Ouro Finance - Everything you need to know about OGS Token

What is Ouro Finance?

Ouro Finance is a crypto project working on Inflation-proof as a service by using a dual-token model: One as a governance token (OGS) and one as an inflation-hedged token (OURO). Considering inflation as an important matter, OURO serves as an inflation-proof store of value.

Ouro Finance and OURO are solving the current problem of stablecoins. As their value is pegged to a fiat currency like the Dollar, they will also be affected by inflation and cannot be a sustainable store of value.

Even though cryptocurrencies like Bitcoin can be used as stores of value, their volatility requires long holding for actual price appreciation, making them illiquid and inflexible.

Ouro Finance website: https://ouro.finance/

How does Ouro Finance work?

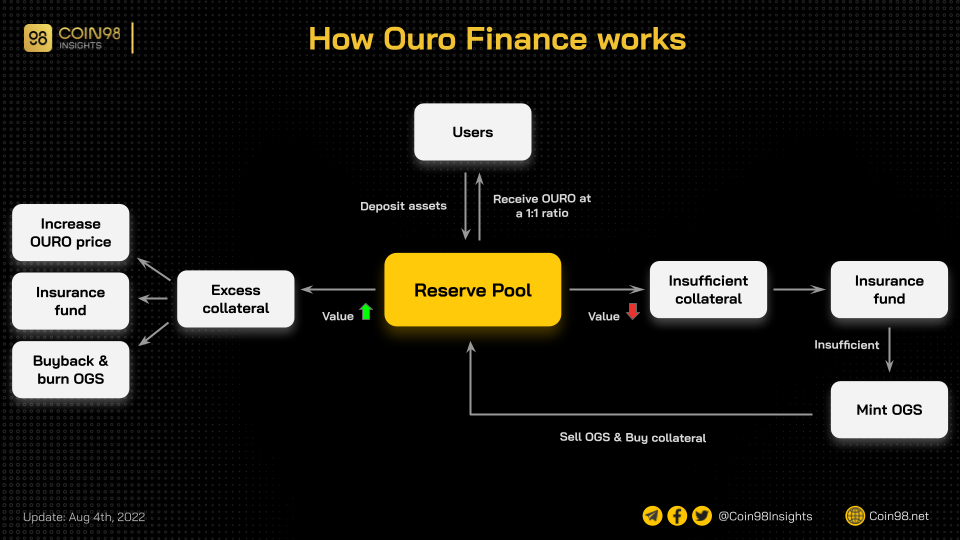

The work model of Ouro Finance focuses mainly on the value of its inflation-proof token: OURO. For the OURO token to perform against inflation, Ouro Finance introduces its core: Reserve Pool.

The Reserve Pool will receive asset deposits from users for an exchange of OURO tokens at a 1:1 ratio. Users can also burn OURO tokens to acquire back assets in the Reserve Pool at any time. These assets are believed to increase in price over time (which is good against inflation) but cannot be used in the short term.

At the moment, Ouro Finance has limited the list to 3 cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). Since these 3 tokens are volatile in price, the value of the Reserve Pool will change constantly. There will be 2 cases:

Value increases:

In this case, the value of the collateral assets will go up, meaning that there will be an excess pool of collateral to keep up the 1:1 peg with OURO. This excess fund will be used for several meaningful things, in order:

- Increase OURO’s price: To perform against inflation, OURO needs to be increased in price should there be a chance. Its price increase will be capped at 3% per month.

- Accumulate an insurance fund: If the price of OURO is increased by 3% and there is still excessive money, 50% of what is left will be used to form and accumulate an insurance fund.

- Buy back & burn OGS: Meanwhile, the other 50% will be used to buy back and burn OGS - the platform’s governance token.

After all these actions are done, the expected result will be a surge in the price of both OURO and OGS.

Value decreases:

The platform will also have to prepare for the unfavourable scenario: when the Reserve Pool cannot keep up a 1:1 peg with OURO. There have to be resolutions to ensure OURO’s price stability and price transparency (100% backed).

The initial solution is to use the insurance fund. As mentioned above, this insurance fund will be stored and accrued over time to ideally become massive enough that it can eventually absorb market downturns for the Reserve Pool for a long time.

If there is not enough purchasing power within the insurance fund to cover the losses, the last resort is to mint OGS. Afterwards, collateral assets will be bought back by selling these minted OGS (currently via PancakeSwap). Essentially, OGS is used to absorb the losses of the Reserve Pool.

In this bad scenario, the price of OGS will most likely go down, which is sacrificed for the price stability of OURO.

How Ouro Finance works

Ouro Finance Token Use Cases

Currently, OGS serves as the governance token of the platform. OGS represents voting power for the project's decentralized operation, meaning users have their voice over the project's general direction, new features to build, partnerships to form, core team members to hire/fire, new assets to support, system parameters, etc.

OURO is the central core of Ouro Finance. It is used similarly to a stablecoin but with its design to ideally hedge against inflation. Over time, OURO is expected to only grow in price.

