What is Lido? Everything you need to know about LDO Token

What is Lido?

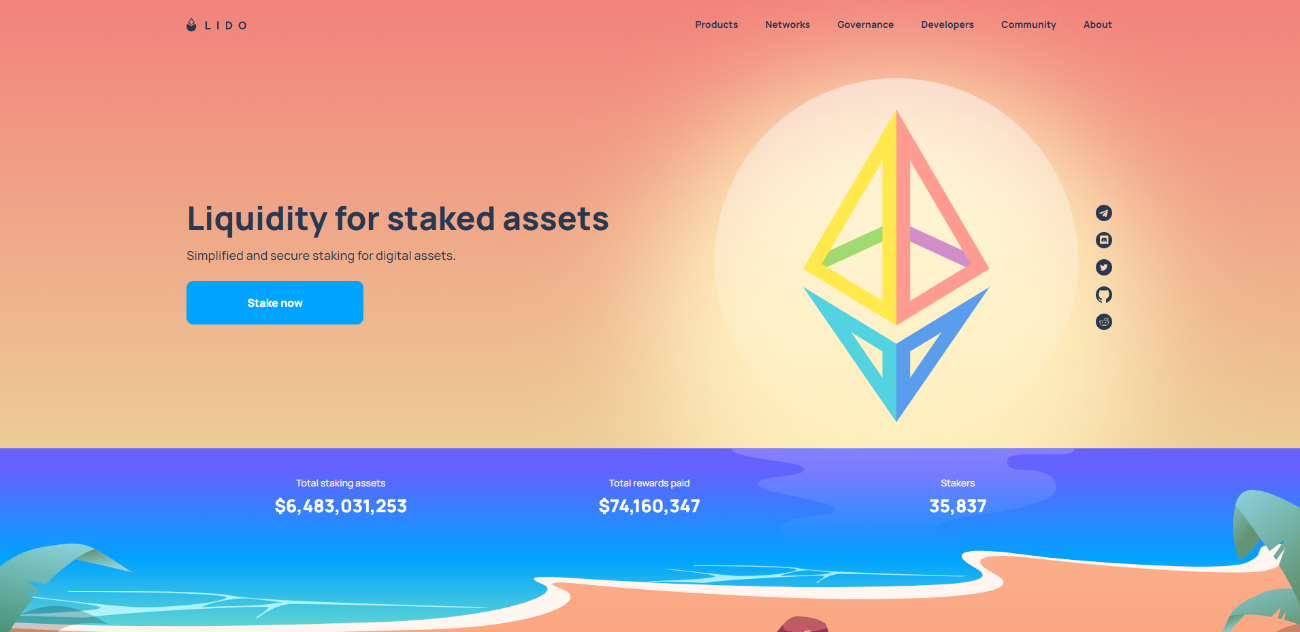

Lido

Lido is a third-party staking service that allows Ethereum users to stake their ETH coins onto the new version of Ethereum (Ethereum 2.0). The Lido app is operated through Ledger Live by the Lido team instead of The Lido App.

Lido allows users to stake not only ETH 2.0 but other crypto assets as well such as bLuna or stSOL on the platform with APR ranging from 3.3% to 6.4% depending on the asset.

Users can deposit Ethererum or other supported crypto assets to the Lido smart contracts and receive staking rewards on the supported tokens. Unlike other platforms, seETH, bLuna or stSOL are available to be transferred at any time and free from the limitations associated with lack of liquidity.

Lido DAO

The Lido DAO is a Decentralized Autonomous Organization that relies on the voting power of governance token holders to set key parameters. The DAO is a collective of service fees that can be spent on various activities through the platform such as research, development or protocol upgrades.

Initially, DAO members can participate in threshold signatures for Ethereum 2.0 by making BLS signatures to become a part of the governance.

In general, Lido DAO aims to provide the following services:

- Launching Lido and deploying smart contracts for the protocol

- Setting fees and parameters for the protocol

- Assigning initial node operators, proposing and updating Lido’s parameters, implementations.

- Managing the insurance, development funds, unbonding and withdrawals.

- Selecting threshold signatures from reputable participants.

- Approving incentives for parties that contribute towards the goals of Lido DAO.

How does Lido work?

Lido offers a decentralized platform for liquidating Ethereum and other crypto assets such as stSOL or bLuna for staking with daily rewards. Lidos offer no minimum requirements and brings users the opportunity for competitive 1:1 minting on deposited ethers, making it as easy as can be.

