What is Beefy Finance? Things to know about BIFI Token

What is Beefy Finance?

Beefy Finance is a Multi-Chain Yield Optimizer platform that allows its users to earn compound interest on their crypto holdings. It helps maximize the user rewards from various liquidity pools, AMMs, etc... through a set of investment strategies enforced by smart contracts.

For those who are unfamiliar, I'll use this example to explain what a yield aggregator protocol is:

The Binance Smart Chain contains a plethora of DeFi applications. Consequently, users are often unsure of which option will give them the best yield. These problems were addressed by Yield Aggregators. As a result, these protocols "aggregate" yield by using a combination of complex strategies that are automatically executed by smart contracts in order to provide users with the highest possible yield. Of these, Beefy Finance is a good example.

When users farm through Yield Aggregators, they can earn interest from the main Liquidity Pools as well as incentives from the Yield Aggregators such as its native tokens (in this case, farming on Beefy Finance will receive BIFI).

Why Beefy Finance?

Most notable about Beefy Finance is its multichain integration, which has already partnered with ten different chains, including Binance Smart Chain and Avalanche, Heco, Polygon, Fantom, Harmony, Arbitrum, Celo, Moonriver and Cronos.

Beefy Finance can provide a simple way for investors to interact with pools, projects, and other yield opportunities without having to constantly make decisions and take manual actions. Hence, it can help you come up with more complicated strategies and more frequent rebalancing.

How does Beefy Finance work?

Valts

Have you ever felt bothered because when you are a farmer on DEXs, you must manually harvest, sell rewards, buy more tokens, and reinvest them continuously?

→ A vault can do all that automatically at a high frequency.

It is a tool that has a specific set of yield farming strategies. Vaults make use of automation to continually invest and reinvest deposited funds, which helps to achieve high levels of compounded interest.

By using a Beefy vault to compound users’ gains, users will save time and pay fewer gas fees by eliminating unnecessary transactions associated with gas costs. Beefy.Finance does not own user funds staked in vaults. Therefore, users could always withdraw from a vault at any moment in time.

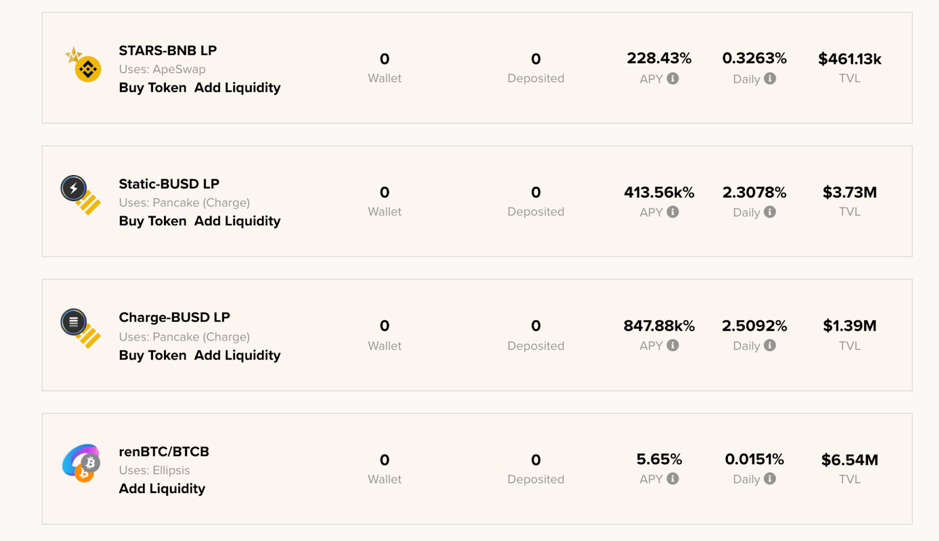

The above picture is illustrative of a different set of vaults that exist on Beefy Finance. For example, if you own the STARS-BNB LP token and stake it on Beefy Finance, Beefy will provide you the pool with the best optimized yield. In this case, this vault gives you an impressive APY of 4,570% and daily APR of 2.15%.

Summarizing, vaults can:

- Efficiently execute yield farming strategies.

- Compound rewards into the initially deposited token amount.

- Use any asset as liquidity.

- Provide one asset as collateral for another.

- Manage collateral at a safe level to mitigate liquidation.

- Put any asset to work to generate a yield.

- Reinvest earned profits.