Team, Investors, and Partners

Updating...

Roadmaps & Updates

After the launch of its v0.1, Ouro Finance will move forward with working on these plans:

A balanced basket of assets

- Inclusion of more mainstream crypto assets.

- Inclusion of inverse index synthetic assets.

- Inclusion of synthetic assets pegged to stocks and commodities.

Hive intelligence

- Formation of project operations, marketing, and technical chat groups to allow direct .community participation in Ouro’s development.

- Launch of on-chain community governance.

Better user experience

- Allowing users to deposit stablecoins (such as BUSD) to acquire OURO.

- Launch of Ouro Info to make key platform parameters accessible to everyone.

More use cases for both OURO and OGS

- Listed on major CEXs for convenience.

- Lending product with OURO and OGS integration.

- Synthetic asset product with OURO and OGS integration.

- Conduct research on enabling private transactions for OURO.

What is OGS Token?

OGS token is a BEP-20 token that serves as the governance token of the project Ouro Finance. At the moment, OGS tokens are traded with the highest liquidity at PancakeSwap.

Detailed information about OGS & OURO Token

Key Metrics

OGS Token

- Name: Ouro Governance Share.

- Ticker: OGS.

- Token standard: BEP-20.

- Token type: Governance.

- Max supply: 1,000,000,000 OGS.

- Circulating Supply: 123,405,169 OGS.

- Contract address: 0x416947e6fc78f158fd9b775fa846b72d768879c2.

OURO Token

- Name: Ouro Stablecoin.

- Ticker: OURO.

- Token standard: BEP-20.

- Token type: Stablecoin, Utility.

- Max supply: Unlimited.

- Circulating Supply: 36,365.6227 OURO.

- Contract address: 0x0a4fc79921f960a4264717fefee518e088173a79.

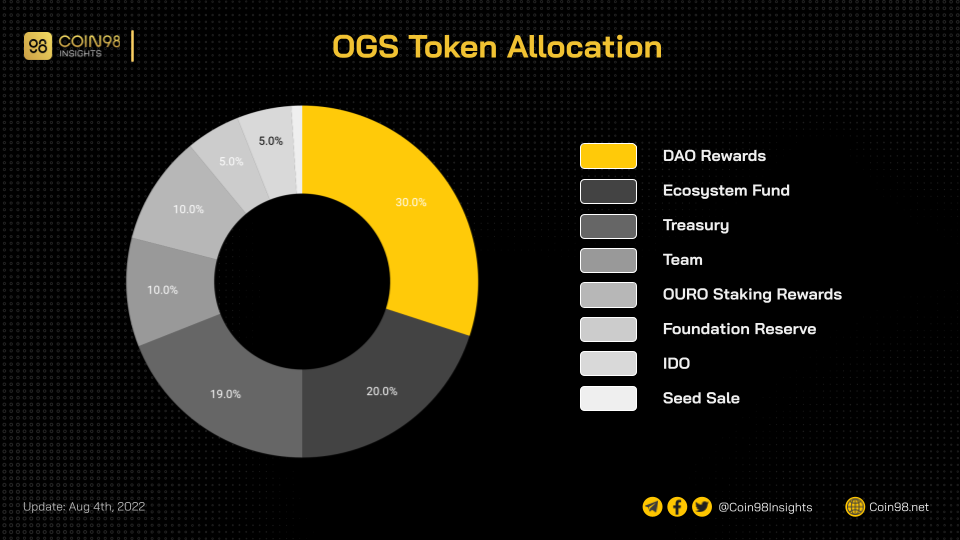

OGS Token Allocation

- Team: 10%.

- Ecosystem Fund: 20%.

- Seed Sale: 1%.

- IDO: 5%.

- Treasury: 19%.

- Foundation Reserve: 5%.

- DAO Rewards: 30%.

- OURO Staking Rewards: 10%.

