10 Best Crypto Exchanges For Investors And Traders (2022)

Trading and investing assets are the most important functions of any financial market, including crypto. In crypto, there are two types of exchanges that investors can use. In this article, Coin98 Insights will introduce you to that 2 exchange types, along with some of the most notable exchange products on the crypto market at the moment.

Overview of crypto exchanges

Essentially, crypto exchanges are products that allow users to buy & sell cryptocurrencies. Along with this core function, they also provide various financial tools like margin trading, derivatives trading, and asset management.

In crypto, there are 2 types of exchanges: CEX (Centralized Exchange) and DEX (Decentralized Exchange). In the next parts, we will learn about how they work and their differences.

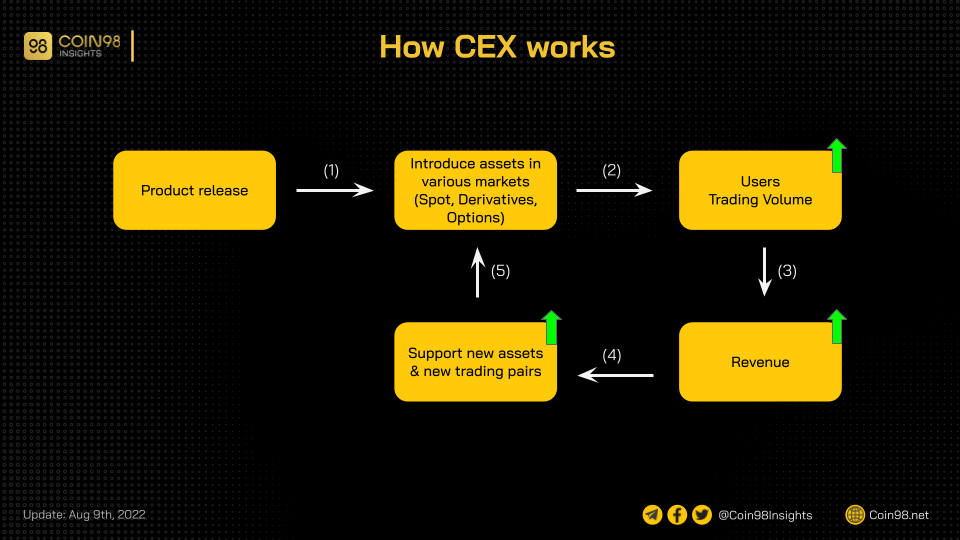

Centralized Exchange (CEX)

Centralized Exchange (CEX) is the first type of crypto exchange. They provide trading services via order books, which is the traditional method. The first crypto exchange was founded on March 17, 2010, named Bitcoinmarket.

The word “centralized” behind the term indicates that it is run and controlled by a few entities in order to maintain its business model. In general, centralized exchanges are still believed to be more trustworthy than decentralized ones. Hence, they often possess more users, liquidity, and trading volume.

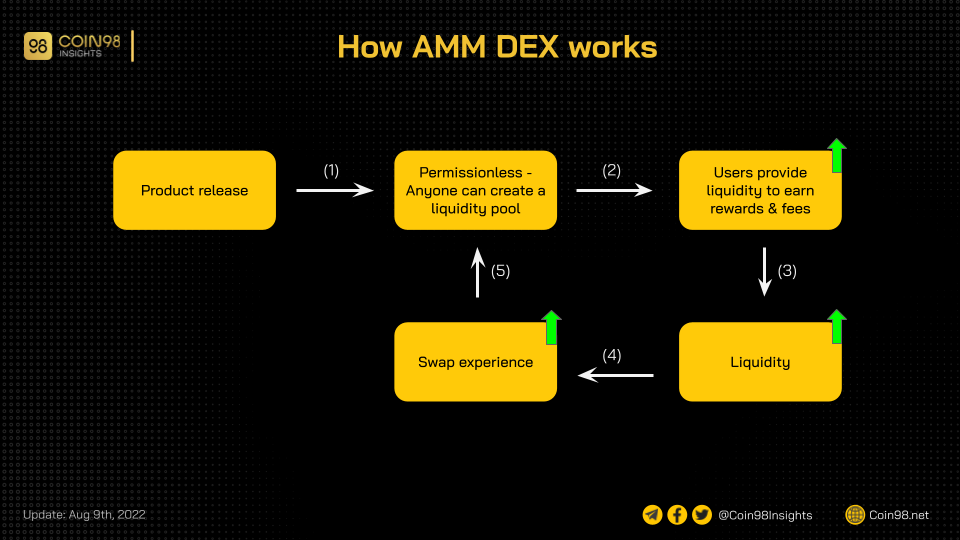

Decentralized Exchange (DEX)

Decentralized Exchanges appear rather late compared to the centralized ones. The first DEX to exist was around 2014, but it was not until the appearance of Uniswap with AMM in 2018 that DEXes became truly recognized.

Different Centralized Exchanges, DEXes operate in a way that no third party is required - they can run even if no one is in charge. Their business model ensures that they are owned by the community and will grow along with the user base - the more users there are, the bigger the exchange becomes.

