What is Venture Capital? Top Venture Capital In Crypto

Venture Capital has been around in the crypto market since the dawn of Bitcoin. Many crypto natives consider it smart money and decide to follow their traits. Nothing is absolute. In this article, we are going to get an understanding of Venture Capital and how it works.

What is Venture Capital (VC)?

Venture Capitals (VCs) are investment firms that focus on funding startups. In the crypto space, crypto VCs are the strong backers of numerous projects. Early-stage startups need capital to operate and accelerate their growth. As a result, they raise funds from VCs instead of taking loans from banks.

Since the advent of crypto venture capital, the amount of money flowing into the market has skyrocketed. In Q1 2018, the number of VC deals was almost 500, followed by consistent numbers of the following quarters. Venture capital seeded investments in 2017-2018 to prepare for the next cycle (2020-2021).

In 2021, VCs went on an investing spree. Over 2000 investment deals were closed in 2021 alone. In Q4 2021, the total amount of money invested reached its peak at $10B+ in the crypto market. This shows VCs are actively investing despite the market condition. We estimate that the number might slow down in the upcoming years if crypto turns bear.

In short, crypto VCs work with the same principle as traditional VCs. They speculate on early-stage startups to get asymmetric returns on their investments. Everyone can be a venture capital himself since this nascent market has extremely high volatility.

Why does Venture Capital exist?

Venture capital’s role in crypto

As mentioned earlier, venture capital concentrates on funding the projects with their money. Besides that, there are numerous invisible benefits accruing to the projects, such as the reputation and the network effect.

Venture Capitals have a wide network with other organizations and teams. Therefore, they can give strong support to projects to launch at scale.

The aura of Venture Capitals is a key driver that illuminates the project. Imagine that Coinbase Ventures or Binance Labs invest in your projects. With a proven historical investment performance, the chance for your project token to skyrocket is high after the first launch.

Risks of VC

In the crypto market, risks are inevitable, and everyone has to bear a certain level of risk. VCs allocate their funds to projects on which they can rely after a throughout vetting process. Despite being in early positions, can VCs have losses in investments?

Sometimes VCs are under the water when the market is in bad condition. They own a large number of crypto assets in their portfolio, ranging from top crypto to low-cap altcoins. Furthermore, they have to manage partnerships among investors and projects. Management is a challenging job.

Without a doubt, it’s hard for VCs to go bankrupt since they are masters of risk management. Portfolio diversification is a skill set that every member of VCs has to have. In crypto, VCs also accumulate top cap cryptos such as Bitcoin or Ethereum.

VCs can double down on some projects that have the potential to grow more. But they never put all their eggs in one basket. After a seed fund, there will be Series A, B, C, and even D.

Multiple VCs occasionally join in one funding round. We barely see any VC that makes investments by itself. The pattern is that one or two big VCs lead the round, followed by other VCs and angel investors.

Risks of being invested in by VC

Being invested in by VC might be a pitfall for crypto projects. The risks can come from unreliable VCs that ruin the project's reputation. VC is a type of partnership that bonds with the project by signed documents. Therefore, projects are tied to the VCs’ credibility.

The project team selling too many tokens to early investors due to false valuation can limit its growth. After various funding rounds, the team might not have many project tokens left to raise more funds. Therefore, understanding the value of your project can help you keep on going in the long term.

Venture Capitals will have control over the team/the project if it depends on them too much. Many teams have come to crypto to build their startups for the first time. Therefore, the team should keep close relationships with VCs while being cautious with two-faced VCs.

In addition, projects can be abandoned by their VCs since they are the biggest project token holders. Venture Capitals can create a massive selloff on the project if they want to. Selling all the tokens and casting negative narratives is the fastest way to knock down a project.

How does a Venture Capital work?

Organization Structure

A VC is a type of legal organization that has a hierarchical structure, including personnel across departments. However, we will mention the most important positions in Venture Capital that affect investment decisions.

If you look at the information, you will come across some key titles of people who work in VCs.

- Limited Partners (LPs) fund the venture capital with money.

- General Partners (GPs) manage the funds, lead the company and make investment decisions.

- Principals look for opportunities in the market and do research on them. They might act on behalf of the company to do due diligence on the projects before submitting them to the GPs.

- Venture Partners are hired by VCs to become investment advisors since they have many years of experience in specific fields. They give advice on whether it is worth investing in or not.

- ...

