Teddy Cash - Everything you need to know about TEDDY Token

What is Teddy Cash?

Teddy Cash is a non-custodial, unchangeable, and self-governing protocol that enables interest-free loans backed by AVAX. Loans are paid out in TSD (a stablecoin pegged to the US dollar) and need a minimum collateral ratio of 110 percent.

Along with the collateral, loans are secured by a Stability Pool that includes TSD and by fellow borrowers acting collectively as guarantors of last resort. More information regarding these mechanisms is available under Liquidation.

Teddy Cash solves the centralized stablecoin issue by developing a more capital-efficient and user-friendly mechanism of stablecoin borrowing. The project has the following key benefits:

- 0% interest rate — as a borrower, there’s no need to worry about constantly accruing debt.

- The minimum collateral ratio of 110% — more efficient usage of deposited AVAX.

- Governance free — all operations are algorithmic and fully automated, and protocol parameters are set at the time of the contract deployment.

- Directly redeemable — TSD can be redeemed at face value for the underlying collateral at any time.

How does Teddy Cash work?

As explained previously, Teddy Cash Protocol will provide no-interest loans in order to maximize the user's ability to use capital.

The project allows maximum loans at 110% collateral ratio with AVAX. For example, if you deposit 100 AVAX as you need to borrow other crypto assets, you can borrow up to the total value of that 90 AVAX.

To get a loan:

- You have to open an account called Trove ⇒ Then deposit AVAX into that account.

- After depositing ⇒ You can withdraw the amount of TSD up to 110% of the amount you have deposited.

Trove has two main balances which are:

- Asset in AVAX (Collateral).

- Debt Account (Demonitated in TSD).

Trove accounts are used to both keep and withdraw loans. Each Trove will correspond to an Avalanche wallet address. You can close your account at any time by paying off your account's debt.

Borrowing rates will vary from 0.5% to 5%, and the initiative presently only accepts AVAX as collateral.

What is TEDDY Token?

The Teddy Cash protocol's secondary token is TEDDY. It collects the system's fee as revenue and incentivizes early adopters and Frontend Operators.

Users who contribute TSD to the Stability Pool receive TEDDY rewards, as those who facilitate those contributions and liquidity providers in the TSD-AVAX Pangolin pool.

Holders of TEDDY tokens can stake them in order to profit from loan issuance fees and TSD.

Detailed information about TEDDY Token

TEDDY Token Metrics

- Token Name: Teddy

- Ticker: TEDDY

- Blockchain: Avalanche.

- Token Standard: ARC-20.

- Contract: 0x094bd7b2d99711a1486fb94d4395801c6d0fddcc

- Token type: Utility.

- Total Supply: 5,753,340 TEDDY.

- Circulating Supply: 100,000,000 TEDDY

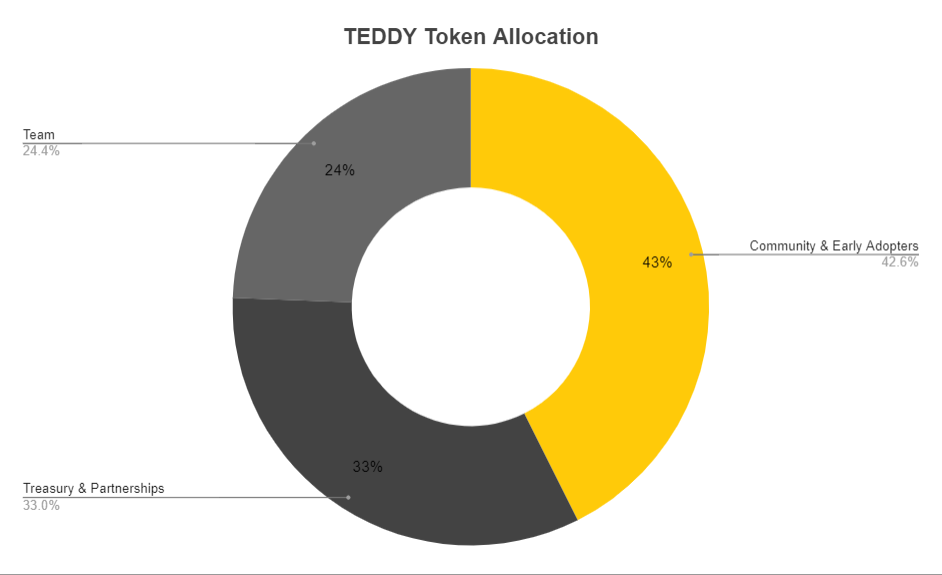

TEDDY Token Allocation

TEDDY Token Release Schedule

42.6% Community and early adopter rewards.

39% for stability pool early adopter rewards. Distributed over 5 years.

- Year 1: 16,000,000 TEDDY.

- Year 2: 8,000,000 TEDDY.

- Year 3: 4,000,000 TEDDY.