Even though DEXes are available in the form of both order books and AMM, the latter is what makes decentralized exchanges so unique compared to centralized exchanges. Decentralization is also better appreciated with AMM.

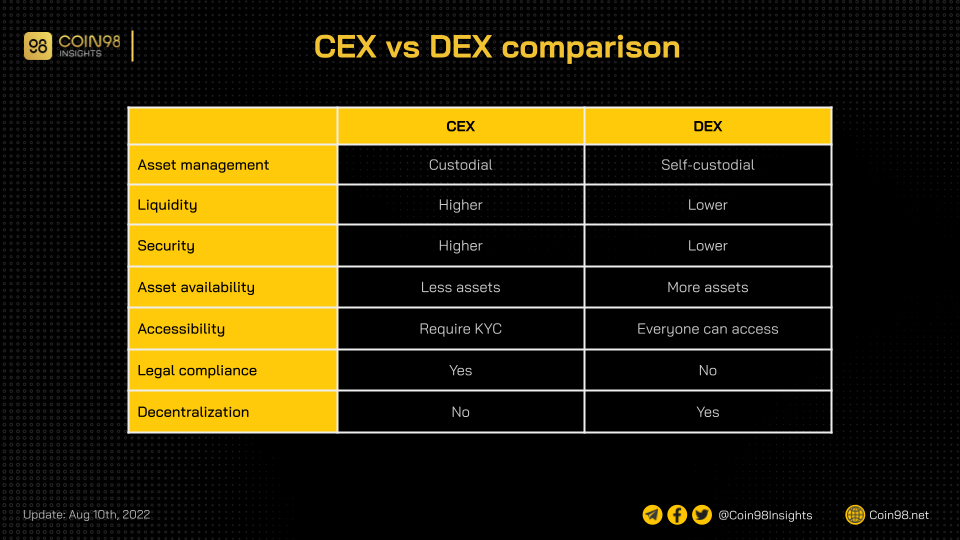

Differences between DEX & CEX

From our perspective, there are 7 major differences between DEX & CEX:

- Asset management: When you are depositing money onto CEXes, you are basically giving them control over your assets. They will have permission to keep your private keys and use your assets at their will. On the opposite, DEXes will not keep your assets and only interact with them once they are allowed.

- Liquidity: Oftentimes, CEXes offer more liquidity than DEXes, especially AMM DEXes. This is due to their nature when CEXes have market makers along with marketing plans to boost up their platform while DEXes operate most solely on users.

- Security: CEXes often offer more security methods than DEXes. In exchange, they control your assets and collect your personal data.

- Asset availability: Listing a cryptocurrency on CEXes requires a lengthy and detailed review process, while listing a token on DEXes is often permissionless. As a result, CEXes normally support a smaller number of assets than DEXes.

- Accessibility: Not everyone can get access to CEXes: They require KYC (Know Your Customer) to get your personal information before you can use their services. At the same time, some countries or regions are banned from using CEXes. DEXes, however, offer freedom of access.

- Legal compliance: CEXes usually need to comply with the law so that their actions are protected by legislation. On the other hand, DEXes have not worked on this aspect yet.

- Decentralization: As is clearly seen in their names, CEXes are centralized while DEXes are more decentralized.

