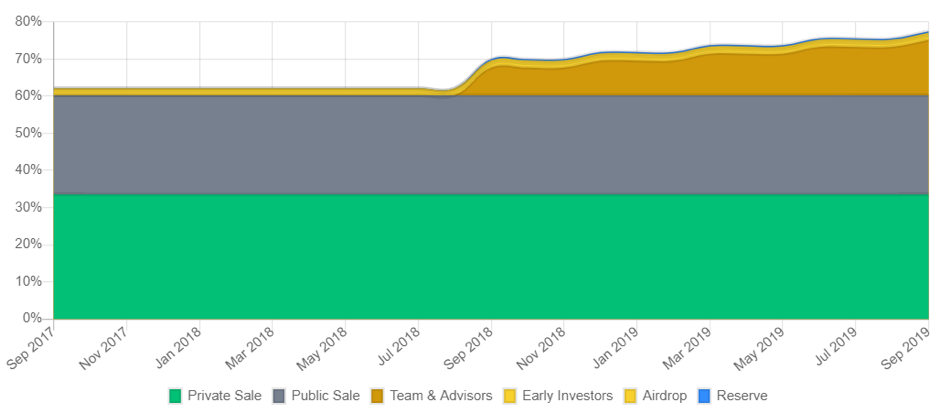

KNC Token Release Schedule

KNC Token Use Case

The KNC token currently has these main roles:

- Governance: create and/or vote for proposals.

- Stake & vote to earn trading fees from the protocol.

- Payments: Through Crypto.com, Visa card, Monolith, PundiX...

- Loans and margin trading on DeFi platforms.

How to buy KNC Token

You can get KNC token by being a liquidity provider on KyberSwap.

You can buy KNC Token through these exchanges:

- DEXs: KyberSwap, Uniswap, SushiSwap,...

- CEXs: Binance, Gate.io Houbi, KuCoin,...

Alternatively, you can use Coin98 Exchange to buy KNC token via the swap button at the end of the article.

Learn more: How to use Coin98 Exchange.

