What is USDT? All you need to know about Tether USD

What is Tether (USDT)?

Tether (USDT) is the first stablecoin that is pegged 1:1 to the U.S. dollar, which means 1 USDT is equivalent to $1. In 2014, it was first issued by Tether Holdings Limited. At the time of writing, Tether is the largest stablecoin in the crypto space by market capitalization.

Most blockchain-based stablecoins are pegged to the U.S. dollar. The U.S. dollar is the most powerful fiat currency in the world. Therefore, many organizations are endeavoring to create blockchain versions of the U.S. dollar.

USDT is pegged 1-to-1 with the U.S. dollar (1 USDT = 1 USD), backed by Tether’s reserve. According to the Tether company, all USDT and other Tether tokens in circulation can be redeemed by the reserves.

There has been a controversy that Tether was not clear about how stablecoin is backed and collateralized. In the past, Tether stated that it used fiat currencies and assets to back its stablecoins. Today it uses reserves where users can deposit cash to receive blockchain-based stablecoins.

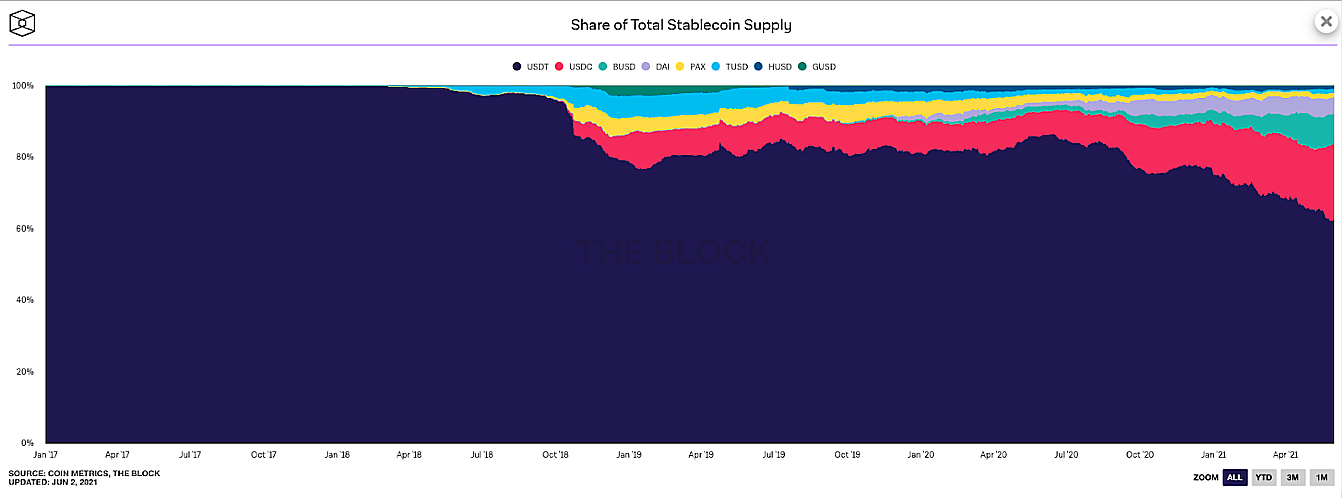

Besides USDT, there are other competitors following the stablecoin trend, such as USDC, DAI, MIM, FRAX, etc. But they are all behind USDT by the market cap. However, USDT has some limitations that are tackled by other decentralized stablecoins.

At the time of writing, USDT issued by Tether is still dominating the stablecoin market.

Understanding USDT

What is USDT used for?

Tether released USDT with an aim to be a medium of exchange in the crypto world. It can bring convenience to the crypto space by fulfilling users’ needs. At the moment, USDT is widely adopted across crypto. Let’s explore its main utilities.

- Storage: Crypto investors need a type of asset that can make their portfolio safe during selloffs. USDT can tackle this problem by acting as a means to save the value. In addition, it will be fast to deploy investments with USDT since it is issued on the blockchain.

- Token transfer: USDT is a fungible token on top of blockchains. It can be transferred from one blockchain address to another. Blockchains will record all transactions and activities of USDT so that users can look up on explorers.

- Payment: Users prefer stablecoins to high-volatile crypto for payment. USDT issued by Tether can be a medium of exchange by stabilizing the price at $1. It can be used for service payment or donation, depending on users’ needs.

- DeFi applications: USDT is one of the most adopted stablecoins in the DeFi space. Many protocols allow USDT holders to trade, provide liquidity and lend on their platforms. We think DeFi is an ideal place for USDT to thrive.

USDT has built many utilities around it, solidifying the lead position in the crypto market. More and more companies and protocols adopt USDT since it brings convenience to users.