After depositing tokens into a vault, the user is supplied with vault specific mooTokens which represent their share in the vault. For example, you receive mooBIFI tokens when depositing BIFI into the BIFI Maxi vault.

How are Vaults determined?

Anyone in the Cowmoonity can work together to build new strategies and submit them to governance for voting. Beefy’s team will look at vault requests via an official forum where anyone is free to submit requests.

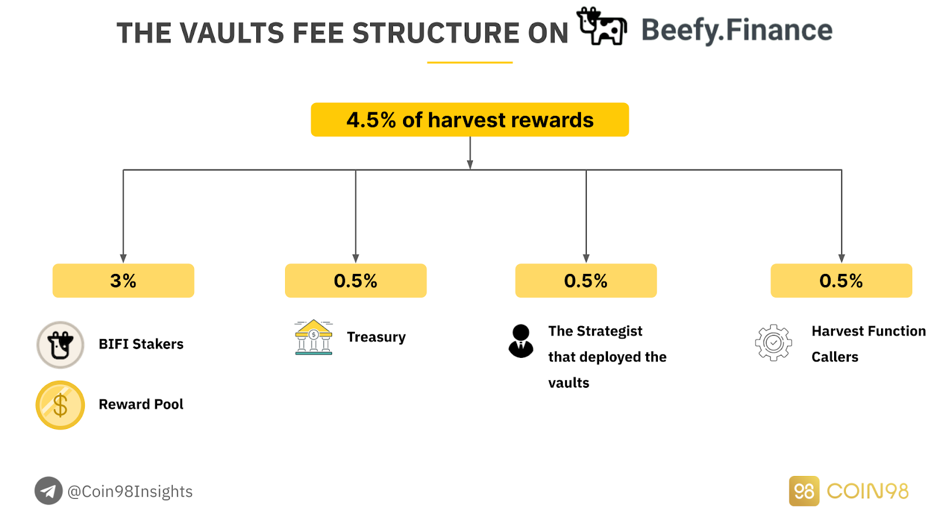

The Vault Fee Structure

In Beefy, vaults will take 4.5% of the harvest rewards. This 4.5% profit will again be split up into the following categories:

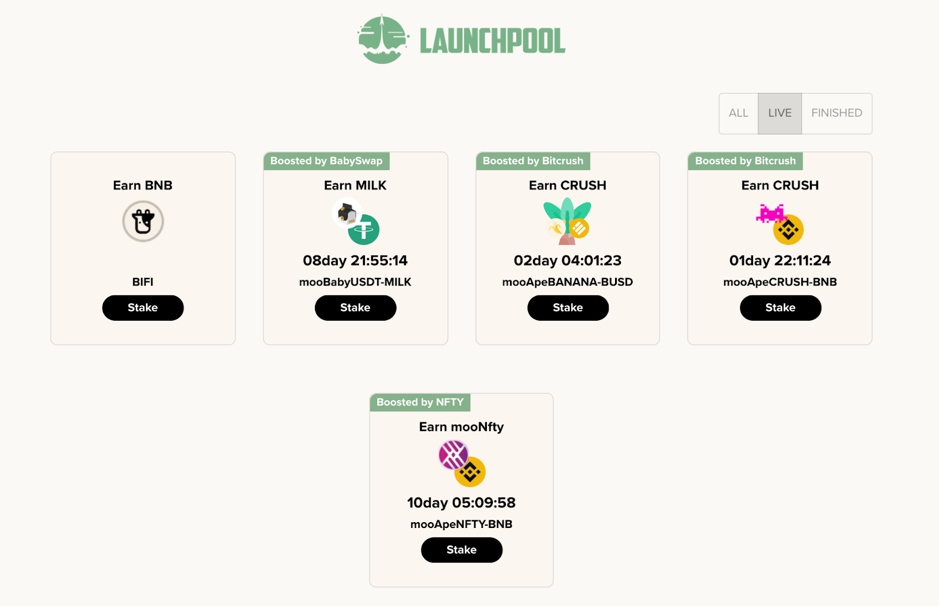

Launch Pool

Beefy Launchpool is the initial vault offering through which Beefy promotes projects on Binance Smart Chain. It will boost certain vaults with the partner token in order to give the best APY to users.

What is BIFI Token?

BIFI is a governance token of Beefy Finance. Platform revenue is generated from a small percentage of all the vault profits and distributed back to those who stake $BIFI.

