What is Binance Labs? All you need to know about Binance Labs

Binance Labs Overview

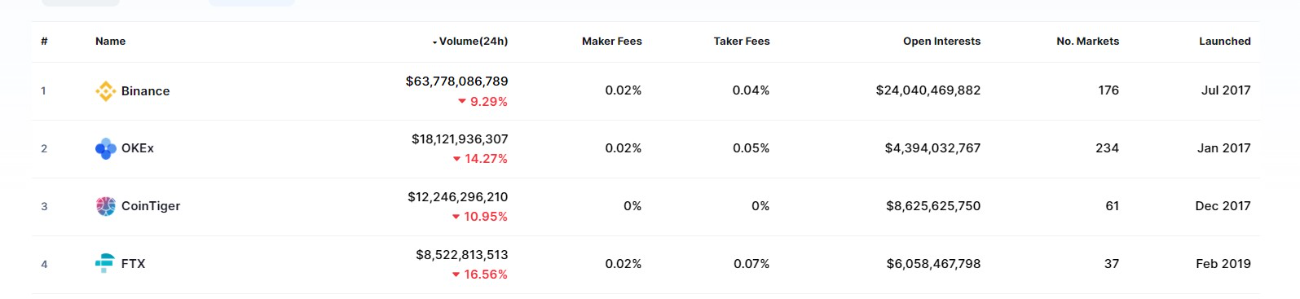

Binance Labs is a Venture Capital (VC) of Binance, which is the largest Centralized Exchange in the crypto world. The main goal of Binance Labs is to identify, support, and invest in startup projects, entrepreneurs, communities in the crypto world.

It was founded in 2017, and over the course of 3 years in operation, Binance Labs invested in over 100 projects worldwide. They focus not only on one sector/niche but also on every corner of the crypto space.

Binance Labs Members

Changpeng Zhao

Changpeng Zhao, known as “CZ'' is the founder and CEO of Binance, which is the largest Centralized Exchange by trading volume. He often tweets on his Twitter, talking mostly about things in the crypto world.

- One of the richest persons in the crypto world.

- Ignited many new crypto trends, such as ICO in 2017 and IGO in 2021.

- Over 4 million followers on Twitter.

Read more: Changpeng Zhao (CZ) - From gas station’s worker to crypto billionaire

Yi He

Yi He is the co-founder and CMO of Binance. She often oversees the venture investment arm and is responsible for accelerating the marketing efforts of Binance. She contributes to leveling up the Binance influence to the top centralized exchange.

Bill Chin

Bill Chin, Head of Binance Labs Fund, is often being quoted his speak at public in Binance Labs' announcements. He believes that Binance Labs' key strategy is to back early-stage ventures and developers.