The above structure is for professional VCs. Most venture capitals contain a group of investors who join in building wealth together. It is not compulsory to be entitled as Limited Partner or General Partner. The performance of the VCs is the most reliable metric.

Crypto Funds

Some top VC firms open crypto-centric funds to invest in projects instead of pouring cash directly. The money is allocated to the crypto funds in order not to mix with the securities funds. And they will build a team around those funds.

Crypto funds give institutional investors exposure to a whole sector instead of each startup. For instance, Paradigm announced its $2.5B venture fund in November 2021. At that time, this was the biggest crypto-native fund, surpassing the $2.2B crypto fund of a16z.

With a bigger fund, the venture capital can invest more heavily in projects that want to raise money in later funding rounds (Series A, B, C…). In addition, venture capital can double down on projects for which they have strong support.

How to get invested by Venture Capital

1. Attract the attention of the Venture Capitals

It will be useless if VCs are not even aware of the project. Launching a website and being active on social media such as Twitter, Telegram, Facebook, etc., might give the startup the chance to get noticed by people who work in VCs.

If a project does not have any connection with VCs, the fundraising round will be much more difficult to complete.

2. Persuade VCs to raise funds

This part is where most startups fail due to VCs not being so satisfied with the given information. Crypto projects send the pitch deck to the VCs. To have a successful deal, the startups have to go through a long due diligence process.

At the moment, projects in crypto barely raise less than one million dollars. If they come to a deal, it will be a stepping stone on their crypto journey.

However, the process depends on the tier of the VC. Reputable VCs are super difficult to connect with. On the other hand, some Venture Capitals only look for quick schemes to take profits in the short term.

Investment DAO

Decentralized Autonomous Organization (DAO) has come to form a governance structure that worships decentralization. In this section, we will talk about investment DAO, one of the most popular forms of DAO.

At the moment, Venture Capital in crypto often works like VC in traditional finance. The organization structure is similar. Their goal is to make profits out of their investments, putting their investors’ interests first. Venture capital is governed by a group of investors who can manage multi-billion dollar funds.

Akin to Venture Capital, investment DAOs focus on seeking potential opportunities to make profits in every corner of the crypto space. An investment DAO is governed by a group of many investors who own tokens representing the on-chain voting power. This means every DAO’s decisions will be executed via proposals. Therefore, they can leverage the power of a community with the same interest.

Here are some notable investment DAOs in crypto: BitDAO, The Lao, DuckDao, KlimaDAO, etc.

If you’re interested in investment DAOs, find out more: What is DAO?

All Funding Stages Of Venture Capital

Venture Capital includes a group of investors (barely only one investor) gathering together to assess early-stage projects to place investments. The goal is to gain maximized outcomes with minimum risks.

Startups often raise funds via 5 stages. Each stage corresponds to the growth and the valuation of the project.

Pre-seed: In the beginning, project founders need money to start realizing the ideas (no products are released). The money can come from people around them, their partners, or investors with whom they have connections.

Seed round: At this stage, the team has completed the details of the plan for the idea. Pitch decks, market research, whitepaper (in crypto), and a roadmap of the project are introduced to outside investors.

After the due diligence, the team can start raising money from investors. The amount is based on the valuation of the startup. Crypto projects often sell crypto instead of equity in the seed rounds.

As shown in the chart, in October 2021, many projects concluded seed rounds, valued from $500k to $8.6M. In our experience, VCs often do seed rounds valuing from $500k to $10M.

Other fundraising stages such as Series (A, B, C, D, and sometimes E) will be open if the projects are able to prove the viability of the products with real numbers. At these accelerating stages, projects will scale fast and expand more with capital raised from VCs.

Crypto is a new ascent industry that has been around for over a decade. Countless projects that raised capital via seed rounds have failed (still run but have poor results for years) or ceased to exist. Therefore, as retail investors, we should manage the risks to avoid possible losses.

On the contrary, if projects show the viability of future growth, VCs will continue to support and fund in the next rounds. Almost all top VCs love going on a long-term journey with the founders. For example, a16z is reputable for its 10-year commitment to its investments.

Besides those 5 stages of funding, projects can raise funds via investment rounds that call for community engagement. They use IEO, ICO, IDO, and other fundraising methods to raise capital via token sales, which retail investors can purchase.

