What Is Yearn Finance? All About YFI Token

What is Yearn Finance?

Yearn Finance is a yield optimization protocol with the core value is to maximize yield and minimize risks for all users. Yearn Finance achieves this by providing a suite of services: lending aggregation, yield generation, and insurance.

The protocol was first built on Ethereum and has now been deployed on Fantom and other chains to be announced soon.

How does Yearn Finance work?

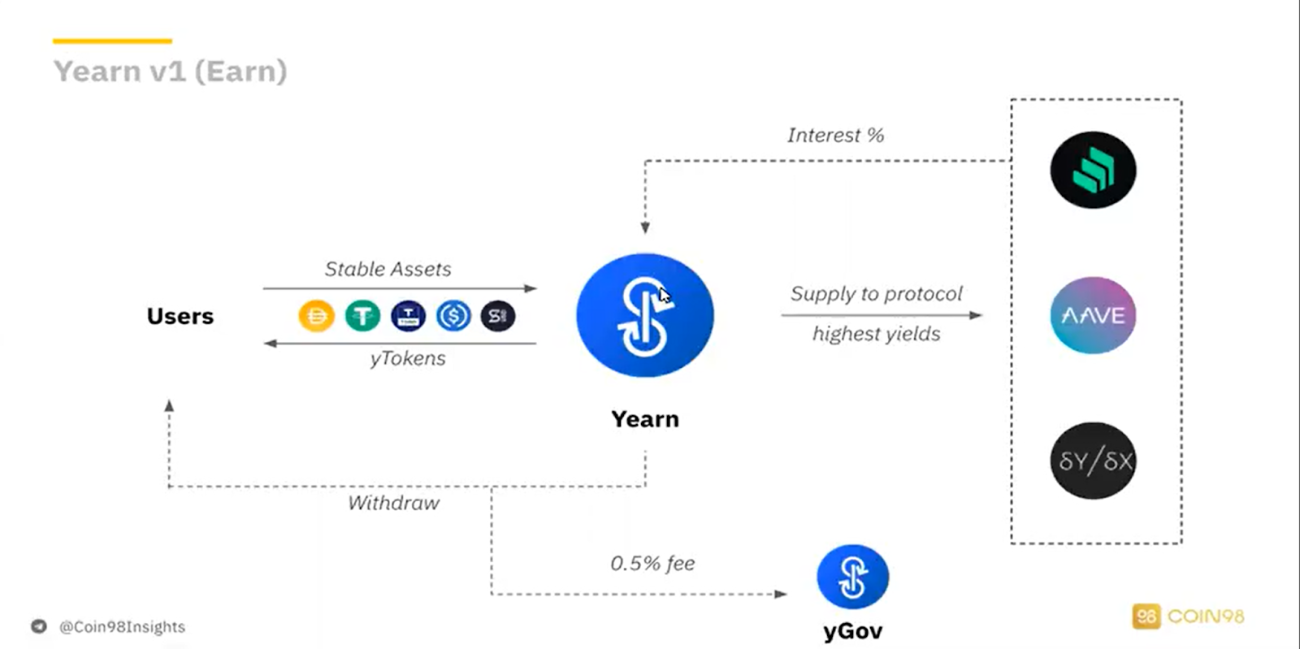

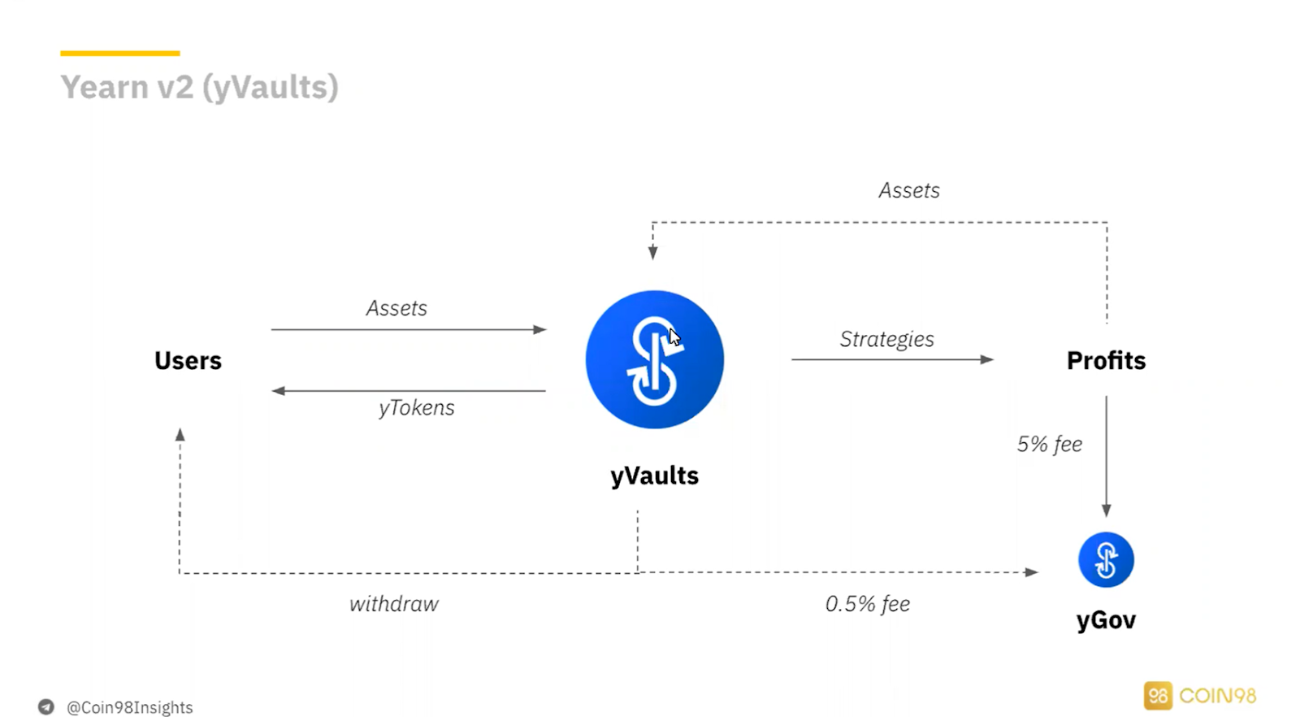

Yearn Finance has 2 main core products: Earn and Vaults.

Earn: The first product of Yearn Finance is “Earn”, a lending aggregator. Users deposit stable assets into Yearn via the Earn page. Yearn Finance enables users to maximize yield by continuously comparing yields offered by different lending protocols and depositing users’ funds into the protocol with the highest yields.