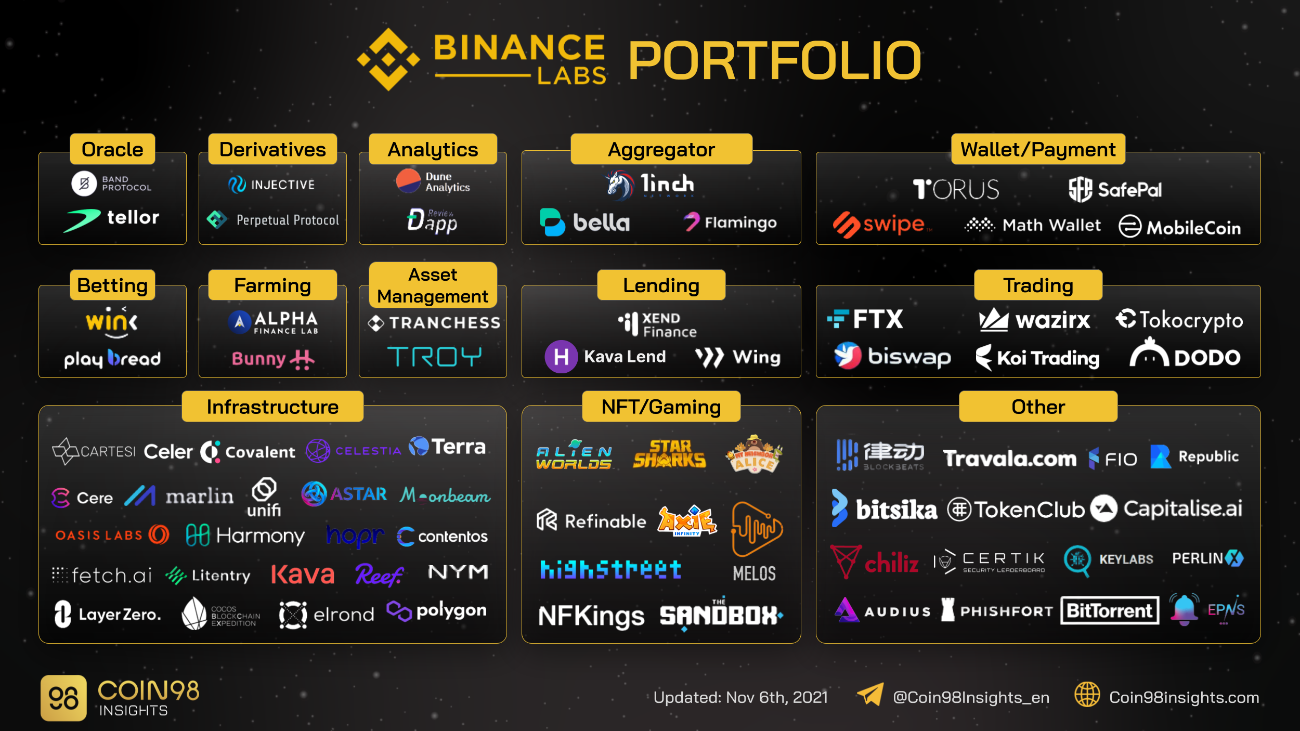

Binance Labs Portfolio

Portfolio Overview

Binance Labs has been actively investing in over one hundred crypto projects in every major field. The portfolio is so diverse that it ranges from the most fundamental crypto legos to the newest NFT/Gaming/Metaverse trend.

⇒ Binance Labs' portfolio is diverse and follows new trends. Since Binance has quite a large influence, they expand their network effect to every corner of the crypto world.

Infrastructure

Most projects in the portfolio of Binance Labs are infrastructure projects that focus on blockchain platforms, blockchain solutions, and infrastructure for financial projects.

One of the strategic targets of Binance Labs is blockchain platform projects such as Terra, Polygon, Kava, Elrond Network, etc. Most invested projects were launched on Binance Launchpad to receive support and attention from the community.