How to store KNC Token

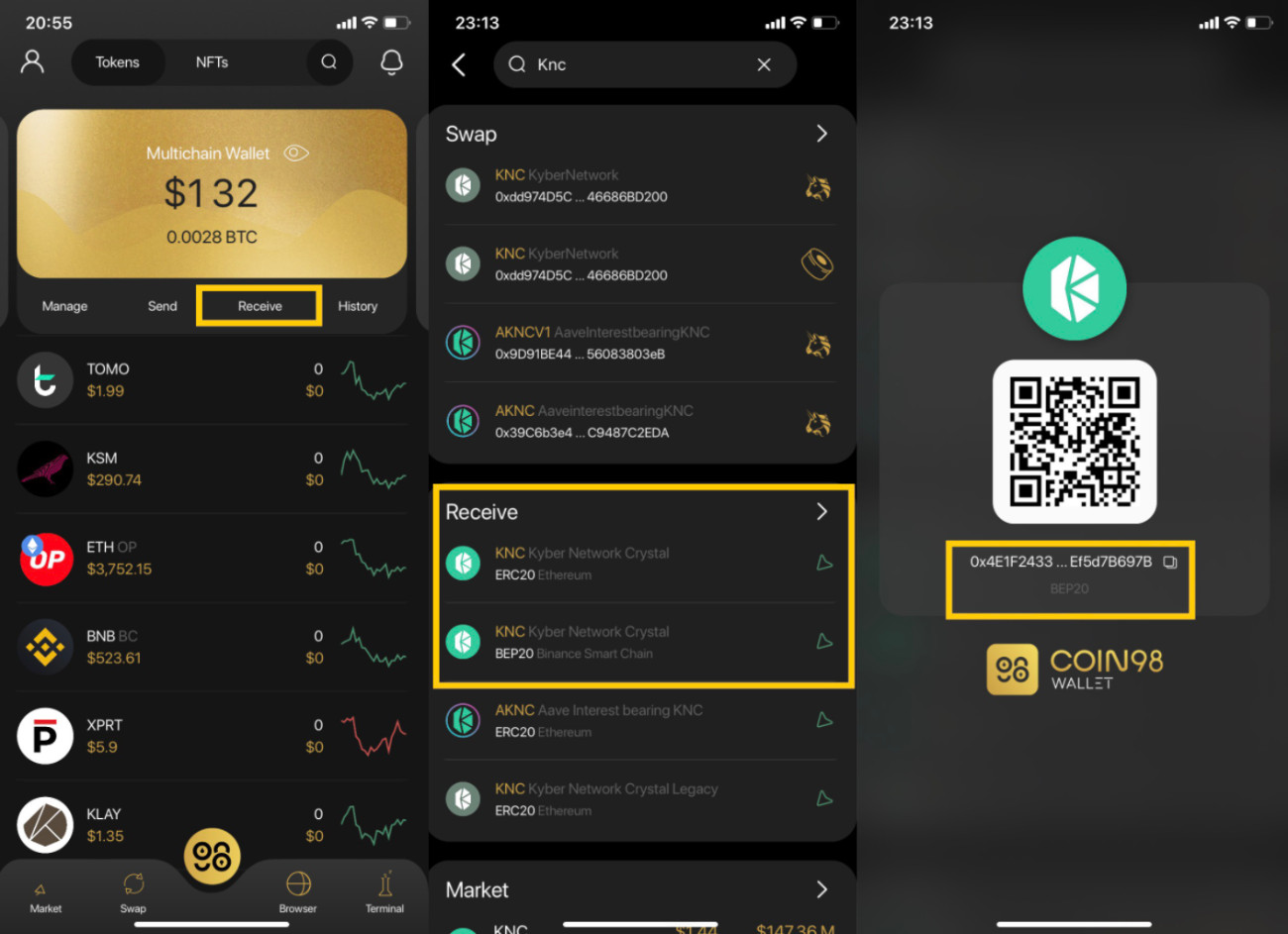

You can store KNC token on Coin98 Wallet with these simple steps:

Step 1: Open Coin98 Wallet & click Receive on the home screen.

Step 2: Search KNC Token.

Step 3: Click on the correct result, copy the wallet address and send KNC to this address.

Team, Investors, and Partners Kyber

Team

Loi Luu - CEO & Co-founder: In the past, he was a Blockchain Advisor for Kambria, which was located in Silicon Valley in Australia. He is also an advisor for Sygnum, a digital asset bank in Switzerland and Singapore.

Victor Tran - Lead Engineer & Co-founder: Victor has many years of experience as a CTO of tech companies. Currently, he is also a founding advisor of SIPHER - a blockchain game based on Ethereum.

Yaron Velner - CTO: Yaron is also a versatile engineer. He is now CTO at Kyber Network and CEO of B.Protocol, a lending-borrowing platform.

Investors

Backed by some reputable names like Hashed, Parafii Capital, and others,...

Partners

Kyber Network launched on multichain, they have numerous partners on different ecosystems, of which the majority are AMM & DEX, Wallets, DApps, etc.

Roadmap and Update

The team currently has not released any information about the roadmap yet. I'll keep you updated.

Update

November 2021: Introduced the Single Token Deposit feature.

December 2021

- Rebranded Dynamic Market Maker (DMM) into KyberSwap.

- Introduced the $50M Liquidity Mining Campaign with Sipher to enhance Sipher’s token liquidity on Ethereum.

- Released ZKyber testnet: A New DEX Trding Experience based on ZK-Rollups with anti-frontrunning capabilities.

Upcoming 2022

- More DEXs and Network; Expanding and deploying on many other networks such as Near/Aurora,...

- More liquidity and token variety.

- Quickly adopte to upcoming DeFi & GameFi trends by investing and partnering with popular projects in the space, while continuing research into Ethereum L2 scalling solutions such as ZKyber.

Is Kyber Network a good investment?

This article should give you a deep insight into the project, so there is no financial advice. You should Do Your Own Research before conducting any investment, and be responsible for your own fund.

However, Coin98 will provide some notable points about the project to give you the best overview to make your own decisions:

- In 2021, total volume traded on KyberSwap was over $4B.

- Over $20M in fees collected.

- ATH TVL of nearly $500M and $50B in Amplified Liquidity.

- Krystal is a product that was initially developed within the Kyber Network and has now become a multi-chain DeFi platform. It raised $6.6M in the seed round with some well-known Venture Capitals such as Hashed, Crypto.com, DeFi Alliance, Coin98,...

- Ecosystem: Currently, users can trade through KyberSwap, which now supports more than 30 DEXs, such as Uniswap on Ethereum, QuickSwap on Polygon, PancakeSwap on Binance Smart Chain, etc.

With their wide range of partners, KyberSwap has already parnered and released nearly $100M Liquidity Mining Campaign on Ethereum, Polygon, Binance Smart Chain, Avalanche, etc. Therefore, using KyberSwap as a "aggregation" location, a person can maximise their investment across a number of different chain types and sizes.

Learn more: What is Colony (CLY)? All about CLY Token.