Users can use their crypto assets such as ETH to mint stETH tokens at a ratio of 1:1 of the ETH deposited. stETH tokens can be traded within other DeFi platforms as well. stETH tokens can also be used for yield farming and lending or collateral. ETH tokens are locked in smart contracts as Lido will hold these funds.

Unlike other platforms, Lido doesn’t require initial deposits to operate its nodes. Lido DAO will require chosen nodes to have a proven track record of staking and be vetted by an independent commission. This also allows them to use their expertise in order to make network infrastructure "more capital efficient".

Therefore, the platform stands out with the following advantages:

- Flexibility: Users can stake any amount of ETH on Lido to receive stETH at a ratio of 1:1. sETH can also be staked, loaned or traded on any platform that supports the token.

- Capital Efficiency: sETH can be used as collateral for borrowing UST for other trading activities.

What is LDO token?

LDO is the native token of the Lido ecosystem. The main use case of LDO token is for its holders to receive the governing rights as one LDO is counted as one vote.

Therefore, the more LDO tokens you hold, the more voting power you will have. Furthermore, the voting mechanism of the LDO token is adjustable and operable in parallel to other protocols on Lido.

Detailed information about LIDO Token

LDO Token Metrics

- Token Name: LDO token.

- Ticker: LDO.

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: 0x5a98fcbea516cf06857215779fd812ca3bef1b32

- Token type: Governance.

- Total Supply: 1,000,000,000 LDO.

- Circulating Supply: 28,412,180 LDO.

LDO Token Allocation

- DAO Treasury: 36.32%

- Investors: 22.18%

- Initial Lido Developers: 20%

- Founders & Future Employees: 15%

- Validators & Signature Holders: 6.5%

LDO Token Sale

The circulating supply of Lido will be:

- 4,800,000 (Curve 4th emission LPs)

- 240,000 (LEGO treasury for grants)

- 500,000 (DeversiFi liquidity markets)

- 5,000,000 (Curve 3rd emission LPs)

- 100,000 (ARCx LP rewards)

- 250,000 (1inch LP rewards)

- 50,000 (Unslashed Finance insurance)

- 5,000,000 (Curve 2nd emission LPs)

- 5,000,000 (Curve 1st emission LPs)

- 4,000,000 (Airdrop rewards)

Lido intends to distribute the supply of LDO in the treasury fund to help fund ecosystem development where opportunities may arise.

However, there is currently no release schedule for the LDO tokens in the treasury fund.

How to buy LDO token

You can use Coin98 Exchange to swap other tokens for BNB.

Step 1: Connect Coin98 Extension Wallet.

Step 2: Select Uniswap.

Step 3: Choose coins/tokens for trading:

- Search LDO.

- If the result does not come up, you can paste the contract of LDO into the search box: 0xbb4CdB9CBd36B01bD1cBaEBF2De08d9173bc095c

Step 4: Adjust the amount you want to swap.

Step 5: Adjust the gas fee, then click Approve.

How to store LDO token

You can store LDO token on Coin98 Wallet with these steps:

Step 1: Open Coin98 Wallet & click Receive on the home screen.

Step 2: Search LDO Token.

Step 3: Click on the correct result, copy the wallet address and send LDO to this address.

Team, Investors, and Partners

Team

The Lido platform is governed by many Decentralized Autonomous Organizations (DAOs) including these popular names:

- CryptoCobain: A big KOL on twitter with over 440k followers.

- banteg: The core development team of Yearn.finance

- ParaFi Capital: An alternative investment firm focused on blockchain and decentralized finance markets.

Investors

Lido has raised a total of $73M in funding over 2 rounds. The latest round was raised on May 5th, 2021 from an ICO event.

Their investors are impressive including Coinbase Ventures, Alameda Research and Three Arrows Capital. These are the giants in the industry and with their support, the Lido platform is expected to grow in no time.

Partners

The Lido ecosystem consists of popular DeFi applications in the industry such as: Anchor Protocol, Curve, Sushiswap, Curve.

Is LDO a good investment?

This article has provided some of the main ideas related to the LDO token and its implications. Still, it is important to note that there are a few key points that investors should take into account before making investment decisions:

- The investor list of the Lido project is very impressive with Coinbase Ventures, Alameda Research and Three Arrows Capital on the list. Is their power enough to make Lido become a popular platform?

- The solution offered by Lido is necessary in order to grow DeFi and help users to maximize their fund’s usage. However, the interest rates provided are pretty low compared to other platforms with the same concepts such as Stafi.