What chain is USDT on?

Tether (USDT) is available on multiple blockchain platforms. It first appeared on Omni Layer on Bitcoin, then Tether went multi-chain. At the moment, USDT is issued on almost all blockchains, including Ethereum, Tron, Algorand, Solana, EOS, Liquid, etc.

As shown in the chart, USDT is issued most on Tron and Ethereum, $41B and $39B USDT, respectively. On the other hand, the USDT supply on Bitcoin, Algorand, EOS, and Liquid is running sideways with no considerable growth signal.

Besides that, USDT also exists on Solana, Avalanche, and other EVM-compatible blockchains. Furthermore, USDT using the ERC20 standard of Ethereum has resulted in many scaling L2s such as Arbitrum and Optimism.

Without a doubt, Tether’s strategy of going multichain has solidified the influence of its stablecoin.

Readers can explore more about USDT contracts right here.

Besides USDT

Tether also issues other blockchain-based currencies, including EURT (pegged to EURO) and CNHT (pegged to CNH). In addition, it also issued a gold-pegged asset named Tether Gold (XAUT).

However, the other 3 assets of Tether are not as widely adopted as the U.S dollar-pegged stablecoin USDT. This is understandable because USDT exists on numerous CEX and DEXs such as Binance, Coinbase, and Uniswap, SushiSwap.

XAUT can be considered a gold index for investment. Instead of buying gold in ounces, investors can directly buy XAUT on exchanges such as Coinbase with the XAUT/USD trading pair to invest in gold.

How does Tether (USDT) work?

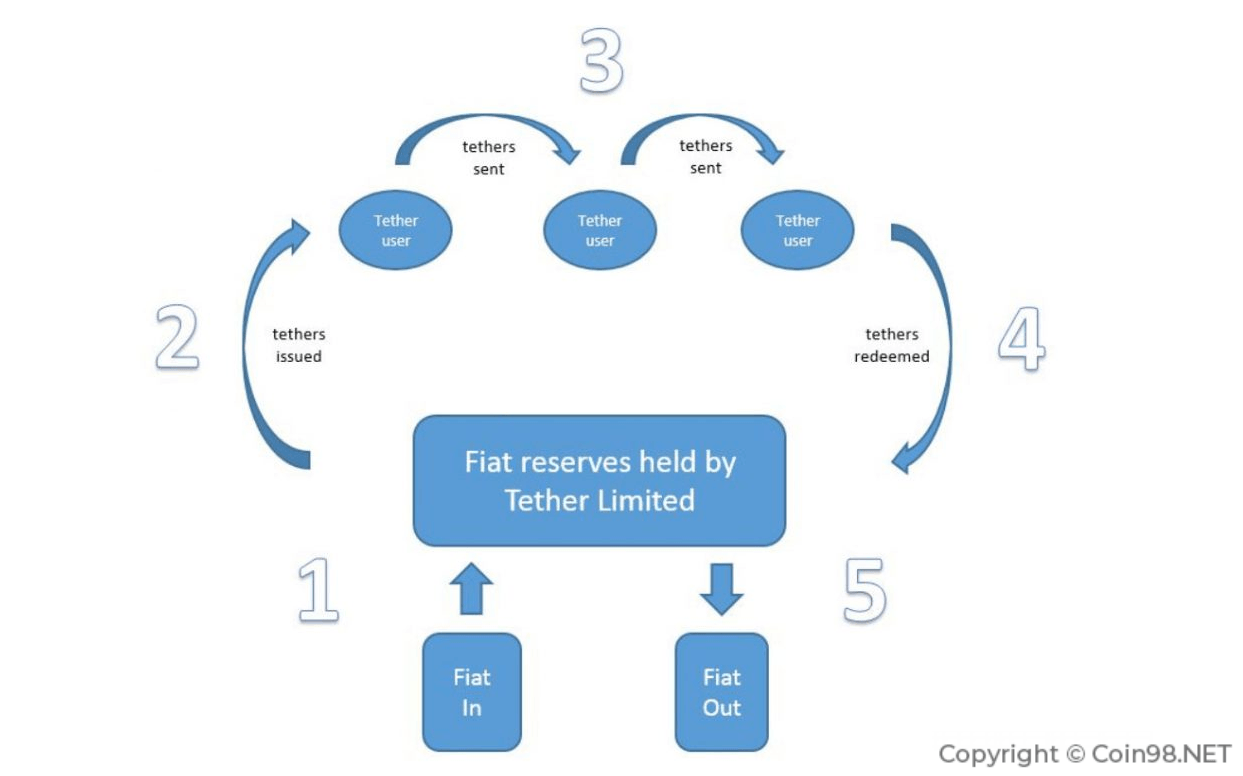

Tether Holdings Limited is a company that controls the supply of USDT and its other stablecoins. This means it can mint new USDT or remove it from circulation. Let’s explore the working principle of Tether stablecoins.

