What is Leverage Trading in Crypto? How does it work?

What is leverage trading in Crypto?

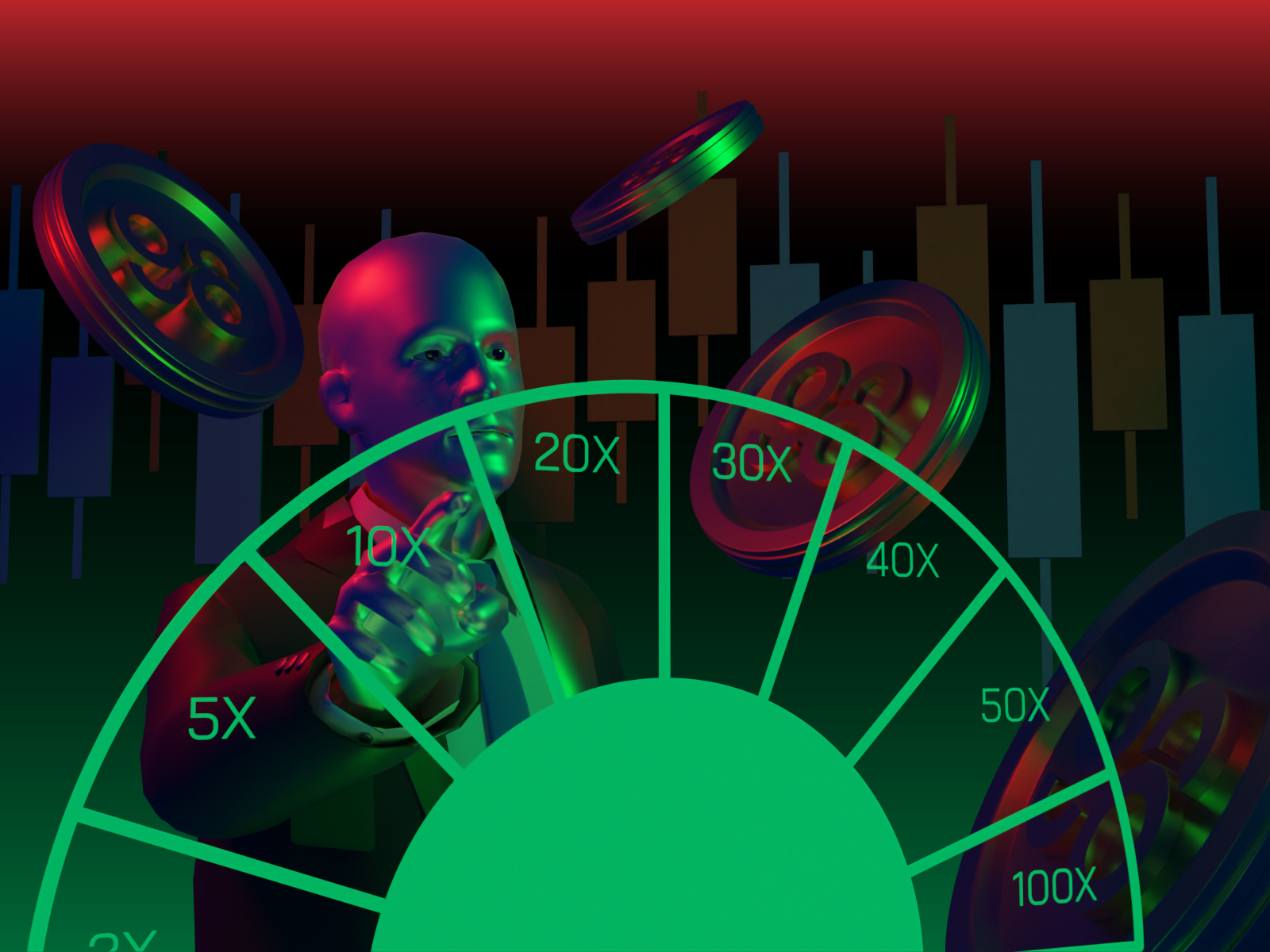

Leverage trading is when you increase your investment size by multiple times. This can be done through various trading options, which will be mentioned in the next section.

For example, you only have $1,000 available while you want to open a $10,000 position. Instead of finding another $9,000 to achieve this in spot trading, you can simply use a 10x leverage in leverage trading. For a 100x leverage, even only $100 is enough.