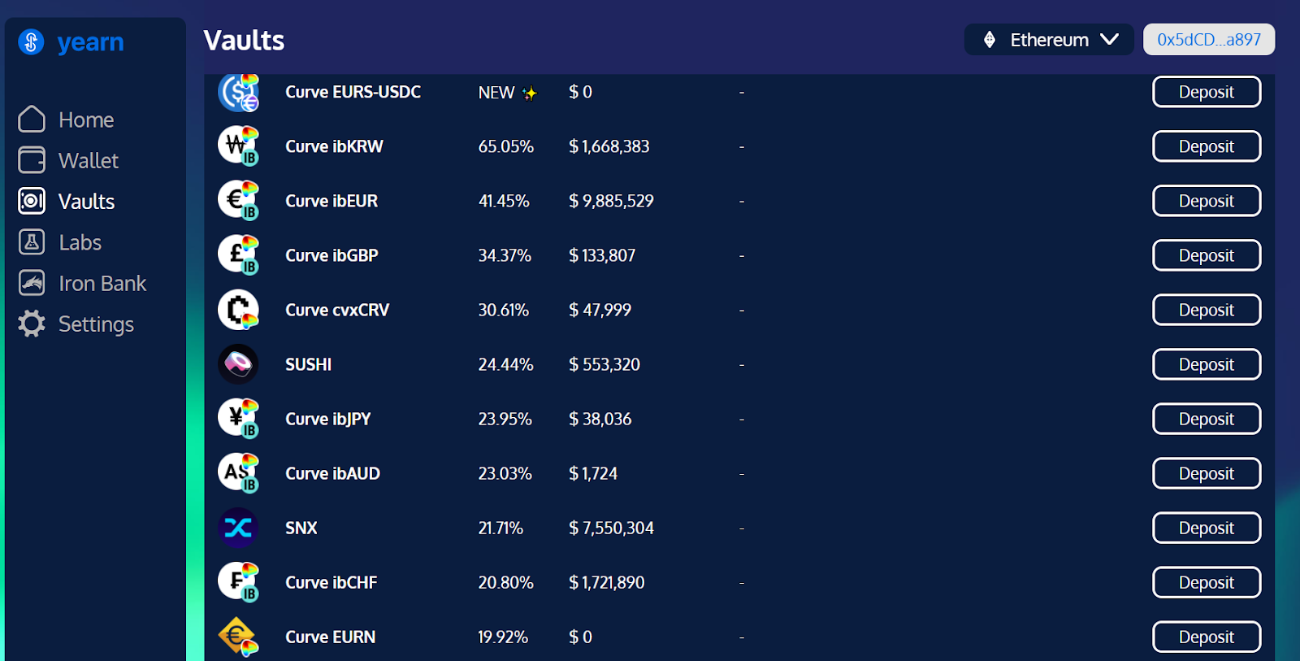

Vaults: This product can be seen as a passive-investing tool. Users just need to deposit their assets into the vaults and the protocol automatically generates yields for them. Thanks to yVaults, even users with little knowledge in investing can earn decent profits by depositing their passive capital into Yearn Finance.

Other than these 2 main products: Yearn Finance also offers:

- Yearn Labs: This includes experimental Vaults with the newest and unconventional strategies. Therefore, make sure you understand each vault’s strategy before investing to avoid risks.

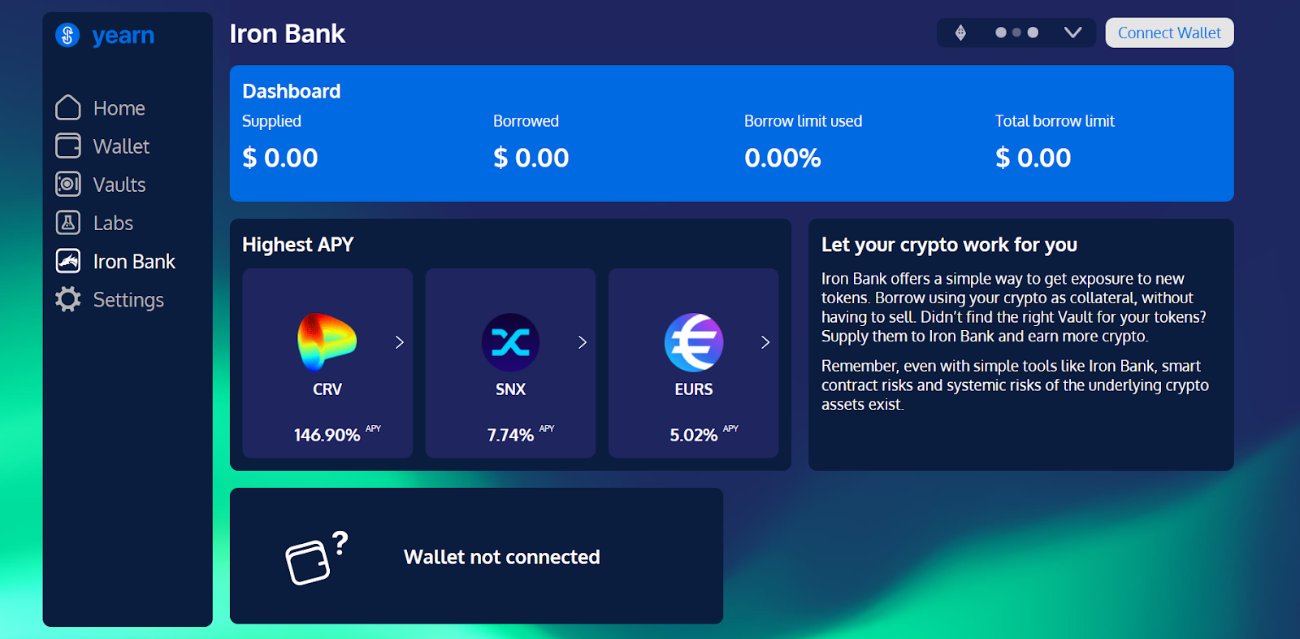

- Iron Bank: Offers lending services to both ordinary users and protocol. For normal users, their loans are overcollateralized while for protocols that are whitelisted, the loans can be zero collateral.