OGS Token Allocation

OGS Token Sale

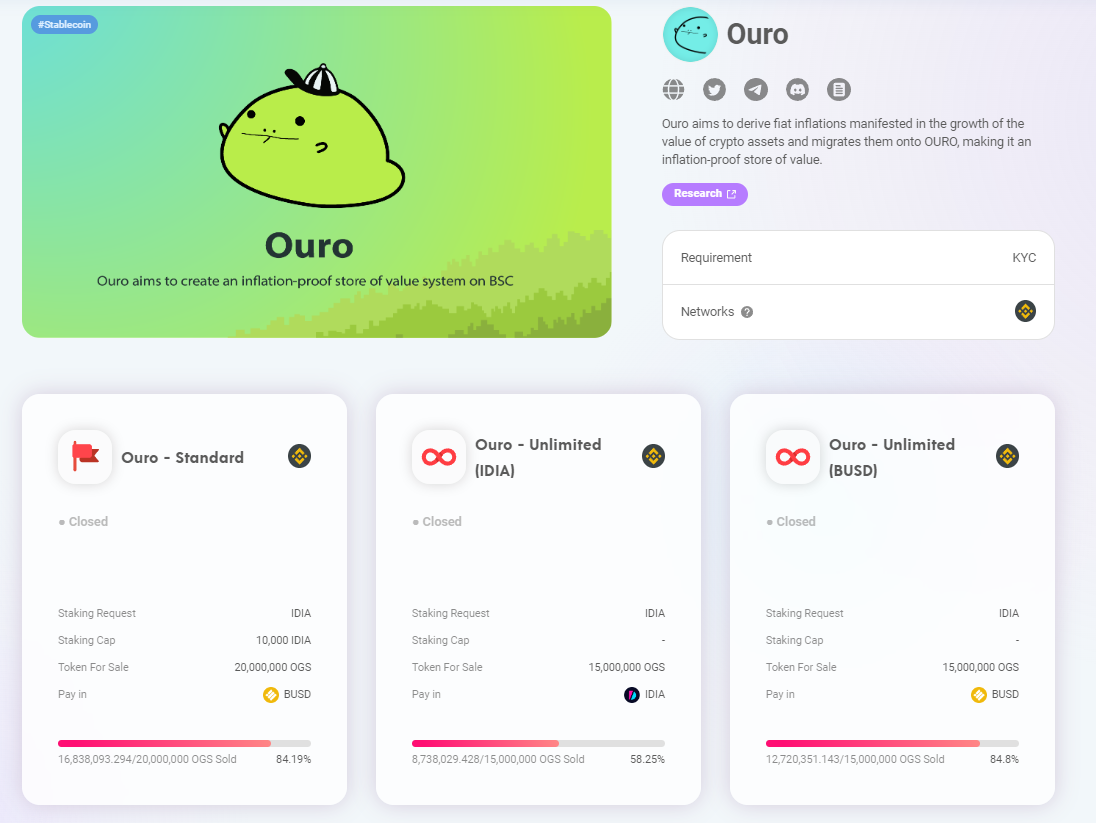

OGS was sold in an IDO on Impossible Finance, raising a total of $1,124,000 with 10,442 participants - which both set a new record for an all-time high on Impossible Finance.

OGS Token Sale on Impossible Finance

OGS Token Release Schedule

You can check the Token Release Schedule of OGS here.

How to get OGS Token

You can get OGS through multiple options:

- DEX: Pancakeswap.

- Provide liquidity on various platforms or directly on Ouro Finance.

- Stake on Ouro Finance.

- Participate in OGS token sales.

How to store OGS Token

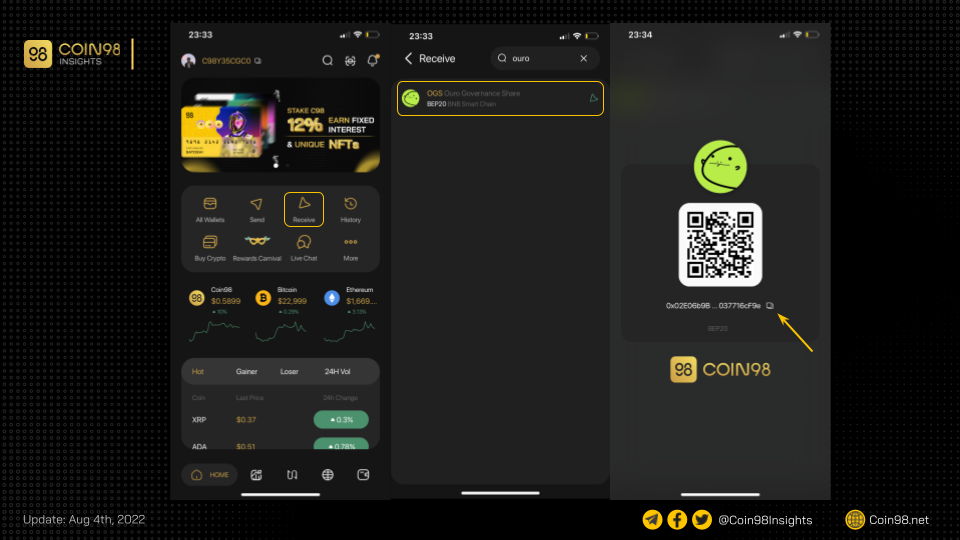

You can store OGS tokens on Coin98 Wallet with these steps:

Step 1: Open Coin98 Wallet & click Receive on the home screen.

Step 2: Search Ouro Finance Token.

Step 3: Click on the correct result, copy the wallet address, and send OGS to this address.

How to store OGS tokens on Coin98 Wallet

How to buy OGS

You can buy OGS on PancakeSwap, or directly via Coin98 Exchange at the end of the article.

Learn more: How to use Coin98 Exchange

Similar Projects

Updating…

Learn more: What is Efficiency DAO (EFF)? All about the EFF Token