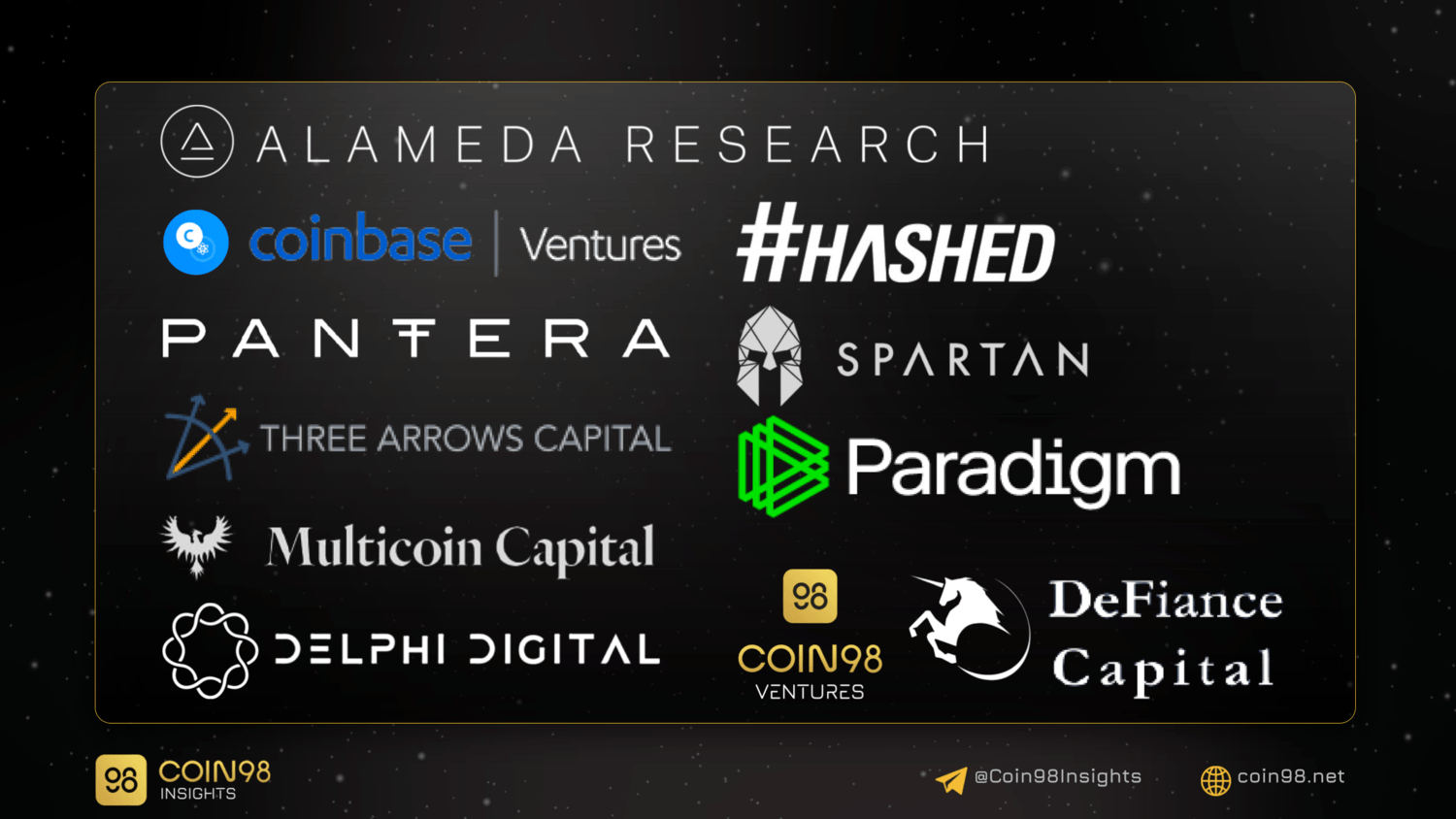

Top Venture Capital In Crypto

At the moment, there are 1500+ active fund portfolios in the crypto space. Therefore, web3 founders can close a deal with one or many of them. Even though reaching top-profile venture capitals is hard, it is still possible for many genuine founders.

Venture Capitals are categorized by tier, depending on the number of crypto assets under management and how reputable they are in the crypto space. Here are a few noteworthy names that we should consider to track their smart money.