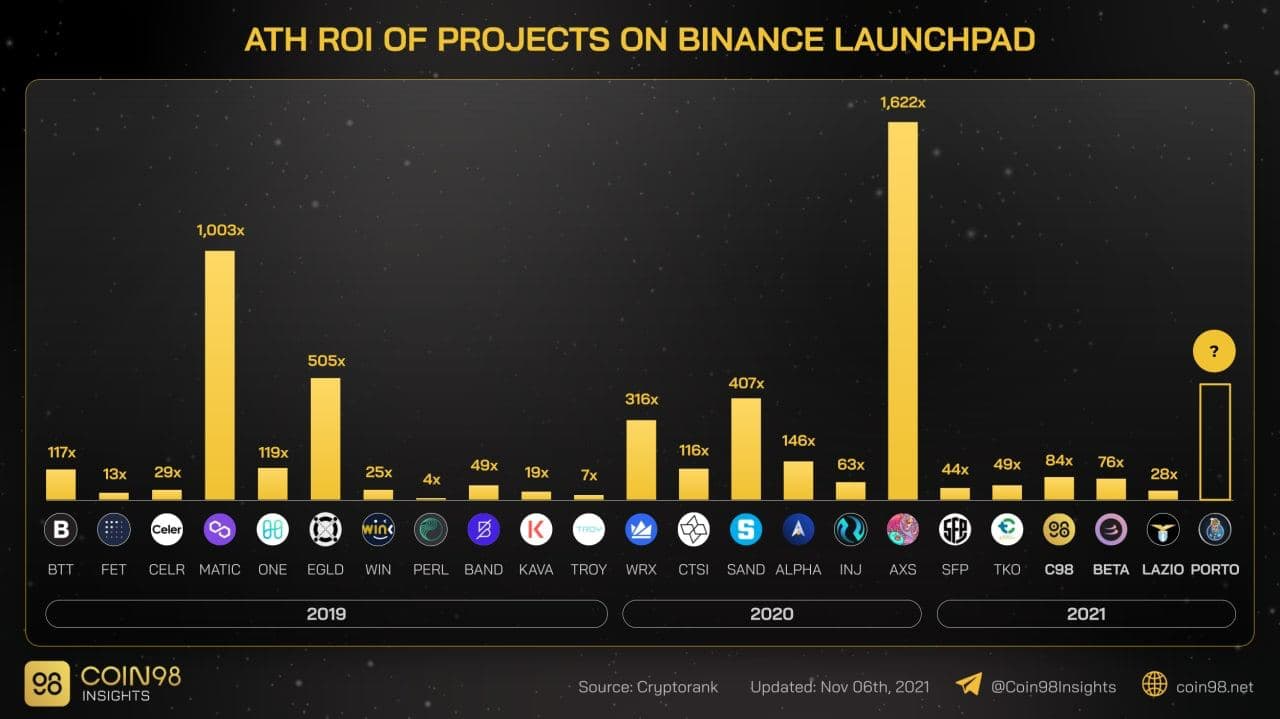

- Polygon is the most outstanding project in terms of ATH ROI, over 1000x. It is a layer-2 solution of the Ethereum blockchain that solves the congestion problem of Ethereum. Multiple top-tier projects were deployed on Polygon, such as the biggest derivatives market, dYdX, and the largest NFT marketplace OpenSea on Ethereum.

- Elrond Network is a blockchain-based platform that enables users to build Dapps and create cryptocurrencies to construct a new internet-based economy.

⇒ Binance Labs focuses on investing in potential blockchain platforms with innovative technologies that solve the current problems of old-fashioned blockchain platforms. Polygon and Elrond Network are the most successful investments of Binance Labs with extremely high ROIs, and they also have long-term potentials.

Trading platforms and Derivatives market

Binance Labs has invested in multiple potential projects that have good outcomes and yield high returns for investors. To create a diversified portfolio, trading platforms always play an important role since they contain most of the liquidity of the crypto world.

- 1inch has raised $2.8M in a funding round led by Binance Labs in Aug 2021. 1inch Exchange is a DEX aggregation platform built by software engineers from Porsche and Near Protocol.

- One of the most successful investments in trading platforms is FTX. This centralized exchange has a close relationship with the top-5 blockchain platform Solana. In late 2019, Binance Labs and FTX formed a solid partnership to leverage the trading derivatives market.

Along with Binance, the centralized derivatives trading platform FTX is the go-to place for traders who would like to leverage their positions up to 20x.

Talking about decentralized derivatives markets, Binance Labs invested in Injective Protocol and Perpetual Protocol. Perpetual Protocol is the second-largest decentralized derivatives market that has a total revenue only behind dYdX.

⇒ Binance is famous for being the largest centralized exchange in the crypto world. Therefore, they hardly invest in this field unless they want to expand their network with other strong entities.

Lending/Borrowing

Binance Labs invested only a few lending/borrowing projects in the early stage. The most notable of those projects is Kava Lend inside the Kava ecosystem based on the Cosmos blockchain. However, until now, Kava Lend seems to be outperformed by other similar lending protocols.

Wallet

Wallet and payment field is also being strongly invested by Binance Labs since there are over 5 projects granted. We can list some notable projects that have the most influence in the crypto world.

- Mobilecoin is a peer-to-peer crypto wallet that was first released in 2020. With Mobilecoin, users can pay crypto assets for a cup of coffee as they pay it in cash. The Mobilecoin platform is built on top of the Stellar and Monero blockchain for privacy and security enhancements.

- SafePal is a cryptocurrency wallet that was first released in 2018. It provides users with both hardware and software wallets connected through the SafePal App. Binance Labs chose SafePal to be the first hardware wallet to invest in.

- MathWallet is a multi-platform crypto wallet that is available on Mobile, Desktop, Browser, and Hardware. Moreover, it supports over 60 chains including Bitcoin, Solana, Fantom, Wax, etc. In 2020, Binance Labs led the $12M series B funding round of MATH to skyrocket MathWallet.

NFT/Gaming

In 2021, NFT/Gaming projects have been skyrocketing since billions of dollars are being poured into the market. Binance caught this trend by announcing the IEO (Initial Exchange Offering) and IGO (Initial Gaming Offering) to launch potential projects to reach fundraising targets.

Binance Labs has invested heavily in multiple NFTs and blockchain-based games such as Alien Worlds, HighStreet, NFKings. The Binance Labs team went ahead in the metaverse trend quite early with The SandBox and My Neighbour Alice.