KYC-verified users deposit the U.S. fiat currency into Tether’s reserve. Then they receive the amount of USDT tokens issued by Tether that is equivalent to the deposited amount. The newly issued token will be sent to users’ addresses.

The token on the blockchain has similar utilities to other cryptos. Users can transfer and store Tether’s stablecoin in blockchain wallets. As mentioned, Tether is available on multiple top blockchain platforms. As a result, it can serve the demand of users across the crypto space.

If users want to redeem their fiat currencies, they can deposit stablecoins on the Tether website. By doing this, Tether will eliminate the stablecoins out of circulation and send the same amount in fiat currencies back to users.

As we can see, the process revolves around Tether’s reserves. This issuance mechanism has ignited controversy among the crypto community since it is considered to be centralized and contains potential risks. However, every act has its pros and cons. In the following section, we will talk more about Tether (USDT).

The controversy surrounding the value of Tether (USDT)

After years of development, Tether and its stablecoins have gone through many challenges. Most of them are rooting from the reserves. This raises a heavy concern among the crypto community, even though Tether has made some announcements.

The latest news about the reserve is the $41M fine from CFTC (the U.S. Commodity Futures) for Tether. Tether claimed that USDT is fully backed by the U.S. dollar. However, after investigations and audits, the U.S. authority found out that the reserves only contained a fraction of U.S. dollars instead of the full amount.

In Tether's Q1 2022 assurance report, Tether had a total of $82.4B in various types of assets. At that time, USDT's market cap was around $80B. This means Tether (USDT) is 100% backed by its reserves as it previously claimed.

Tether is not always transparent about how USDT is backed. At the time of writing, it remains a concern among investors. Other decentralized stablecoins have used this argument to hit Tether.

USD vs. USDT: What is the difference?

Comparison

Tether (USDT) inherits many characteristics of the U.S. dollar (USD), and they also differ a lot in various criteria.

USD is the official fiat currency of the U.S. and some other countries. On the other hand, USDT is a USD-pegged stablecoin issued by the company Tether. It can fluctuate depending on the crypto market sentiment. Unlike the U.S. dollar, USDT can have zero value when the Tether company goes bankrupt.

USDT is a cryptocurrency issued by Tether using blockchain technology. It exists in the form of many blockchain standards such as ERC-20 on Ethereum, BEP20 on BNB Chain, SPL on Solana, etc. On the other hand, the U.S dollar exists in a paper form in seven denominations: $1, $2, $5, $10, $20, $50, and $100.

USD is the largest fiat currency in the world, while USDT is the largest stablecoin in the crypto market. At the time of writing, the total market cap of all cryptocurrencies is around $1,500B, which is comparatively small compared to the U.S stock market ($48,000B market cap).

USDT and USD differ in units. The dollar sign $ is placed before the amount like $1, and one U.S. dollar is equal to 100 cents. On the other hand, USDT is a fungible token, and USDT holders can send a decimal number of USDT, such as 0.5 USDT, to another address.

USDT is minted by Tether when verified users deposit fiat currency (USD) to receive blockchain-based stablecoins. According to Tether Holdings Limited, USDT is 100% backed by Tether’s reserves. The U.S. dollar is one of the assets stored in the reserves

Why use USDT instead of USD?

At the moment, USDT is used for purchasing and trading crypto assets on centralized and decentralized exchanges. It eliminates the cumbersomeness of traditional fiat money since it exists on the blockchain.

Many regulators are looking into crypto assets, especially stablecoins. The crypto table can change at any time, raising a light concern among the community.

What is USDT wallet?

Since USDT is a cryptocurrency, it can be stored in crypto wallets that support compatible standards. It exists on numerous blockchains with different types of token standards. As a result, we will introduce where to keep your USDT.

In general, there are 3 main ways to store USDT in wallets:

Hot Wallet: Your USDT will be stored in your blockchain addresses. This means you will use a passphrase (seed phrase) to have access to your crypto wallets such as non-custodial wallets such as MetaMask (Ethereum), Phantom (Solana), Coin98 Super Wallet (Multichain), etc. Coin98 Super App is an all-in-one application that supports USDT on multiple blockchain platforms.

Cold Wallet (Hardware Wallet): Your private key will be stored in a physical device (it might look like a USB drive). To use the crypto wallet, you will need to connect the device to the internet via computer or mobile device. This method keeps your crypto wallet safe from online attackers.

Exchange Wallet: Your crypto assets will be stored on centralized exchanges, meaning you will not have a private key for your wallet. Here are some top trading volume exchanges: Binance, Coinbase, etc.