What is YFI token?

YFI is the native token of Yearn Finance. It has ERC-20 standards and is the main governance token of the protocol.

Detailed information about YFI token

YFI Key Metrics

- Name: yearn.finance

- Ticker: YFI

- Contract: 0x0bc529c00C6401aEF6D220BE8C6Ea1667F6Ad93e

- Blockchain: Ethereum

- Token Standard: ERC-20

- Token type: Governance Token

- Total Supply: 30,000 YFI

- Circulating Supply: 29,962 YFI

YFI Token Allocation

100% YFI tokens are distributed to the community through liquidity mining.

YFI Token Sales

YFI is a “fair launch” token so there is no pre-sale.

YFI Token Use Cases

Holding YFI of Yearn Finance protocol is similar to holding a share in a company. YFI holders have the right to join the governance of the protocol and are eligible for earning shared revenue from Yearn Finance.

Users can get YFI tokens by providing liquidity to the protocol.

How to buy YFI token

You can buy YFI tokens from several exchanges:

- CEXs: Binance, Coinbase, FTX,...

- DEXs: Uniswap, Balancer,...

Besides that, you can also buy YFI on Coin98 Exchange in the section “Swap” as you can see from the end of this article.

Learn more: How to use Coin98 Exchange

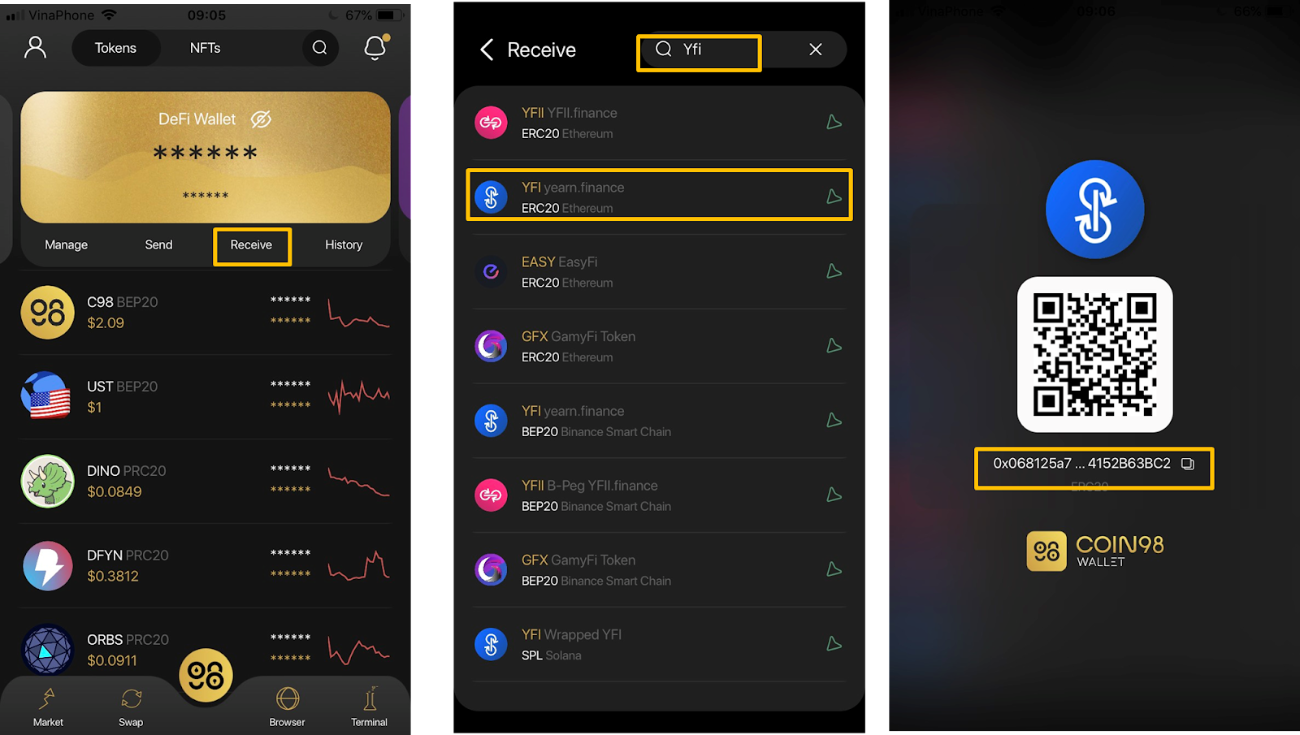

How to store YFI token on Coin98 Wallet

You can store YFI ERC-20 on Coin98 Wallet by following these steps:

Step 1: At the main screen of Coin98 Wallet, click Receive.