5 best centralized crypto exchanges

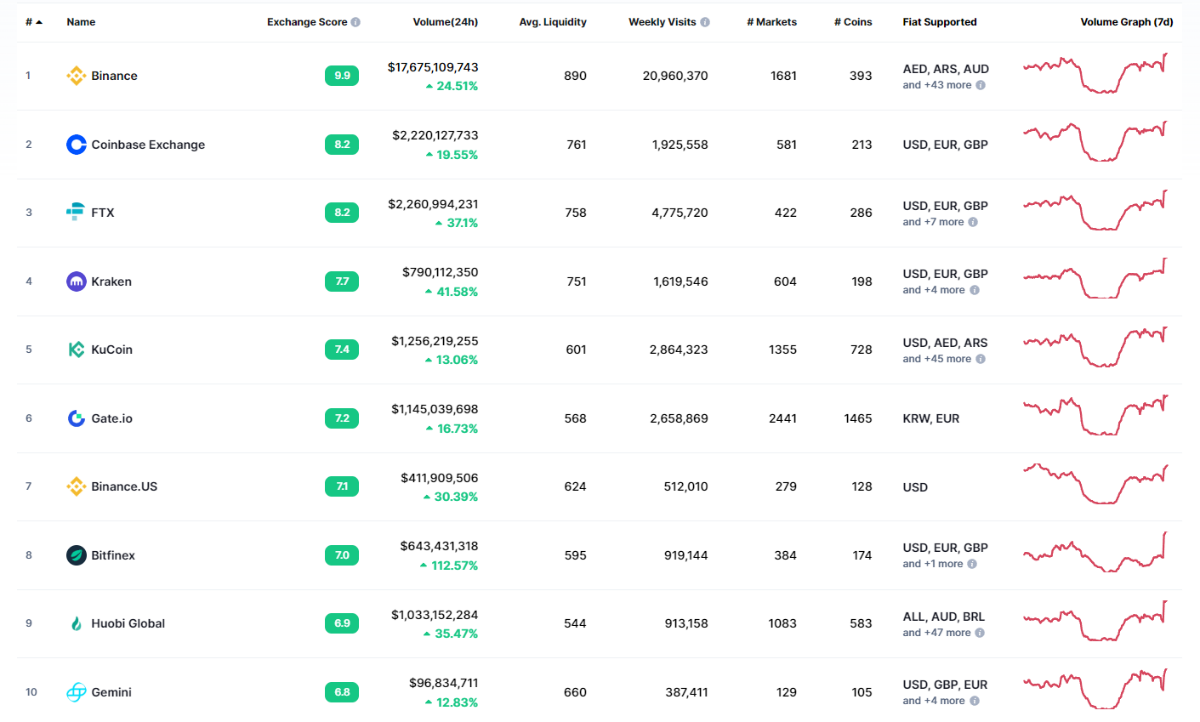

In this part, Coin98 Insights will introduce you to the top 5 best centralized crypto exchanges at the moment. The ranking will be based on Coinmarketcap, which is rated by Web Traffic Factor, Average Liquidity, and Volume.

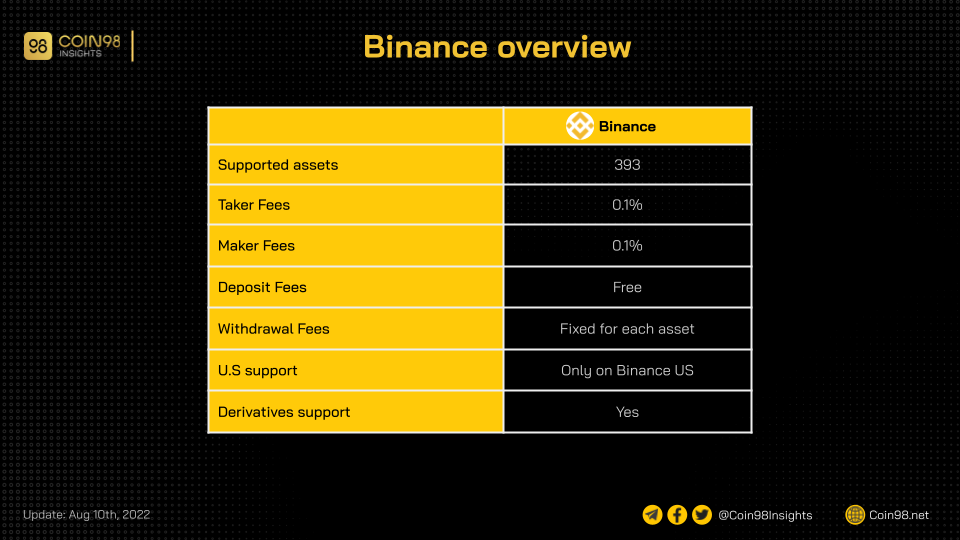

Binance

Binance is a cryptocurrency exchange founded in 2017 by Changpeng Zhao in China. Appearing rather later than other exchanges, Binance has quickly gained an edge to undoubtedly become the number 1 centralized crypto exchange at the moment.

Owning $17.6B trading volume per 24h, completely dominating Coinbase at 2nd place with only $2.2B, there is no question about Binance’s current status. With various financial instruments and a strong network effect, Binance has gone worldwide from Asia to the U.S and beyond.

Pros:

- Large number of trading pairs.

- 0% fees for trading Bitcoin (BTC).

- Support multiple languages.

- Provide a wide range of services.

- Strong network effect.

Cons:

- No major shortcomings.

Learn more: Binance Beginner's Guide & Review (2022)

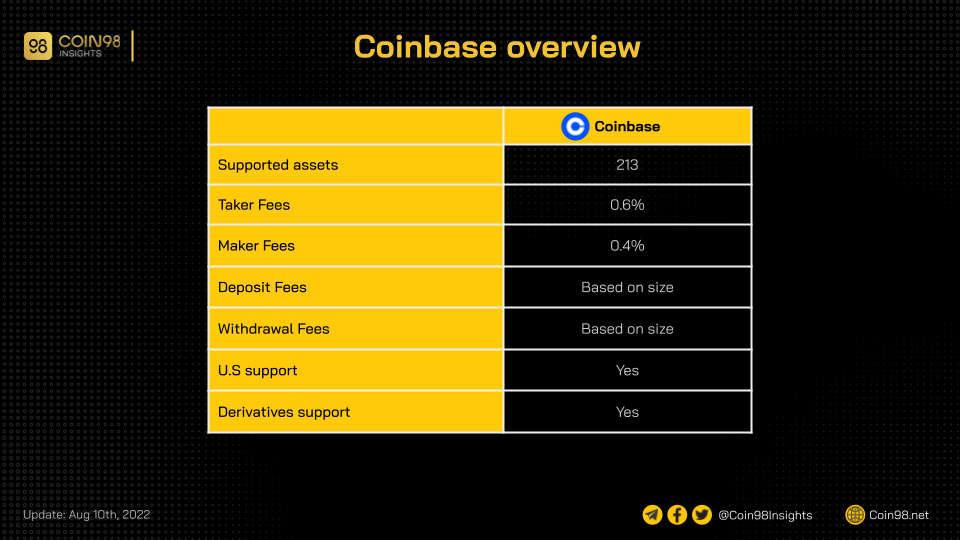

Coinbase

Coinbase was founded in 2012, four years after Bitcoin was invented. It was first founded by Brian Armstrong, a former Airbnb engineer, later joined by Fred Ehrsam, a former Goldman Sachs trader, and Ben Reeve, founder of Blockchain.info.