- Year 4 : 2,000,000 TEDDY.

- Year 5: 1,000,000 TEDDY.

3.6% for AVAX/TSD Pangolin LP rewards: 3,000,000 TEDDY Distributed over the first 6 weeks.

33% Treasury for partnerships, advisors, marketing and other rewards, e.g. additional LP rewards: 1M tokens were used for AVAX/TEDDY pool2 rewards.

24.4% Team. Locked for 1 year by the smart contract. Then 25% is granted by a multi-sig every quarter.

How to buy TEDDY

You can buy TEDDY from various of exchanges including TraderJoe, Pangolin...

Alternatively, you can buy TEDDY using Coin98 Exchange by using the swap function at the end of this article.

Learn more: How to use Coin98 Exchange.

How to mine TEDDY Token

TEDDY is earned in three ways:

- Depositing TSD into the Stability Pool.

- Facilitating Stability Pool deposits through your front end.

- Providing liquidity to the TSD: AVAX Pangolin pool.

How to store TEDDY Token

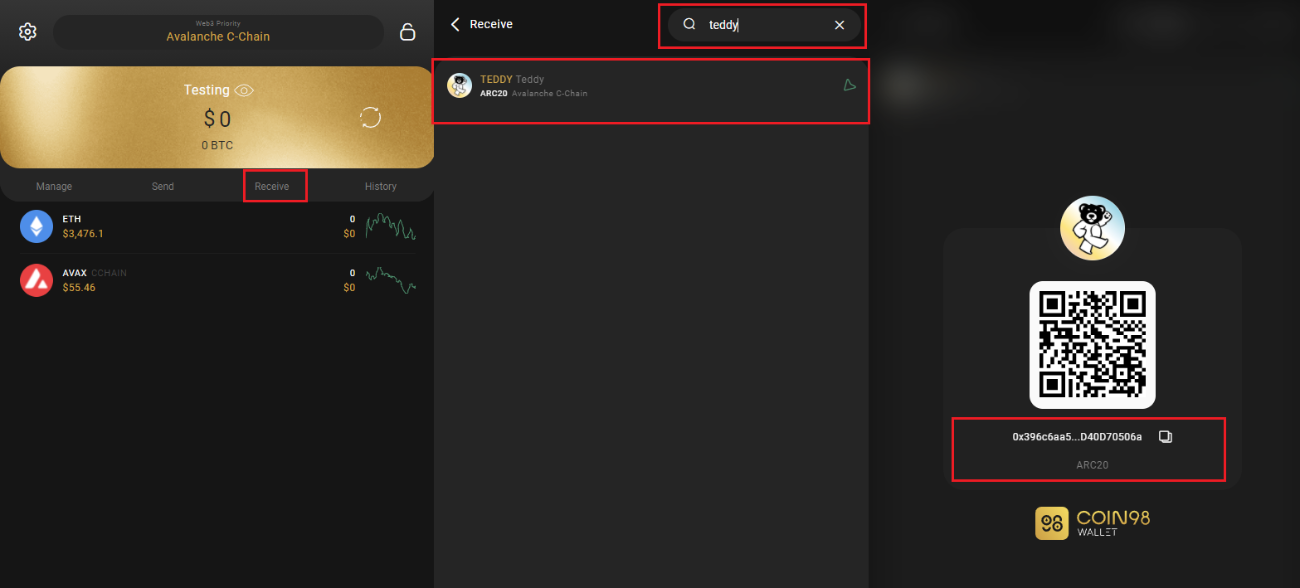

You can store TEDDY token on Coin98 Wallet with these steps:

Step 1: Open Coin98 Wallet & click Receive on the home screen.

Step 2: Search TEDDY Token.

Step 3: Click on the correct result, copy the wallet address and send TEDDY to this address.

Roadmaps and Updates

The project is working on establishing the DAO platform, which will allow the TEDDY token to have additional governance capabilities and its holders to participate in the project governance.

Teddy Cash also intends to update the UI and design, as well as agree to have the project audited in the near future.

Partners

Here are some of TeddyCash's partners.

Teddy has deployed Chainlink's Oracle solution, which is the most reputable oracle platform in the market today.

Is TEDDY a good investment?

This article has provided some of the main ideas related to the TEDDY token and its implications. Still, it is important to note that there are a few key points that investors should take into account before making investment decisions:

- In general, the project is still in its early stages, but the total value locked volume has grown dramatically in recent days. The ability to lend up to 90% of the collateral value can help users use capital more efficiently. However, everyone should be advised that the project only accepts AVAX as collateral, thus users' assets may be jeopardized if the price of AVAX moves dramatically.

- With the deployment of Chainlink as the project's oracle and agreement on the impending audit, Teddy Cash appears to focus on being the project to establish a safer Lending & Borrowing platform for users.

BenQi: A non-custodial liquidity market protocol, built on Avalanche.

Learn more: What is PAID Network? All about PAID Token.