Detailed information about BIFI Token

BIFI token metrics

- Token Name: Beefy Finance

- Ticker: BIFI

- Blockchain: Binance Smart Chain

- Token Standard: BEP-20

- Contract: 0xCa3F508B8e4Dd382eE878A314789373D80A5190A

- Token Type: Utility and Governance

- Total Supply: 80,000 BIFI

- Circulating Supply: 78,000 BIFI

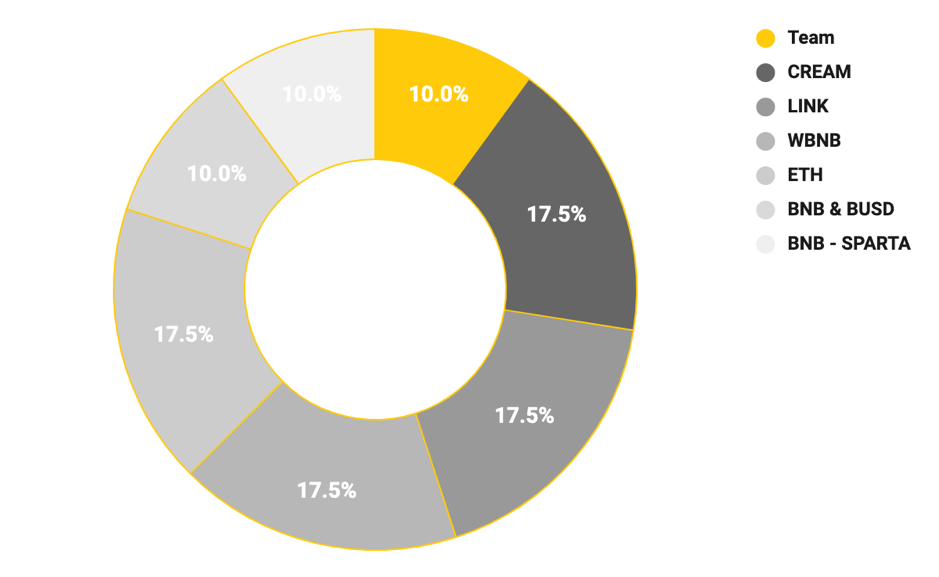

BIFI Token Allocation

- Team: 10% - 8,000 BIFI

- Pool 1 ($CREAM): 17.5% - 14,000 BIFI

- Pool 2 ($LINK): 17.5% - 14,000 BIFI.

- Pool 3 ($WBNB): 17.5% - 14,000 BIFI

- Pool 4 ($ETH): 17.5% - 14,000 BIFI

- Pool 5 ($BNB-$BUSD): 10% - 8,000 BIFI

- Pool 6 ($BNB-$SPARTA): 10% - 8,000 BIFI

BIFI Release Schedule

- Community token (Pool 1-6) with total 72,000 BIFI (90% supply) released in two months

- The team’s token will be released in the first two years, which are split into four phrases:

- Phrase 1: 2 weeks after the pool launched.

- Phrase 2: 3 months after the pool launched.

- Phrase 3: 9 months after the pool launched.

- Phrase 4: 21 months after the pool launched.

BIFI Token Use Case

BIFI token has these main roles:

- Governance: Create and/or vote for proposals.

- Stake to earn harvest reward fees.

How to get BIFI Token

You can get BIFI Token by providing liquidity on Beefy Finance

How to buy BIFI Token

You can buy BIFI Token through these exchanges:

- DEXs: Coin98 Exchange, 1Inch, PancakeSwap, QuickSwap, Trader Joe, VVS Finance, SushiSwap...

- CEXs: Binance, CoinEx, Nominex,...

Alternatively, you can use Coin98 Exchange to buy ONE token via the swap button at the end of the article.