Coinbase now has approximately 90 million users, 11,000 institutions, and 185,000 ecosystem partners in over 100 countries. It stands out by providing strong support for some of the biggest financial institutions like Blackrock.

Pros:

- 200+ available cryptocurrencies.

- Provide various products and services: Coinbase Wallet, Coinbase Pro,...

- Institutional support.

- Law compliance.

Cons:

- High trading fees.

- Only a few fiat currencies are accepted.

- May not be suitable for the majority of retail investors.

Learn more: Coinbase Review (2022)

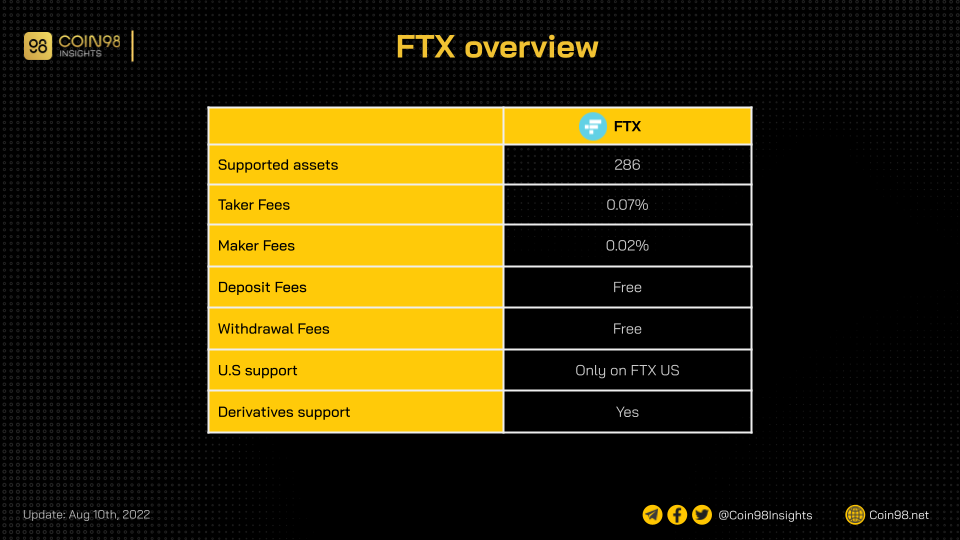

FTX

FTX is a centralized cryptocurrency exchange that offers various applications and services like derivatives, options, volatility products, and leveraged tokens. In July 2021, FTX raised $900 million at an $18B valuation from over 60 investors. This is the biggest fundraising event to be ever recorded in the history of crypto.

FTX has been working on law compliance to provide the best services for U.S and Europe citizens. Especially in the U.S, FTX has acquired various terms and public places to empower its position in this country.

Pros:

- Support over 300 cryptocurrencies.

- Competitive trading fees with discount programs.

- 0 deposit and withdrawal fees for a variety of tokens (USD stablecoins + SPL tokens).

- Versatile market types, including leverage of up to 100x.

- Have an NFT Marketplace.

- Develop applications on both desktop and mobile.

Cons:

- May be unfriendly for new crypto users as they have a professional interface with lots of complicated features.

- No live chat support.

Learn more: FTX Beginner's Guide & Review (2022)

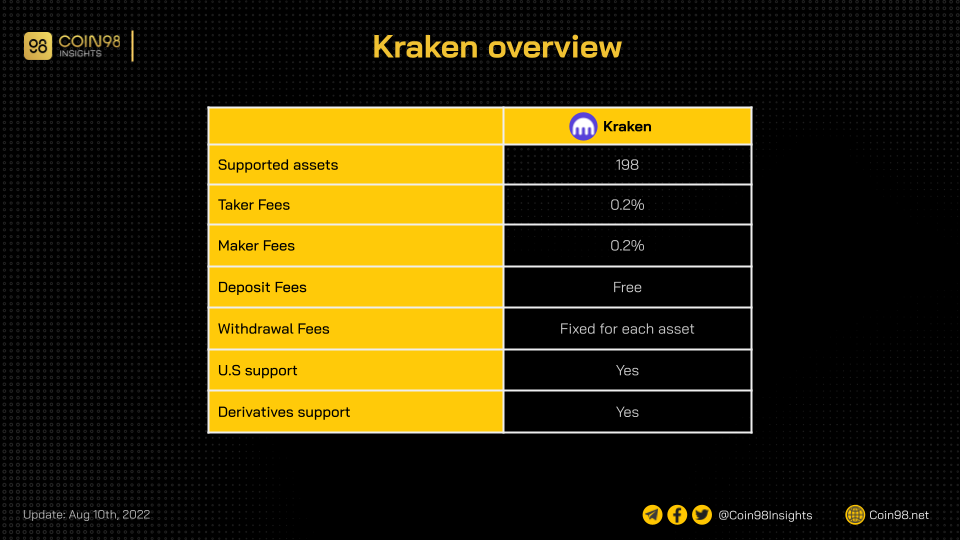

Kraken

Kraken is a crypto exchange founded in 2011 in San Francisco with offices around the world. It supports customers in most countries of the world, including the United States. Beginners will do best with the main Kraken platform, while advanced and expert crypto enthusiasts may prefer Kraken Pro and the advanced margin and futures features.