- Paradigm

- Multicoin Capital

- A16z

- Alameda Research

- Binance Labs

- Coinbase Ventures

- …

The list above is only the suggestions that we make. Due to the article length, other top-tier venture capitals are not regarded, but they are in no circumstances underestimated. Coin98 Insights has a series of deep-dive articles about venture capitals in crypto presented on our website.

Should we follow Venture Capitals?

Every venture capital has differentiated strategies to win in the market. They might seed their long-term investment or close deals fast with a short vesting period. It depends on their thesis.

Tracking where the smart money goes is a widely-used strategy in crypto. Retail investors tackle on-chain data to follow whales’ traits. Smart money goes first, then retail money follows. As a result, there are many on-chain detectives ready to track down smart money.

High-profile venture capitals always manage risks by distributing their investments across the crypto land. If we follow their portfolios, we should manage risks too. An investment from a reputable VC is not a guarantee of success. It should be a criterion to be added to our own thesis.

For example, Hashed participated in 30 investment deals in the first half of 2022. This raises a concern for us about how the team is able to manage them all. Resources of Hashed are dispersed among projects. Quality outperforms quantity.

If a project is invested in by well-known VCs, it will gain more trust from the community. High-profile VCs do due diligence in every detail since any official investment will affect their brand in the crypto space. No VC wants to be involved in an illicit scheme.

Therefore, following Venture Capitals is a good strategy but selecting reliable ones is a big challenge. In the following section, we will introduce how to follow VCs.

How to follow Venture Capitals

Many investors have a thesis of following VCs. Building a solid thesis leads to a strong conviction. Top-tier VCs have talents from every corner of the internet. Furthermore, their portfolios have been built over time, not in a day. That is the reason why we should not ignore VCs.

For simplification, we will introduce how we weigh high-profile VCs by go-to criteria.

Selecting a viable Venture Capital is easy but sometimes challenging. It is effortless since reputable VCs have strong traction on social media. Every crypto native knows their existence, and eyeballs can not ignore them.

However, it is a cumbersome process since every VC has its own investment thesis. The thesis requires a comprehensive understanding to build a strong conviction. It is obscure for newcomers. A thesis is proven by the performance of the portfolio.

The size of the fund managed by VC is also a crucial factor. The larger the fund, the more impact the VC can create. Pouring money into a bad investment can lead to undesired losses.

After selecting a VC, we will break down the portfolio by category, then seek potential projects with flywheels. How they do deal with VCs, and how big is the valuation. Understanding the stage of the project via its investment rounds leads to the time when we can pull the trigger.

Taking action might seem simple, but it is the hardest part. Many other factors (narratives, market sentiment, macro circumstance) affect the outcome of the investment. Thus, you should consider carefully and do your own research to build up confidence in the investment.

The future of Venture Capitals

Venture Capitals are often called smart money since they join the projects in early-stage funding rounds. After a bull run, VCs will reinvest in more potential projects with innovative ideas. This creates a flywheel for them since they have abundant funds to build other investment positions.

However, in the crypto space, the gap between institutional investors and retail investors is filled by blockchain technology. VCs are whales, and their movements leave footprints on the blockchain.

The details of the investment deals between projects and VCs usually remain undisclosed to the public. Investors probably do not know at which price the VC hopped in.

In our opinion, Venture Capital will continue to invest in more crypto to prepare for the possible next bull run in the future. The funds will be reallocated to builders who make applicable and usable products.

Less reputable VCs will have to pave the way to climb to the top of the market.

One of the most interesting things about the crypto space is that crypto startups have venture funds to invest in other startups. This creates smaller venture capitals inside venture capitals.

FAQ about Venture Capitals

How to track VCs’ portfolios

By following social channels like Twitter, Medium, Website, and so on, investors can get the latest information about the portfolio update of VCs. Coin98 Insights also has an articulated series focusing on updating and breaking down the latest deals of VCs.

Do Venture Capitals exit?

Exiting happens when VCs have sold all the equity and tokens to take profits (or cut losses). The project can turn into a phase when it does not need the support of VCs, or it may go down into failure. To avoid causing chaos, VCs often announce their exits when all the exit deals are completed.

If you want to follow what deals have VCs exited, Crunchbase is a go-to place. https://www.crunchbase.com

How to join Venture Capitals

You can join a VC by becoming a member with a suitable position. Your expertise in any field is helpful for some VCs, while others might need capital. On the other hand, you can gather connections to start your own VC. This will be a highlight for your investment profile.