Users can keep USDT on 40+ blockchains, and it can be bridged among them. Here’s the list of blockchains where USDT is available.

- EVM blockchains: Ethereum, BNB Chain, Heco, Avalanche, Fantom, Layer-2s, etc.

- Non-EVM blockchains: Tron, Solana, Algorand, EOS, zkSync, Terra, etc.

How to buy USDT

USDT is the largest stablecoin with over $70B market cap. Without a doubt, USDT is available to trade on numerous exchanges, including CEXs and DEXs. In addition, many blockchain token standards support USDT. This enhances the availability of the largest stablecoin.

Centralized Exchanges (CEXs): Users can buy and sell USDT on CEXs. For example, USDT can be traded with over 300+ cryptocurrencies, enhancing USDT as a medium of exchange. Besides Binance, users can trade USDT on Coinbase, FTX, etc. Last but not least, USDT is accepted as collateral for margins and futures trading.

Decentralized Exchanges (DEXs): USDT is widely accepted on DEXs since it is available on different blockchains, particularly over 40+ blockchains at the moment. USDT is used for trading for other cryptos on DEXs. We can name some top-volume DEXs as: Uniswap, PancakeSwap, Curve Finance, Orca, SushiSwap, etc.

Minting on Tether: As mentioned above, KYC-verified users are able to mint new USDT by depositing fiat money on Tether. However, the KYC process of Tether might be an obstacle for many international investors, especially where crypto is strictly banned.

Over-the-Counter (OTC): Users trade crypto assets directly with each other to avoid the price impact of crypto exchanges. However, this method might contain potential risks of fraud since OTC is a deal between two entities.

How to get USDT

After purchasing USDT to put in your crypto wallets, what can we do to get more USDT? There are tons of methods to bag more of it. However, due to the risks, we will introduce some possible ways to earn passive income with USDT.

Staking

Staking is the activity of depositing your crypto assets on blockchains to earn passive income paid in crypto. This keeps the blockchain consensus running and enhances security.

Crypto natives can stake their USDT into pools of DeFi protocol to earn yields with decent APYs. To avoid Impermanent Loss, investors should select pools that support single-sided staking or stablecoin pools.

- Single Exposure (Single-side staking): APY is often a one-figure number.

- Stablecoin Pool: APY usually ranges from 3% to 15%, depending on the total stake and trading volume. The yield comes from trading fees when users provide liquidity into pools.

Lending

Lending USDT on lending protocols in the crypto space can give you a return bigger than staking. Users lend their crypto assets (USDT) to the protocols to earn interest from the borrowers.

The interest comes from borrowers who can be retail investors or leveraged traders. Therefore, stablecoin lending often gives higher yields than single-sided staking.

As shown in the table, lending USDT on Aave gives a 2.6% APY, higher when compared to a 2.38% USDT staking reward on Compound. However, the numbers can change over time. And there are other DeFi protocols that provide juicier rewards.

Disclaimer: Staking and Lending contain risks of losing your funds. You should do your own research and be responsible for your investments.

USDT FAQs

What is USDT backed by?

USDT is 100% backed by Tether’s Reserves. In the Reserves, there are various types of assets, including Cash, Bonds, Funds, Secured Loans, and crypto assets. Cash and Cash Equivalents make up most of the reserves. Users can redeem Tether’s stablecoins into cash at any time.

Is USDT safe?

The crypto market is an emerging market that is extremely volatile, and it can be manipulated. At the moment, the total market cap of all stablecoins in crypto is around $160B, only 12% of the total crypto market. As a result, it can grow fast or burn down to ash quickly.

Unlike the algorithmic stablecoins, USDT is 100% backed by Tether’s reserves which are available to be redeemed at any time. As investors, we should prepare our mentality and be aware of potential risks.

How stable is USDT?

As the historical price of USDT shows us, it has faced strong turbulence from 2017 to 2019. From 2020 until 2022, USDT has been in a stable range of around $1. In the market selloffs, the $1 peg can change, and Tether must take action to bring it back to the $1 mark.

What would happen if USDT collapsed?

The latest stablecoin crisis of UST caused a chaotic selloff in the crypto market. As LUNA used to be in the top 5 crypto by market capitalization, the impact was massive. The TVL of all DeFi protocols plunged about 40% (from $250B to $145B).

As a result, by projecting the UST case, we can reckon what would happen if USDT collapsed. It would create a bad scenario for the crypto market. Many trading pairs have USDT as the base token.

However, there is still a controversy among the community about the transparency of Tether (USDT). Thus, investors should manage the risks at a durable level. Many unfortunate events happened in the past, and nobody can guarantee the future.