Pros:

- Simple and user-friendly user interface.

- Support the U.S.

- Good customer service options.

Cons:

- Only a few fiat currencies are accepted.

- Multiple complaints about security and hacks.

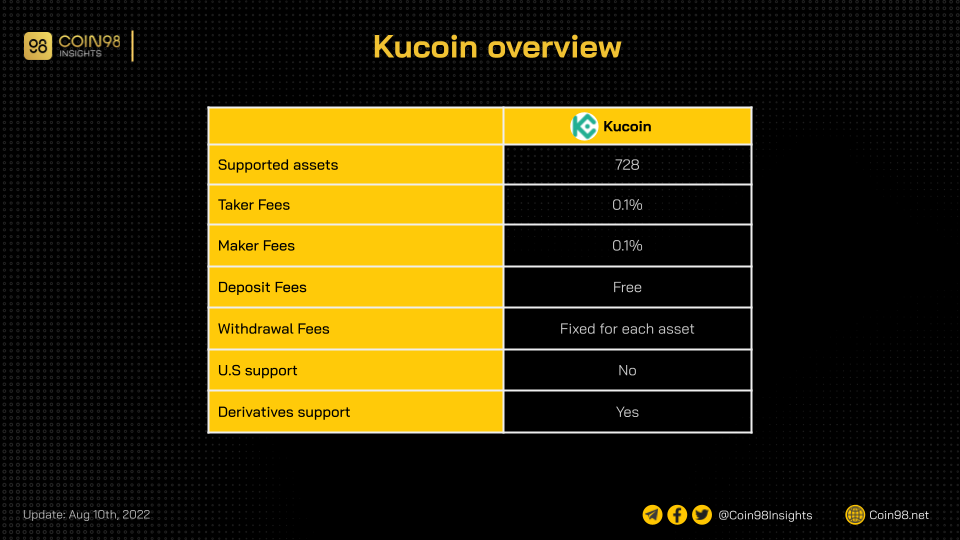

Kucoin

Launched in 2017, KuCoin is a crypto exchange headquartered in Seychelles. Since its founding, it’s grown to be one of the largest global exchanges by trade volume, and it now has over 10 million users and a presence in more than 200 countries.

Kucoin gains an edge over its competitors by providing multiple services and supports to low and mid-cap altcoins, offering a safe and secure investment environment for these high-risk assets.

Pros:

- Support a large number of cryptocurrencies.

- Provide versatile services and trading tools for high-risk assets.

- Low trading fees.

Cons:

- Not available for U.S citizens.

- Limited payment methods.

- Crypto beginners may find the exchange difficult to get used to.