Learn more: How to use Coin98 Exchange

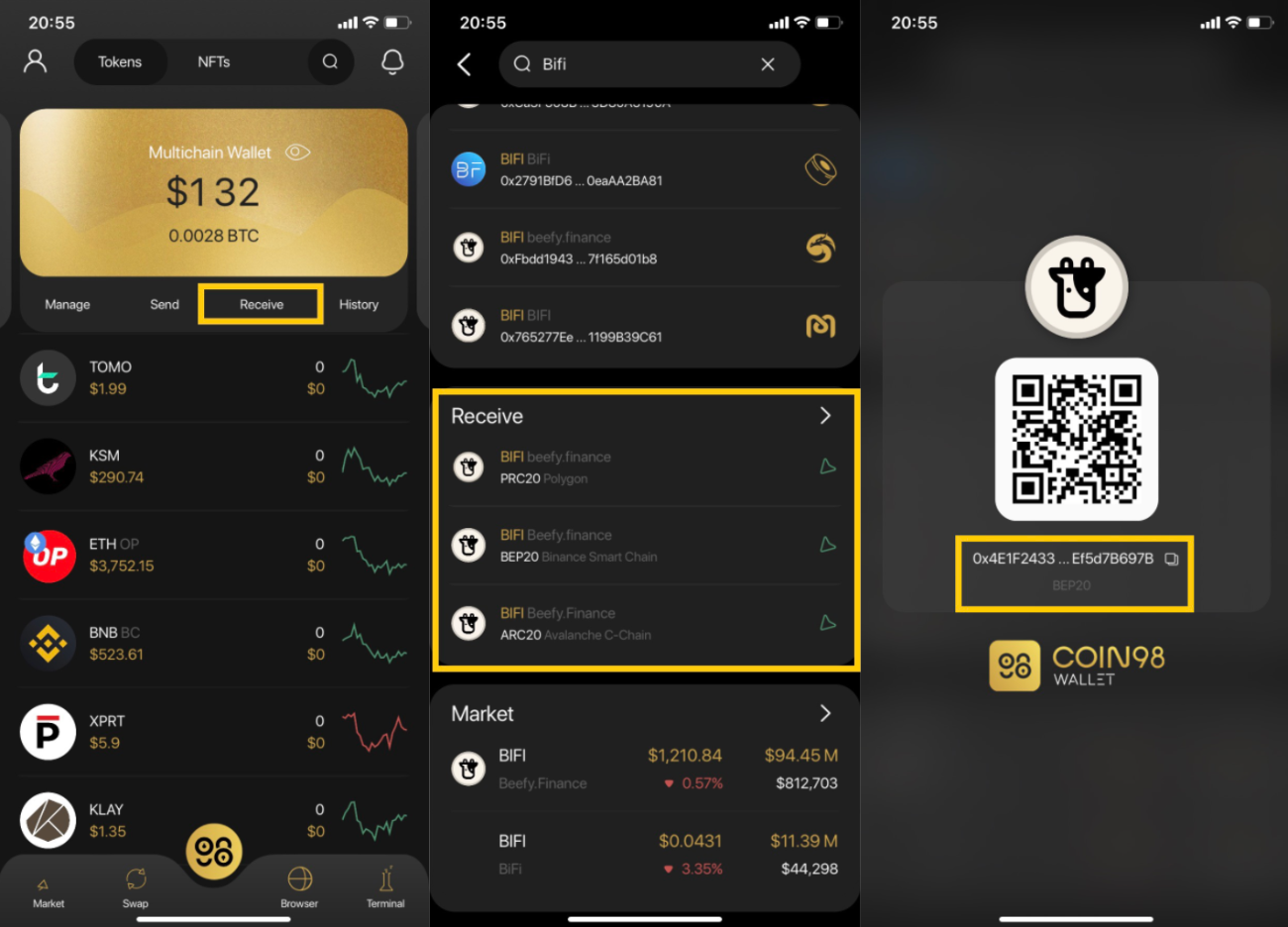

How to store BIFI

You can store BIFI token on Coin98 Wallet with these simple steps:

Step 1: Open Coin98 Wallet & click Receive on the home screen.

Step 2: Search BIFI Token.

Step 3: Click on the correct result, copy the wallet address and send BIFI to this address.

Team, Investors, and Partners

Team

The BIFI team is anonymous. However, we have found two devs (total of 10 developers), which are "@superbeefyboy" and "@beefyfinance".

Investors

Since the BIFI Token Allocation only includes Beefy Team and the Pool’s Liquidity Providers.Therefore, this project has not raised any funds from early investors.

Partners

Because Beefy Finance launched on multichain, they have numerous partners on different ecosystems, of which the majority is AMM & DEX, where they have Liquidity Pool that Beefy currently integrates. Some of them are Qi Dao (Polygon), Beethoven (Fantom), BabySwap (Binance Smart Chain), etc.