Step 2: Search for YFI token.

Step 3: Copy your YFI wallet address and send YFI tokens to this address.

Yearn Finance Roadmap

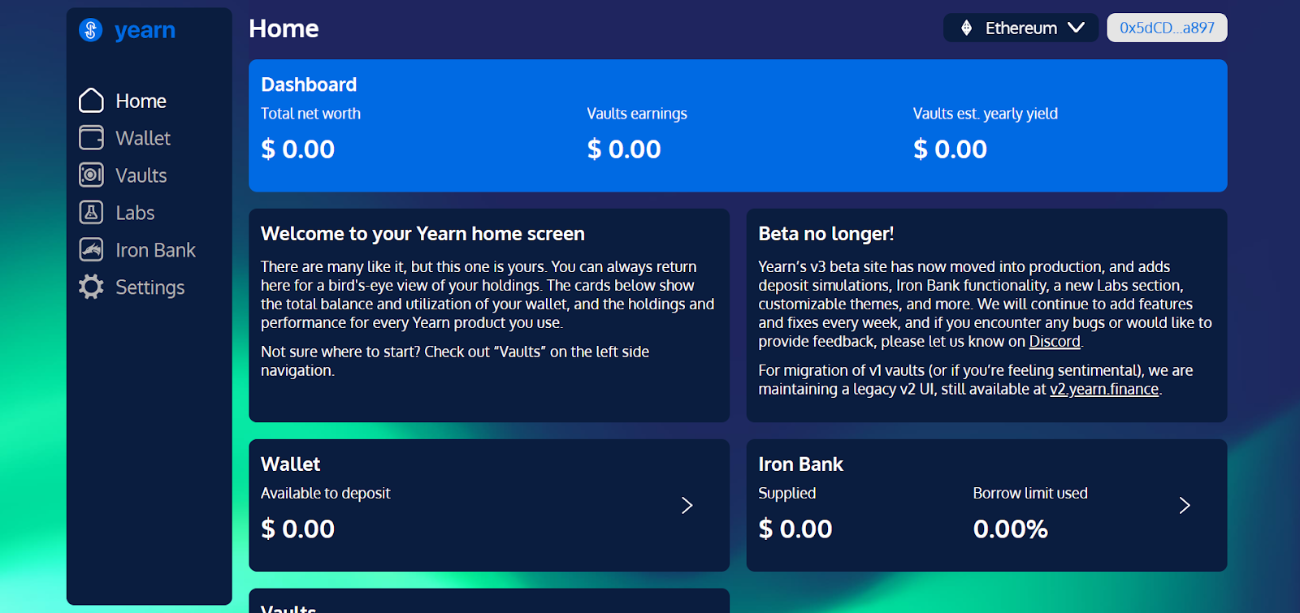

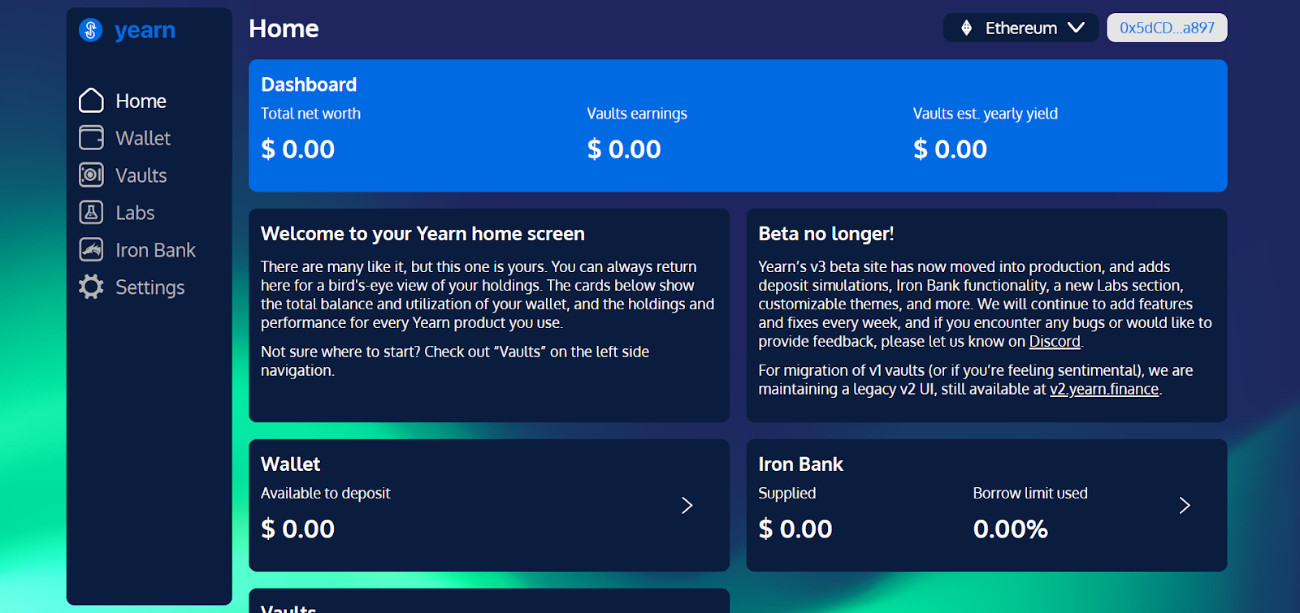

Yearn Finance has released the new UI for Yearn V3 and the next step of the protocol is to establish full features of V2 to V3 before completely replacing it.

The merge includes the process of implementing:

- Labs page detail views.

- Hover tooltips to match v2 (APY, headers, etc).

After the merge, more features will be added as well:

- New landing page with improved onboarding.

- Historical APY for vaults.

- Historical protocol yield and user gas savings.

- Gasless zap out approvals.

- Gas cost estimations.

- Multi-language support.

- Integrate yearn.fi risk dashboard.

- Integration of Bowswap to ease moving from low to high-yield vaults.

- Ability to add custom skins.

- More detailed user position info on home page.

- Ability to hide dust on the wallet page.

- Other things will be announced soon.

Team, Investors, and Partners

Team

The mastermind behind Yearn Finance is Andre Cronje, one of the most influential figures in DeFi. Andre Cronje himself also gained a reputation as the founder of Yearn Finance and now he chairs the Technology Council of South Korea's Fantom Foundation.

Investor

Yearn Finance is built and funded by Andre Cronje himself.

Partners

Yearn Finance partnered with many other protocols to further expand the Yearn Finance ecosystem: Cream, Pickle, SushiSwap, Akropolis.

Is Yearn Finance (YFI) a good investment?

I hope that from all the mentioned information, you can get a basic understanding of Yearn Finance to start researching more about this project. It is hard to tell firmly whether any project/ token is a good investment or not.