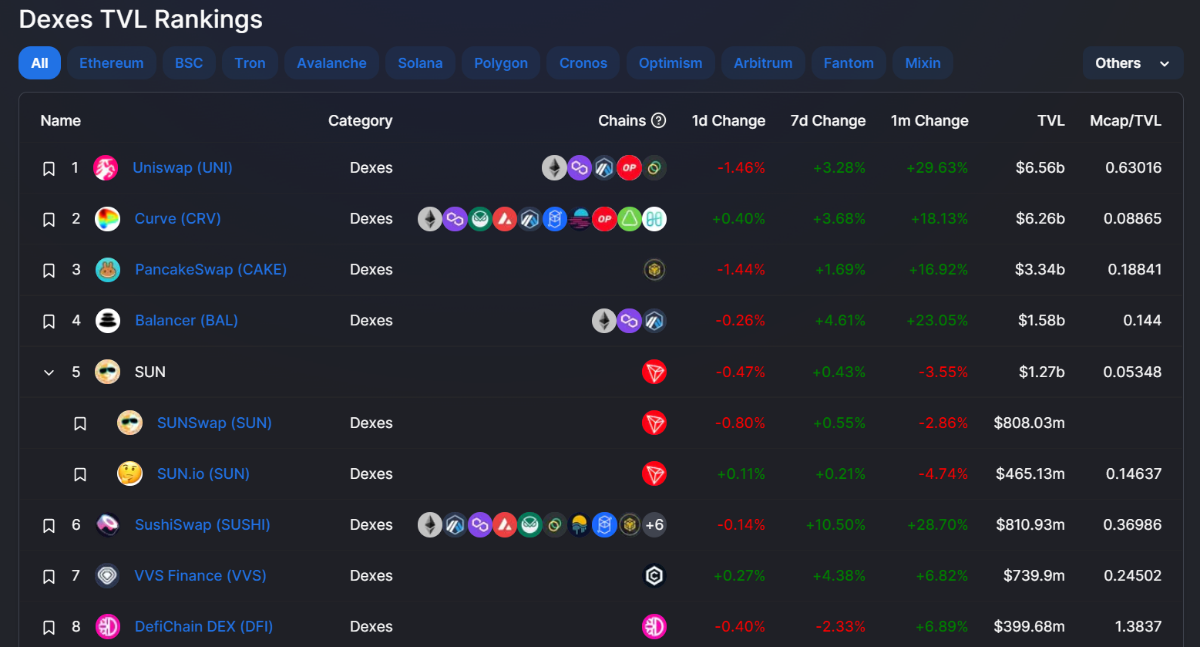

5 best decentralized crypto exchanges

In this part, we will show you the current top 5 best decentralized crypto exchanges. The criteria used to rank DEXes will be different from CEXes: While there are various matters to the well-being of a CEX, the most important aspect of DEX that we will be looking at is liquidity.

For the time being, liquidity is the backbone of DeFi. Specifically for these DEXes, the higher the liquidity they have, the better the product experience will become: liquidity reduces price slippage, improves swap capacity, and produces yields. For most DEXes, liquidity attraction is the number one priority.

While other rankings by Coinmarketcap or Coingecko may be based on trading volume per 24h, we solely believe that this variable is too unpredictable, which constantly fluctuates upon various other factors. Therefore, to rank DEXes, we choose to look at liquidity, also known as TVL (Total Value Locked).

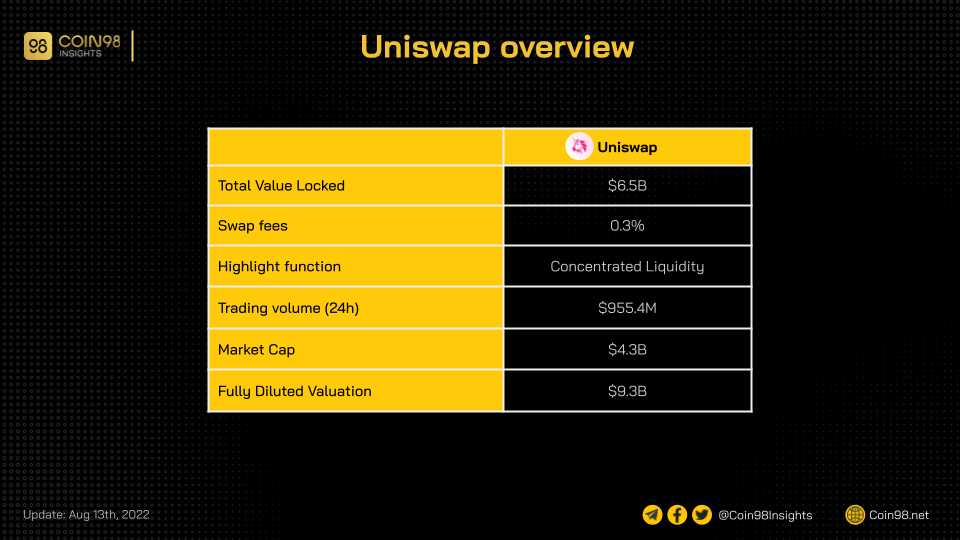

Uniswap

Uniswap is one of the first fully decentralized exchanges (DEX) built in 2018 on top of the Ethereum blockchain. Uniswap is the first permissionless AMM DEX to become so successful, with many newly updated innovations up till today.

Since the introduction of Uniswap V3, there have been numerous changes in the way how Uniswap works. With the release of Concentrated Liquidity, it has been able to outperform the majority of competitors in this field.

Pros:

- Produce innovative products and features.

- Focus solely on improving the AMM DEX experience rather than moving on to other niches.

- Rich liquidity and high trading volume.

- Versatile trading pairs.

Cons:

- No major shortcomings.