Moreover, Beefy Finance also integrates with Trust Wallet, one of the most-used wallets, in order to increase their brand awareness

Roadmap and Update

The team currently has not released any information about the Beefy Finance Roadmap yet. I will keep you updated.

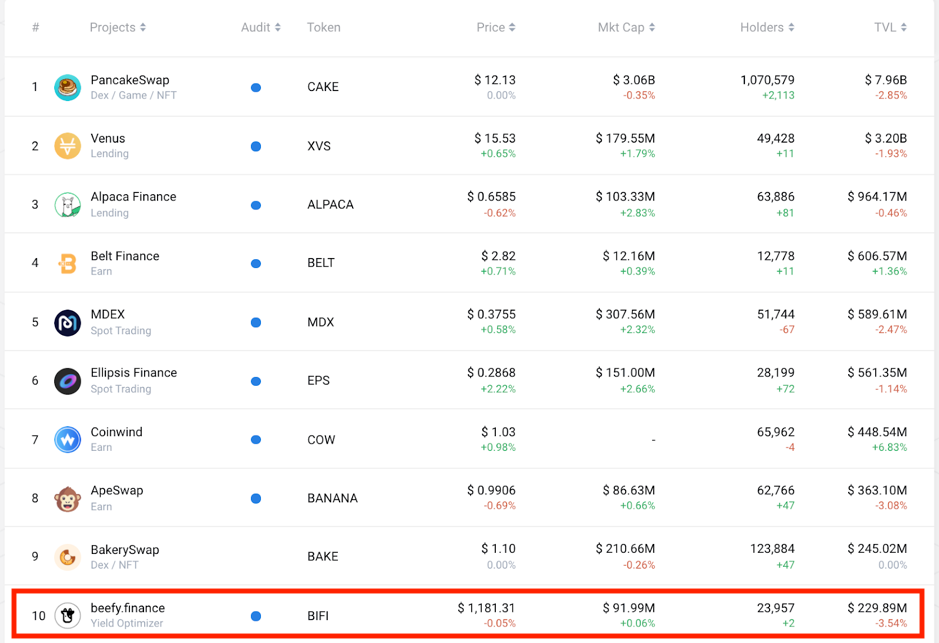

Is Beefy Finance a good investment?

According to the Beefy Finance Website, this yield aggregator holds $223M in TVL with a total of 249 Active Vaults and nearly 37,000 holders across ecosystems. It is now the leading Yield Aggragator, and is in the top 10 total value locked on Binance Smart Chain, regardless of BSC being the ecosystem that has the largest number of Dapps.

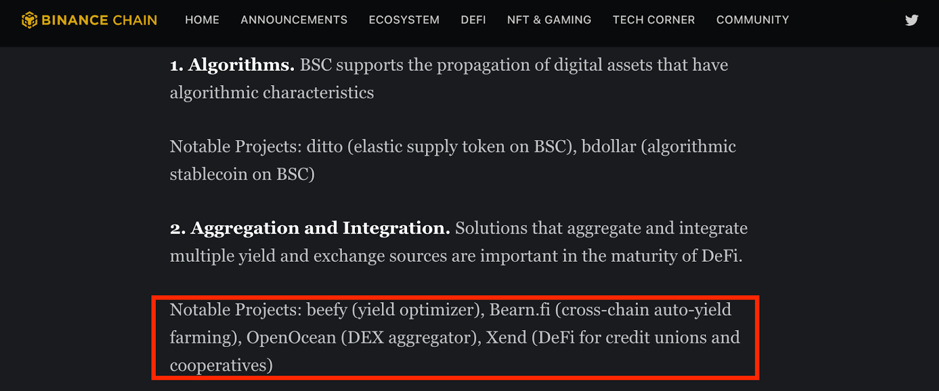

In 2021, Beefy was mentioned many times by Binance in their reports & suggestions due to Beefy’s contribution to DeFi maturity. It is also featured as the first aggregator on Binance Smart Chain.

If you are looking forward to finding a platform that provides an optimized and convenient way to earn the highest possible yield, Beefy Finance is a good choice to stake your assets, regardless of which blockchain you are on.

Similar Projects

- Yearn Finance (YFI): One of the most notable protocols in the DeFi world. Yearn Finance is a yield optimization protocol with the core value is to maximize yield and minimize risks for all users.

- Alpaca Finance (ALPACA): Leveraged yield farming protocol on BSC.