However, I will provide you with some key highlights of Yearn Finance so that you can do your own research and make your own investment decisions.

Yearn Finance is led by one of the most influential figures in DeFi - Andre Cronje and he has shown commitment to the project when he has been dedicating to upgrading Yearn Finance to offer users a better experience for nearly 4 years. Therefore, we can still expect further growth of this protocol under the management of Andre Cronje.

Yearn Finance has revealed its plan to go multichain in the context that Ethereum is still facing the scalability problem and users start to move to other chains. This can be considered as a positive action of Yearn Finance to catch up with the market sentiment and continue to attract new users to the platform. Up to this date, Yearn Finance has already deployed on Fantom, and more chains are expected to be announced in the future.

Despite the arrival of many new protocols on other chains offering various features, Yearn Finance is still able to maintain its position as one of the top protocols in the Yield sector with the TVL of $5.31B. This shows Yearn Finance is considered a reliable platform for people to earn yield in the crypto market.

Yearn Finance V3 offers a wide range of vaults with a decent APY so it can be seen as a reliable and attractive place for people to earn at the same time.

Similar projects

Beefy Finance (BIFI): Multichain Yield Optimizer focusing on safety and auto-compound crypto assets for the best APY.

Alpaca Finance (ALPACA): Leveraged yield farming protocol on BSC.