Learn more: How to use Uniswap

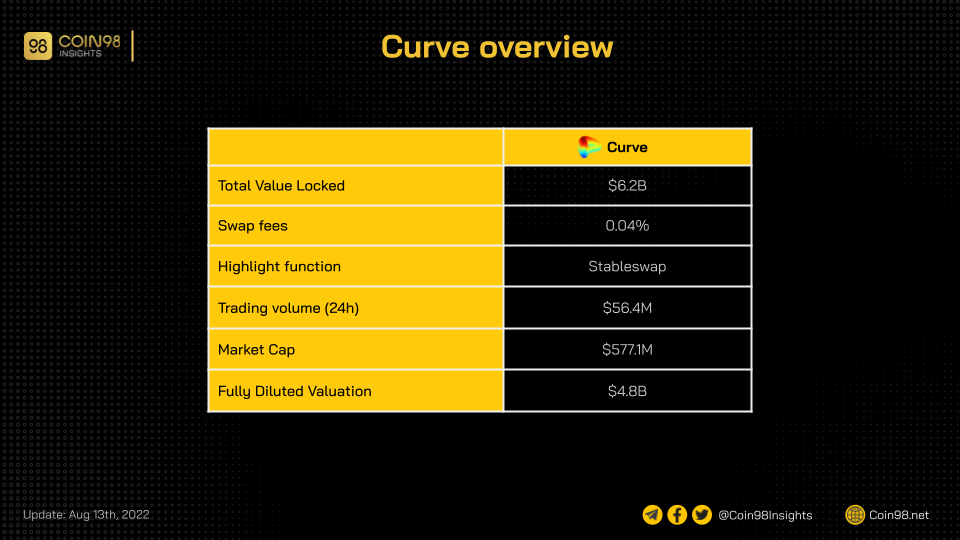

Curve

Curve Finance is an AMM DEX built on the Ethereum blockchain, specifically designed for swapping assets of similar prices such as stablecoins like USDT, USDC, DAI, or synthetic assets like wETH and stETH.

Curve has grown so big that it has become the “home” of stablecoins. Most stablecoins, if possible, want to deploy on Curve to bootstrap liquidity. Curve is also known for its native token, CRV, for having one of the most solid tokenomics in crypto, thanks to its veCRV token model. This model has been widely applied by various big names in the space, just to show how innovative it is.

Pros:

- Low trading fees, almost 1/10 compared to Uniswap.

- Efficient stableswap with low slippage.

- Strong tokenomics.

- Available on 10 chains.

- High yields on stablecoin farming.

Cons:

- Involved in a recent front-end hack.

- Record low trading volume compared to others lately.

- UI/UX needs to be improved.

Learn more: How to use Curve Finance

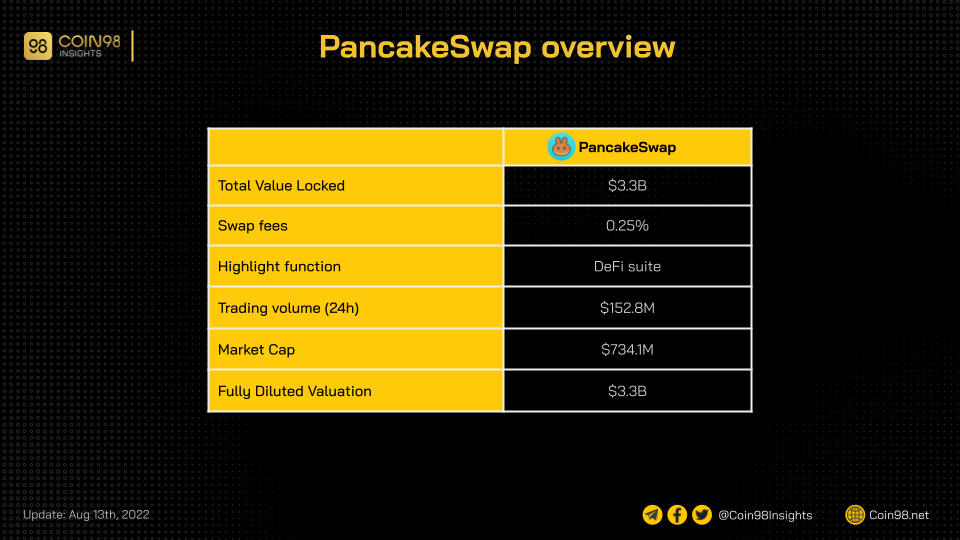

PancakeSwap

PancakeSwap is the fork of Uniswap V2 on BNB Smart Chain (BSC). Though being a fork, PancakeSwap has changed its way to develop into a DeFi suite rather than a single AMM DEX like the original product.

By providing users with more DeFi services like NFT, Lottery, IFO (Launchpad),... instead of only swapping, PancakeSwap has dominated the AMM DEX sector on BSC. Though staying solely on a single blockchain instead of deploying multichain, PancakeSwap has been extremely successful in outperforming even cross-chain protocols like SushiSwap.

Pros:

- DeFi suite with various functions and services.

- One of the most successful forks in crypto.

- User-friendly UI/UX.

- Great tokenomics.

Cons:

- Only available on one blockchain (BSC).