- Axie Infinity is the most successful gaming investment of Binance Labs since the gaming project was launched on Binance Launchpad. Axie Infinity is now the biggest NFT game in the crypto-verse that releases the Ronin sidechain to expand beyond to create a blockchain-based ecosystem.

- The Sandbox is a community-driven metaverse project that was invested by Binance Labs in the private round. After that, the SAND token of The Sandbox was launched on Binance Launchpad. Now the total market cap of SAND is over $5.5B.

Others

Certik was invested in by Binance Labs in the very early stages. It’s now the most popular security company in the crypto world that is responsible for auditing new projects with high expertise. The company has helped to enhance security, letting users have the seamless experience of decentralized applications.

In which Ecosystem Binance Labs invested?

Having been operating since 2017 - the first crypto bubble, Binance Labs has invested in lots of projects on Ethereum which is the largest smart contract platform. Since 2017, lots of projects have been built on Ethereum. As a result, Binance Labs’ portfolio contains most Ethereum-based projects.

Binance Smart Chain is the main focus ecosystem of Binance since its inception is to create an abundant ecosystem in the crypto world. Binance has been favorably incubating projects that are built on BSC such as Tranchess, NFT game Starshark or Wink casino-themed platform, etc.

Binance Labs also invests in other blockchain ecosystems such as Cosmos, Solana, etc. However, they want to explore the Binance branding further in the crypto space.

Should we follow Binance Labs’ portfolio?

Performance

Binance Labs has been involved in the crypto world very early, so they have built a strong network with other partnerships and a quite diversified portfolio. As they have been investing in crypto projects since 2017, the portfolio growth of Binance Labs is quite impressive (today prices with the prices at the beginning of 2021) as follows: Axie Infinity (AXS): 21000%

- The Sandbox (SAND): 15000%

- Polygon (MATIC): 12000%

- Terra (LUNA): 9000%

- Perpetual Protocol: 1000%

- FTX (FTT): 700%

Investment Thesis

Binance now is a crypto giant in the crypto space since it is now developing fast the all-in-one ecosystem. Therefore, they want to expand their influence as well as acquire as many outstanding projects as possible.

Binance Labs invests more often in the series A, B, C,... than in the seed/angel round. This investment style of Binance Labs aims to invest in potential projects that survive through the seed round.

Binance Labs’ investment thesis is clear, shown by the variety of the portfolio.

- Latest trends: Binance Labs catches the trend fast and even leads the new trend sometimes.

- Long-term investments: Even though catching the trend fast, Binance Labs focuses on supporting

- A diversified portfolio: Investment deals of Binance Labs always cover every corner of the crypto world, enhancing the strong network effect of Binance.

- Leverage with a strong community and full support: Every project that goes into the Binance ecosystem will inherit all the available advantages to get bootstrapped with the best user base.

Binance Labs in 2022

There are lots of hot keywords in 2021 such as NFT, GameFi, Metaverse, Web 3.0, DeFi 2.0, etc. Binance Labs led by CZ who is sometimes called the trend creator has been always leading the trend with multiple early investments.

As we can see Binance Labs are pouring capital into NFT, Metaverse, and Web 3.0 platforms. Metaverse and Web 3.0 are the next destinations for the crypto world to head to. We should follow the social media of Binance to catch up with the latest updates.

Especially, the Twitter account of CZ is a must-follow one since he often expresses his ideas and thesis in the crypto world.

Conclusion

As Binance Labs is detailed broken down in this article, we can conclude some keynotes that might express the overall style and thesis of this venture capital.

- Binance Labs has an experienced and expert team that can catch up with the latest trends and invest in projects with a long-term view. They also actively support the development of projects instead of pouring funds.

- In the other half of 2021, the Binance Labs team has a very long-term view with multiple metaverse and web 3.0 investment deals.

- Binance Labs investments aim to expand the presence of Binance in every sector of the crypto space. Binance Labs is a vital part of the Binance ecosystem which makes a strong network effect.

- They often invest in the early stages of new projects instead of funding later rounds. This indicates that they are willing to go along and take risks with the fund-granted teams.

And that is all you need to know about venture capital Binance Labs. I hope you’ve gained the overview and our insights will be useful to you. There will be more articles for other VCs. Stay tuned!