What is leverage trading used for?

Leverage trading gives investors more versatility over their investment options, especially for those with low budgets. Some most well-known use cases of leverage trading include:

- Implementing leverage for more profits.

- Diversifying investment strategies to earn in both bull and bear markets.

- Hedging against other positions.

- Speculating on small price movement using technical analysis.

How does leverage trading work?

As mentioned above, leverage trading in crypto works by multiplying your original position size by up to 125 times. So how can this be done?

There are currently 3 ways to leverage your positions, which are: margin trading, futures contracts, and leveraged tokens.

- Margin trading means borrowing funds from others.

- Futures contracts represent the value of an underlying asset. Their details, including the expiration date, leverage,... can be customized.

- Leveraged tokens integrate leverage directly into their prices.

However, leverage does not only multiply your position size but also the risk of using it. The higher the leverage, the riskier it will be. Why is it risky?

Because in leverage trading, you are exposed to liquidation risks. Liquidations are events that force you to close your leverage trading position as your committed capital (which is considered collateral) goes down in value to below the acceptable level.

For instance, you use $100 with a 100x leverage in margin trading, meaning you are borrowing $9,000, to open a $10,000 position. However, how can the lender be guaranteed about you borrowing their money without possibly repaying them?

If the $9,000 you are borrowing from them now becomes worthless ($0) for some reason (say, the price of the asset you buy with that $9,000 goes down to 0), you will have a $9,000 debt without collateral. There is a chance that you can just get away without repaying them, leaving a $9,000 loss.

As a result, they will set out a liquidation price or liquidation point. If the borrowed fund goes below that point, you will be liquidated and your initial fund ($100) will be given to them to ensure no loss.

In this case, the liquidation price is 1% less than the borrowed amount, which will be $8,910. You can bear up to a $90 loss. Otherwise, you will lose all the money, including the initial and the borrowed one.

How to calculate leverage when trading?

Your liquidation level will be calculated based on your leverage.

- Spot trading means trading assets at 1x leverage, so there is no probability of liquidation.

- For a 2x leverage, meaning you are doubling the order size, your order will be liquidated if the collateral value reduces by half (50%).

- Similarly, for a 10x leverage order, for instance, you will be liquidated if the initial fund reduces by 10%. As for a 100x leverage, only a 1% loss is enough to liquidate your position.

Read more: What is liquidation? How does liquidation work in crypto?

Advantages & Disadvantages of using leverage

Advantages

- Increase position size, hence increasing possible profits.

- Minimize required capital, allowing users to save up money for other investments.

- Can be used to gain profits in both ups and downs of the market.

- Extremely solid tool for advanced investors.

Disadvantages

- Risky, can bring as much loss as profit.

- Need experience in order to fully utilize it.

- Require paying fees

How to use leverage in Crypto

Leverage is incredibly useful in some cases. Here are some tips on how to use leverage in Crypto:

- Adjust leverage according to the risk/reward.

- Use stop-loss and take-profit to minimize loss and maximize returns.

- Use leverage with technical analysis to take advantage of a small rally/sell-off rather than building a long-term position.

Top Crypto exchanges for using leverage

Most crypto exchanges have supported leverage trading up to this time. Here are some of the most used and popular ones.

Binance

Binance is currently the number one crypto exchange. It supports a massive number of trading pairs with high leverage availability as well as liquidity.

Learn more: How to start leverage trading on Binance Exchange.

Gate

Gate is also an awesome platform for leverage trading. Being different from the other two mentioned above, Gate gives more attention to low and mid-cap altcoins. Do pay attention to the liquidity on those kinds of tokens before using leverage on them, though.

Leverage trading in Crypto FAQs

Is leverage trading safe?

It is safe as long as you know how to manage liquidation risks. Leverage trading has high complexity that usually requires advanced users to fully understand and maximize its efficiency.

If you are a crypto beginner and new to the tool, I suggest that you allocate only a small portion of capital and low leverage to try it first.

Who uses leverage trading in Crypto?

Short-term traders are more likely to use leverage trading than long-term holders. Since the crypto market is highly volatile, implementing leverage for a long duration is not a good idea.

What happens if you lose a leverage trade crypto?

As mentioned above, leverage trading involves liquidation risks that might sell off your position completely. Therefore, it is highly recommended to put a stop loss on your leverage trading position, especially for ones with high leverage levels.