Learn more: How to use Pancakeswap

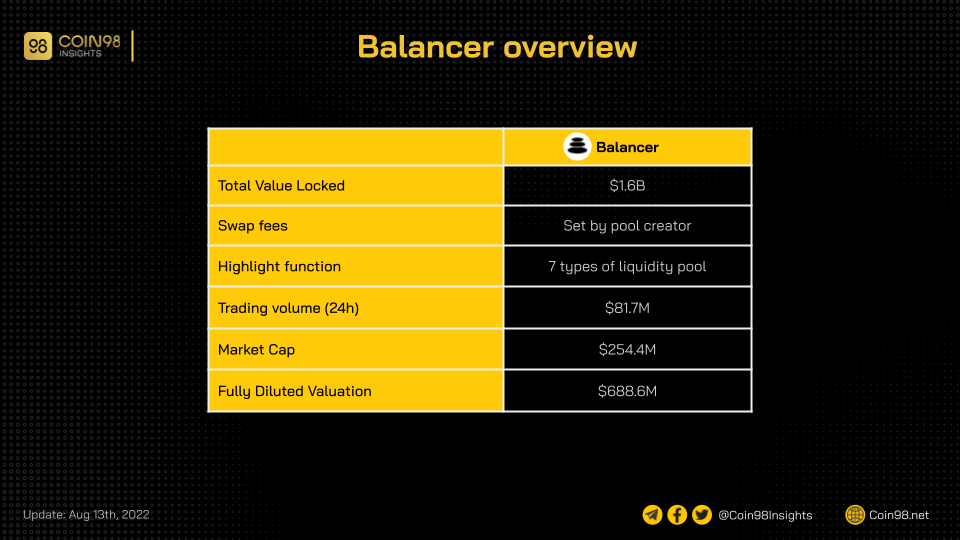

Balancer

Balancer is one of the pioneers in the DeFi space, along with Uniswap, Curve Finance, and Bancor at that time. Balancer changes the way everyone looks at AMM DEXes by creating an innovative and distinctive approach to liquidity pools.

While most AMM DEXes maintain liquidity provision via a token pair with a ratio of 50/50, Balancer introduces Weighted Pools to enable a liquidity pool of up to 8 tokens, each with a flexible weighting.

For example, rather than using a dual-token liquidity pool with a 50/50 weighting, users can create one but with an 80/20 proportion via Balancer. Similarly, this can be a 50/30/20 for a triple-token system, etc. The number keeps going, opening myriads more options for liquidity pools.

Pros:

- 7 types of innovative and flexible liquidity pools.

- Offer more creative ways to optimize liquidity, like portfolio management & auto-rebalance.

- More capital efficient than using a dual-token system.

Cons:

- The idea may be complex for beginners.

- Harder to implement compared to the simpler dual-token method.

Learn more: How to use Balancer Exchange

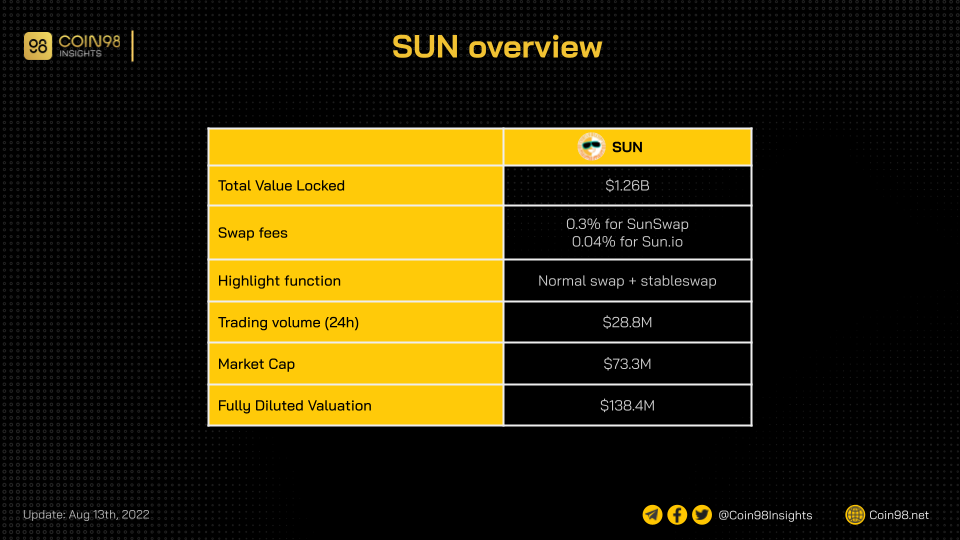

SUN (SUNSwap & SUN.io)

On Jan 28th, 2022, SunSwap - the largest decentralized exchange (DEX) on the Tron network, is now officially integrated with Sun.io. While SunSwap operates as a normal AMM DEX like Uniswap, Sun.io offers stableswap and works similarly to Curve Finance.

With this merge, the two will have a total of $1.26B value locked. By TVL, this makes them the second biggest protocol and the biggest DEX on Tron, far eclipsing the second DEX with only $14.3M in liquidity.

Pros:

- Dominate the AMM DEX sector on the Tron network.

- Combine normal swap + stableswap into one.

Cons:

- Its dominance may come from the centralization of the Tron network rather than the actual quality of its product.

- No innovative products/services.

FAQs about crypto exchanges

What crypto exchanges accept credit cards?

At the moment, most crypto exchanges that accept credit cards are Centralized Exchanges (CEXes). You can use credit cards to buy cryptocurrency on any CEXes, preferably via the top 5 mentioned ones.

Why do crypto exchanges have different prices?

Each crypto exchange has a different market. Therefore, the price actions on one exchange do not happen on the other, making asset prices vary between them. Nevertheless, there are always arbitragers who will take advantage of this price difference. As a result, the price difference would not be significant.

Learn more: What is arbitrage?

Conclusion

Essentially, crypto exchanges are products that allow users to buy & sell cryptocurrencies. Along with this core function, they also provide various financial tools like margin trading, derivatives trading, and asset management.

In crypto, there are 2 types of exchanges: CEX (Centralized Exchange) and DEX (Decentralized Exchange). From our perspective, there are 7 major differences between CEX and DEX. However, the most important factor is their centralization, as clearly shown in their names.